Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Stellar’s Payment Focus vs. Cutoshi’s Holistic Vision: The Future Of Crypto Ecosystems

19.02.2025 17:30 3 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Stellar has dropped by more than 31% in the past week, and experts feel the decline could further continue.

This is why they suggest the crypto audience diversify their asset portfolio by investing in newer projects like Cutoshi, which is already performing great in its presale.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

While Stellar’s payment-centric approach has earned it global recognition, Cutoshi’s multifaceted ecosystem has much more to offer. Let us study more about the reasons why Cutoshi could leave behind Stellar in terms of growth.

Stellar’s Payment-Centric Model

Stellar is obviously a big player in the payments space. It leverages its Stellar Consensus Protocol to allow fast and cheap transactions. With partnerships with governments, financial institutions, and remittance platforms, Stellar has processed millions of transactions. Its major focus lies on serving as a bridge between traditional finance and blockchain technology.

However, its narrow focus on just payments leaves room for the kind of innovation that projects like Cutoshi are associated with.

Cutoshi’s MemeFi Ecosystem

Cutosh is a meme coin inspired by Satoshi Nakamoto’s principles and is building an ecosystem that goes much beyond payments. Its DEX and Swapping Platform allows for cost-effective asset swaps across Ethereum, Solana, and other networks. addressing. With a mere fee of 0.25% per trade, Cutoshi’s DEX is not only cheap but also rewards liquidity providers with 80% of trading fees.

Beyond its DEX, Cutoshi’s ecosystem includes an educational DeFi platform that educates beginners on blockchain technology, Web3, and DeFi through interesting modules. That is not all. Cutoshi also plans to launch Lucky Cat merchandise to increase its utility.

These features create a loyal, engaged community, turning holders into stakeholders rather than passive traders.

Cutoshi vs. Stellar In 2025

Stellar’s strength lies in its specialization. Its partnerships with institutions like IBM and Deloitte and its focus on financial inclusion make it a powerhouse in the payments space. However, its reliance on institutional adoption and limited community engagement could hurt its growth in a market increasingly driven by retail investors.

Cutoshi, on the other hand, represents a shift toward holistic ecosystems that cater to both utility and cultural relevance. Its deflationary tokenomics with 440 million tokens and a burn mechanism create long-term value.

