Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Ripple Price Prediction, Latest XRP News and A New Altcoin Investors Believe Is The Next XRP

20.02.2025 11:35 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The XRP price prediction has turned more optimistic in recent weeks, thanks to shifting U.S. regulations and a rise in overall crypto adoption.

A changing political landscape has rejuvenated XRP, placing it firmly back on investors’ radars. Remittix has also burst onto the scene as a PayFi pioneer with over $12.3 million raised and more than 467 million tokens sold in its presale.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Ripple Price Prediction: From Multi-Year High to Pullback

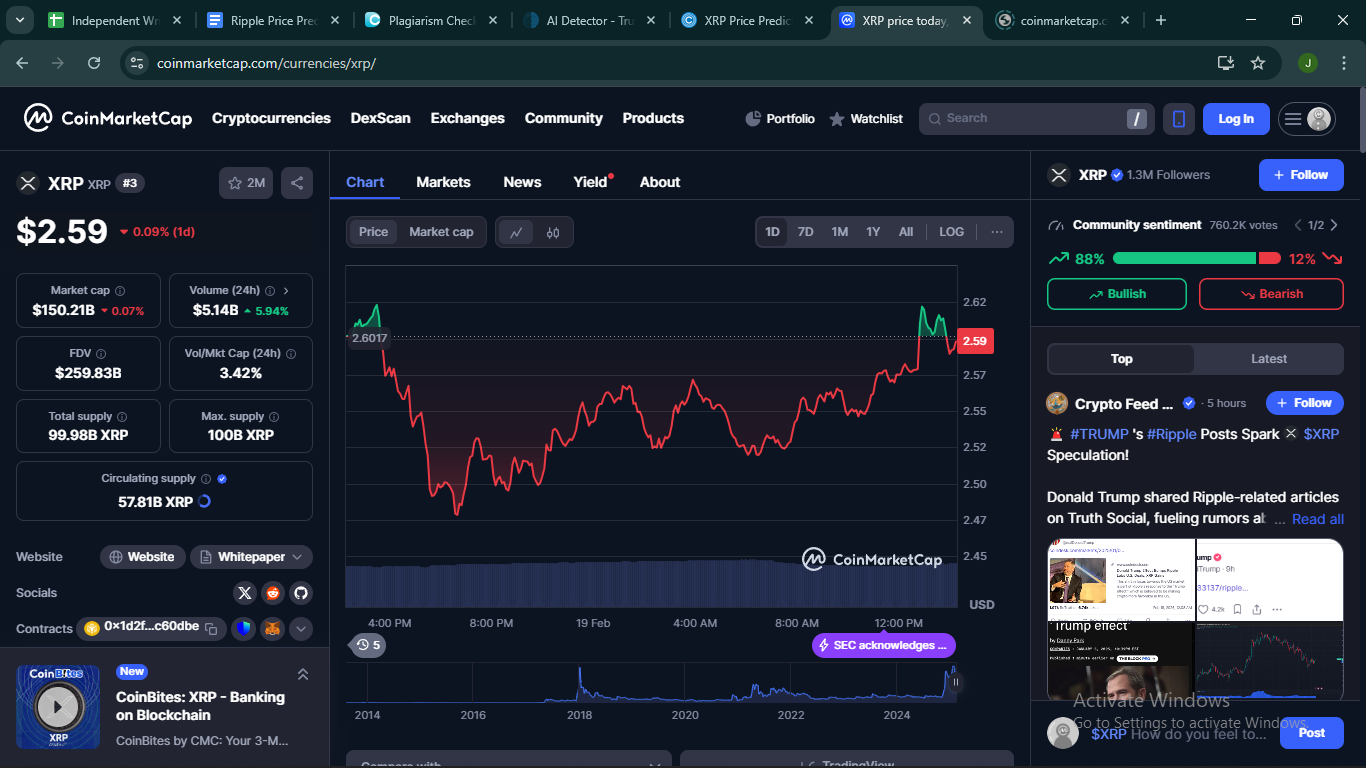

The Ripple price prediction community was buzzing on January 16, when XRP soared to $3.39, marking a multi-year high. Yet the celebrations were short-lived. As of now, the token has pulled back to $2.59, over a 20% drop from its January peak. Although that might sound discouraging, XRP is still up 145% over the past 90 days.

