Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Pepe Price Prediction: Can $PEPE Reach 1 Cent In the Next Bull Run?

19.02.2025 20:36 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

PEPE’s price just wiped out a zero, and big investors are taking notice. Whales recently bought 480.4 billion tokens for $8.72 million, fueling speculation that $PEPE could reach 1 cent in the next bull run.

Some believe it’s possible, while others argue the token would need massive market shifts to get there.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Then there’s PlutoChain ($PLUTO), a new project that generated a lot of attention as a hybrid Layer-2 solution that could improve Bitcoin’s speed and usability.

Let’s break down PEPE’s chances of hitting $0.01 and how PlutoChain could finally make Bitcoin fast and usable.

Can PEPE Reach $0.01 in 2025? Here’s What the Charts Say

PEPE has been making moves again, with its price now sitting at $0.00000972, up 3.32% in the past week.

Some traders believe a bigger rally could be on the way, especially after a crypto whale jumped back in with a $8.7 million investment.

That kind of move usually gets people talking, and right now, speculation is heating up about whether PEPE could actually hit $0.01 in the next bull run.

On the technical side, PEPE is trading above both the 50-day and 200-day moving averages, showing bullish momentum. If a golden cross forms, where the 50-day MA crosses above the 200-day, that could be another sign that PEPE has room to run.

The analyst from X, Jimmy, believes that PEPE has real potential of hitting 1 cent valuation.

PlutoChain ($PLUTO) Could Be the Layer-2 Upgrade That Makes Bitcoin Fast and Usable

Bitcoin is the biggest name in crypto, but let’s be real—it’s not the easiest to use for daily payments.

Transactions take too long, fees get expensive, and it doesn’t support smart contracts. While Bitcoin works well as digital gold, it falls short of a practical payment system.

