Here’s What’s Holding XRP Back and What Could Trigger a Breakout

23.02.2025 9:00 1 min. read Alexander Zdravkov

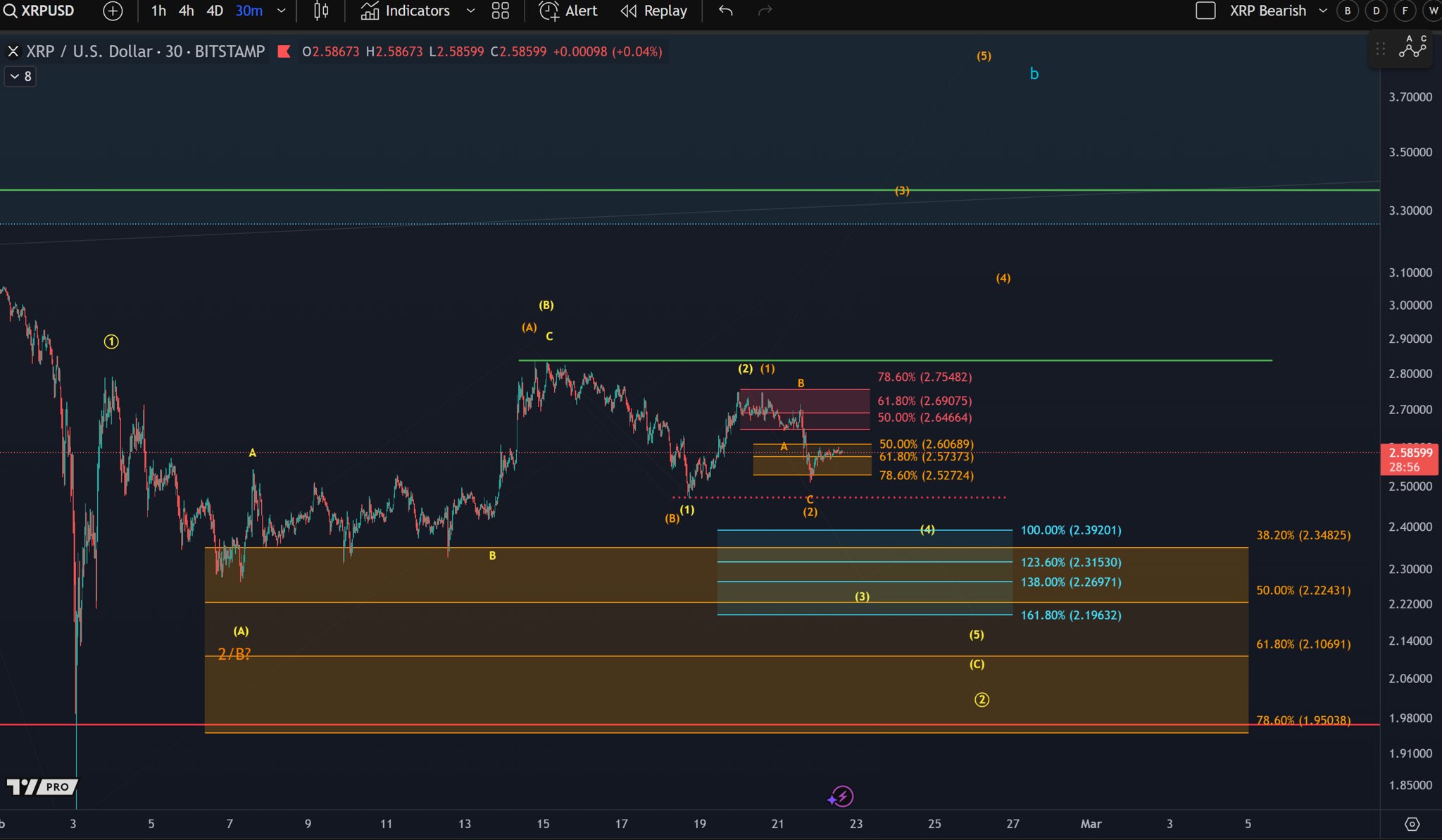

XRP’s price remains stuck in a tight range as investors assess the fallout from the Bybit hack. Despite a broader selloff, the token has managed to hold above $2.5, though its recent price action suggests uncertainty.

Analysts at More Crypto Online describe XRP’s outlook as neutral, casting doubt on earlier expectations that the coin could reach $250 in the long term.

According to More Crypto Online, XRP has yet to break out of its current range, maintaining support above $2.47. At last check, the token was priced at $2.592, marking a 0.63% decline over the past day. During this period, it fluctuated between $2.512 and $2.597 before settling.

While XRP’s bullish structure remains technically intact, it has struggled to push past the $2.8 resistance level. If this trend continues, further downward movement could be likely in the short term. Analysts point to two critical levels: a drop below $2.47 could signal more losses, while a break above $2.75 may trigger a rally.

Earlier projections suggested XRP could surge to $250 by 2026, with market analyst XRP Captain attributing this potential rise to heavy accumulation by large investors. However, this remains one of the most optimistic predictions for the token.

While sentiment around Ripple remains positive, supply concerns have been highlighted as a major hurdle for significant price appreciation. Nevertheless, the broader regulatory environment in the U.S. appears favorable, keeping long-term prospects open-ended.

-

1

Chinese Firm Unveils $300M XRP Reserve Plan Amid Crypto Ban

30.05.2025 20:00 1 min. read -

2

Ethereum Profitability Rebounds as On-Chain Metrics Flip Bullish

23.05.2025 20:00 1 min. read -

3

Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Inflows

23.05.2025 17:22 1 min. read -

4

SEC Is Backing Away from Memecoin Regulation – Here’s Why

01.06.2025 15:00 2 min. read -

5

Traders on Polymarket Are Doubling Down on XRP’s ETF Approval

26.05.2025 10:00 1 min. read

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

ChatGPT takes a deep dive into the future of some of the most talked-about cryptocurrencies — XRP, Solana (SOL), and Cardano (ADA). With the focus on the second half of 2025, ChatGPT explores the price movements and potential growth of these tokens, alongside a new crypto project showing a staggering 2,700% growth potential. Here’s a glimpse of what the future may hold for these coins.

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

Speculation around the next crypto asset to break into the U.S. ETF market is heating up, and XRP may have just taken the lead.

Altcoin ETF Summer? SEC Poised to Open Doors for Crypto Index Funds

A wave of optimism is sweeping through the digital asset space as analysts suggest the U.S. Securities and Exchange Commission (SEC) may begin greenlighting crypto-linked exchange-traded funds (ETFs) as early as July.

Solana ETF Approval Odds Soar as Wall Street Eyes Altcoin Season

Excitement is building around the possibility of U.S. regulators approving a spot Solana ETF, potentially as early as this summer.

-

1

Chinese Firm Unveils $300M XRP Reserve Plan Amid Crypto Ban

30.05.2025 20:00 1 min. read -

2

Ethereum Profitability Rebounds as On-Chain Metrics Flip Bullish

23.05.2025 20:00 1 min. read -

3

Bitcoin and Ethereum ETFs See Over $1 Billion in Daily Inflows

23.05.2025 17:22 1 min. read -

4

SEC Is Backing Away from Memecoin Regulation – Here’s Why

01.06.2025 15:00 2 min. read -

5

Traders on Polymarket Are Doubling Down on XRP’s ETF Approval

26.05.2025 10:00 1 min. read