Egrag Crypto sees the Bull Market Support Band (BMSB) as a key factor in XRP’s trajectory, noting a pattern that echoes 2017, when the token hovered near the BMSB before soaring 1,500% to the Fib 1.618 mark. If this pattern repeats, Egrag targets $27 as a possible outcome.

Similarly, Javon Marks draws parallels to the 2017 rally, suggesting that once XRP tested its previous all-time high as resistance, it then blasted past it. Marks envisions a second target of $99, a staggering 3,900% gain from current prices. Still, both analysts stress that XRP must clear its formidable $3.15–$3.50 resistance range, likely requiring a powerful catalyst to break free and embark on such a dramatic run.

Beyond the Ripple price prediction, the biggest update is the release of RLUSD, a stablecoin backed by real-world financial reserves. While XRP remains central to RippleNet’s cross-border payment flows, RLUSD provides a safer instrument for risk-averse institutions wary of crypto’s notorious price swings.

A New Altcoin Investors Hail as the Next XRP

While many traders anticipate a bullish Ripple price prediction, a growing segment of the crypto community is redirecting attention to a promising altcoin called Remittix. Priced at $0.0628, Remittix has already raised over $12.3 million in its presale, with more than 467 million tokens sold. At first glance, it might appear as just another ERC-20 token, but Remittix’s PayFi protocol gives it unique potential.

Imagine a software developer in Mexico freelancing for a client in Canada. With Remittix, cross-border transactions become seamless. This streamlined system spares both sender and recipient from the technical hurdles that often hinder mainstream crypto usage.

Investors flock to Remittix because it seeks to solve a massive real-world challenge: low-cost, efficient cross-border payments. Its developers have locked liquidity and tokens for three years, signaling a commitment to long-term growth—critical for backers who might recall the unscrupulous rug pulls of years past.

The token’s approach also resonates strongly in emerging markets, where remittance fees can eat up a significant chunk of monthly income. By showcasing instant transfers and near-zero transaction costs, Remittix aims to become a go-to solution for millions of unbanked or underbanked individuals.

Remittix Shines as the Best Option

While crypto fans keep an eye on the Ripple price prediction, the wait for regulatory clarity and broader adoption could take longer than expected. Remittix, on the other hand, addresses real-world remittance problems head-on.

Its presale success underscores the enthusiasm for a solution that merges crypto’s speed with everyday banking convenience. For those seeking the next standout altcoin, Remittix offers a compelling blueprint—and potentially less risk—than waiting on XRP to break free of its regulatory limbo.

Interested in how Remittix might outpace XRP? Check out Remittix here!

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read -

2

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read -

3

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

4

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read -

5

Best Crypto to Buy Now as Ethereum Plans to Cut Block Times in Half

25.06.2025 17:54 7 min. read

Best Crypto to Buy Now as Arthur Hayes Makes New Bitcoin Price Prediction

When macro strategist Arthur Hayes, co-founder of BitMEX and now at Maelstrom, flagged a possible retracement of Bitcoin to the $90,000 zone, it grabbed the market’s attention. His thesis centers on the U.S. Treasury’s plan to refill its Treasury General Account, which could temporarily pull liquidity from the financial system and pressure risk assets. This […]

Best Crypto Presales to Invest in this Month: 4 Projects with Huge Potential

The overall crypto market cap is now valued at $3.47 trillion, marking a 2.36% jump over the past week and a near 50% increase year-on-year. This wave of bullish sentiment is partly driven by fresh macro developments, including the U.S. government’s pro-crypto stance and new housing policies that could soon allow crypto assets to count […]

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

BTC Bull Token has reached a critical moment. With less than 24 hours left in its presale, the project has already raised $8 million, signalling huge investor confidence. Buyers now have one last chance to secure tokens at a lower price before claiming goes live and the token becomes tradable on exchanges. Many crypto traders […]

Best Crypto to Buy Now as $8.6B Bitcoin Whale Awakens After 14 Years

When a Bitcoin whale that had lain dormant since 2011 sprang to life this week, it unleashed a colossal 80,000 BTC, worth about $8.6 billion, onto the blockchain. Such a historic stir not only shattered records for daily movements of decade‑old coins but also underscored how long‑term holders can reshape market dynamics in a heartbeat. THE FINAL […]

-

1

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read -

2

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read -

3

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

4

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read -

5

Best Crypto to Buy Now as Ethereum Plans to Cut Block Times in Half

25.06.2025 17:54 7 min. read