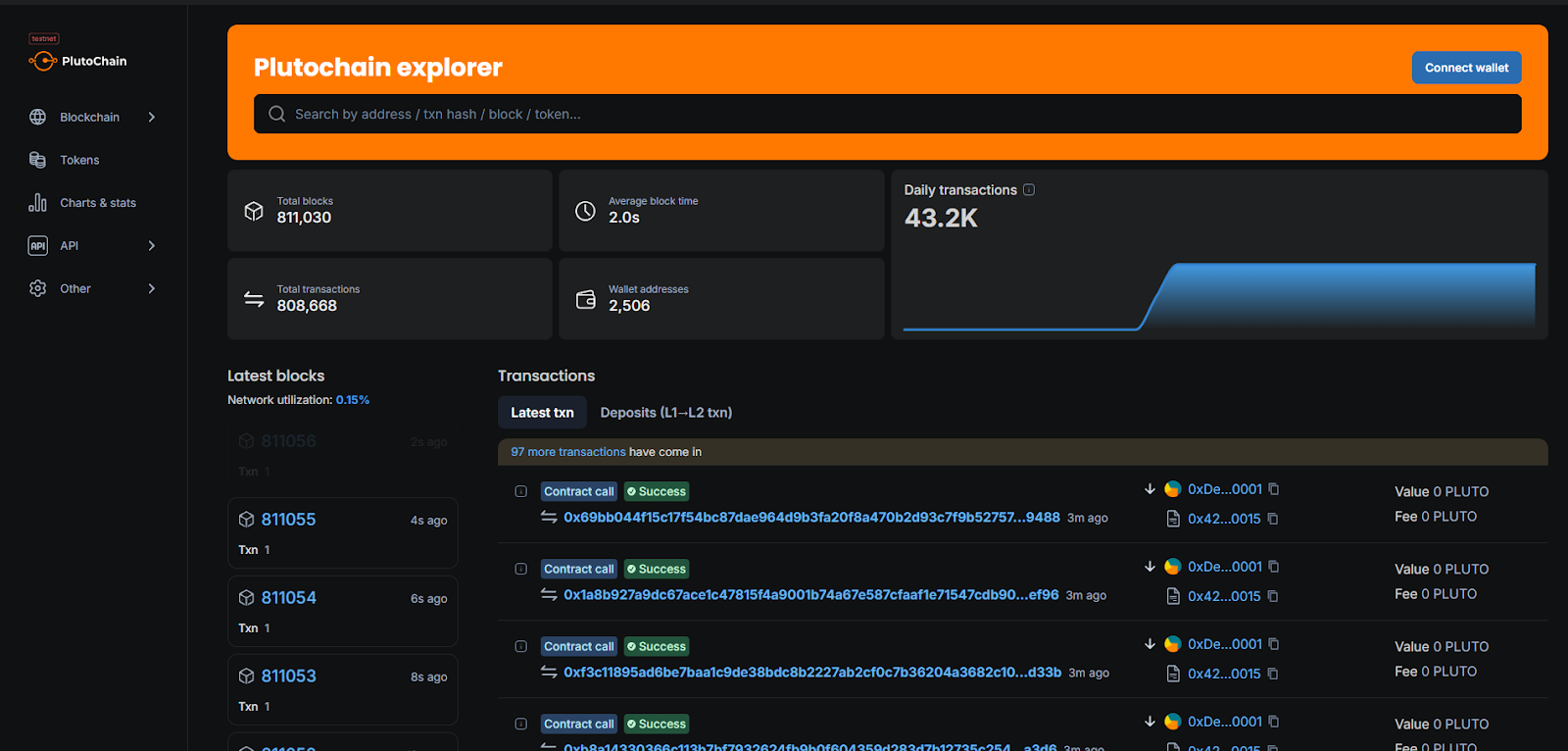

PlutoChain ($PLUTO) could fix these issues with a hybrid Layer-2 solution built to make Bitcoin faster, cheaper, and more functional.

Instead of waiting 10 minutes to confirm a block, PlutoChain processes blocks in just 2 seconds on its own network. This could allow instant payments, smoother remittances, and microtransactions that actually make sense.

Fees are another big issue. Bitcoin’s transaction costs can be unpredictable, which makes small payments inconvenient. PlutoChain could cut those costs, which could make BTC more accessible for both businesses and everyday users.

PlutoChain also brings Ethereum Virtual Machine (EVM) compatibility, which could connect Bitcoin to DeFi platforms, NFT marketplaces, and AI-driven applications—something Bitcoin alone can’t support.

Security remains a priority, with PlutoChain passing audits from SolidProof, QuillAudits, and Assure DeFi.

Regular stress tests ensure the network can handle high demand. During testing, PlutoChain processed over 43,200 transactions in a single day, proving it has the scalability to support real-world usage.

Unlike Bitcoin’s miner-controlled system, PlutoChain lets users propose and vote on network upgrades, which effectively makes it more decentralized and adaptable.

Final Words

PEPE’s price jump and whale activity have people wondering if $0.01 is really on the table. Some traders believe it could happen in the next bull run, while others think it would take a massive market shift to get there. Either way, the hype isn’t slowing down.

At the same time, Bitcoin still hasn’t fixed slow transactions and high fees. Luckily, PlutoChain ($PLUTO) may have what it takes to fix that with faster block times, lower fees, and EVM compatibility. If it works, Bitcoin could finally become more than just digital gold—it could actually be useful for payments.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as Bitcoin Price Dips Below $110K

12.06.2025 16:15 8 min. read -

2

Best Crypto to Buy Now as Canada Spot XRP ETF Unlocks New Capital Inflows

18.06.2025 19:04 8 min. read -

3

Next 1000x Crypto: 4 Presales That Could Give Massive Returns

21.06.2025 19:34 6 min. read -

4

Best Crypto to Buy Now as Amazon and Walmart Plan New Stablecoins

14.06.2025 19:17 7 min. read -

5

Bitcoin Hyper Is the Fastest Way to Use BTC – and It’s Just Getting Started

16.06.2025 10:43 5 min. read

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

Hedge fund titan Philippe Laffont has flipped his stance on Bitcoin, forecasting its market cap could more than double to $5 trillion within five years. This projection underscores shifting institutional sentiment and waning volatility in the largest crypto asset. Philippe Laffont on #bitcoin: “Every day I do think, ‘Why do I not own it?’” pic.twitter.com/YopeiJD2wn […]

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

The Best Wallet Token (BEST) presale has surpassed $13.5 million, just as Mastercard’s recent partnership with Chainlink opens a highway for over 3 billion cardholders to buy crypto directly on-chain. With more fiat money flowing directly into on-chain wallets, demand for safe, non-custodial wallet solutions is set to increase dramatically. This trend aligns with Best […]

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

Finding the best altcoins to buy right now means looking past Bitcoin, Ethereum, Solana, and XRP. Sure, those four get all the headlines, but smaller projects with clever use cases could explode even higher this July. With that in mind, here are five low-cap coins you should check out before the end of the month. […]

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

Over the weekend, crypto took a hit due to the drama in the Middle East – but it has recovered fast. Bitcoin, Ethereum, and especially Solana made a strong comeback from their recent lows. This uptick has also boosted the Solana meme coin market, with DogWifHat and Snorter seeing some of the biggest gains. This […]

-

1

Best Crypto to Buy Now as Bitcoin Price Dips Below $110K

12.06.2025 16:15 8 min. read -

2

Best Crypto to Buy Now as Canada Spot XRP ETF Unlocks New Capital Inflows

18.06.2025 19:04 8 min. read -

3

Next 1000x Crypto: 4 Presales That Could Give Massive Returns

21.06.2025 19:34 6 min. read -

4

Best Crypto to Buy Now as Amazon and Walmart Plan New Stablecoins

14.06.2025 19:17 7 min. read -

5

Bitcoin Hyper Is the Fastest Way to Use BTC – and It’s Just Getting Started

16.06.2025 10:43 5 min. read