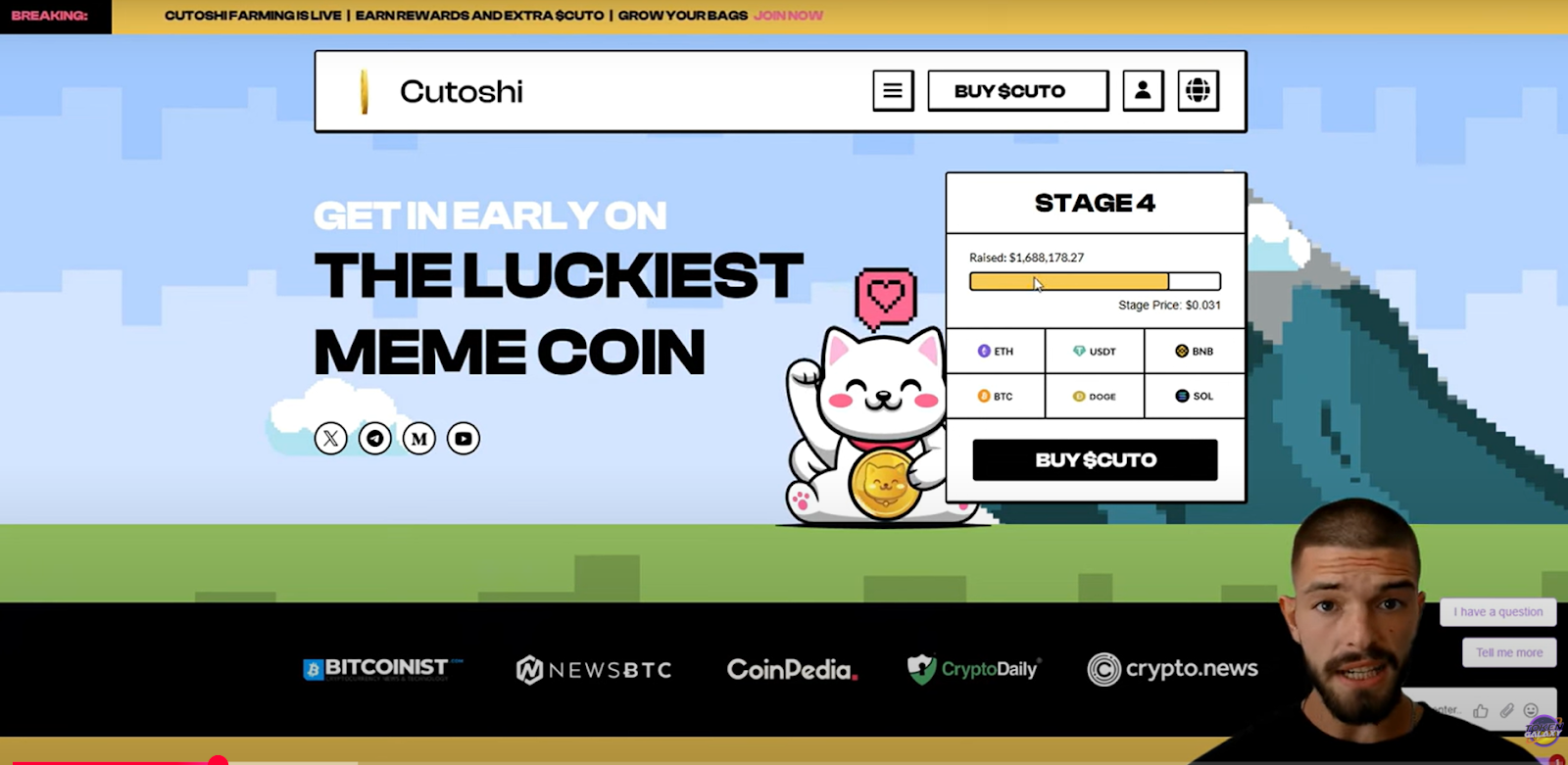

Crypto analysts predict Cutoshi as a Top 2025 DeFi performer. Check out a review of the altcoin by a Crypto content creator:

🤖 DIVE INTO DEFI WITH CUTOSHI! YOUR PATH TO FREEDOM!

Conclusion

Stellar’s payment focus and Cutoshi’s holistic vision represent two very different paths for crypto ecosystems. While Stellar excels in efficiency and institutional trust, Cutoshi’s blend of meme culture and DeFi utility offers a simpler yet powerful alternative for investors seeking both innovation and price growth.

As the crypto market matures, the question isn’t just about speed or scalability. What will also matter are ecosystems that help users on multiple levels. So, while Stellar will continue its path to solve a major problem leveraging blockchain technology, Cutoshi has already shown signs of a future market leader.

Cutoshi’s presale continues to attract investors, and now, with a 35% special bonus till 19 February being offered on all deposits, its demand is going through the roof.

Cutoshi Presale Live, Learn More Below

- Price: $0.045 per $CUTO

- Supply: 440,000,000 tokens (ERC-20)

- Website: https://cutoshi.com

- Telegram: https://t.me/cutoshicommunity

- X (Twitter): https://x.com/CutoshiToken

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

2

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

3

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read -

4

Hyperlane Explodes 460% After Upbit Listing, but Bitcoin Hyper Could Pump Even Higher

11.07.2025 17:35 5 min. read -

5

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

15.07.2025 18:20 5 min. read

Best Crypto to Buy Now as Ethereum ETFs Hit Record Inflows

In a remarkable turn, ether exchange‑traded funds (ETFs) outpaced their bitcoin counterparts in daily inflows for the first time, pulling in over $600 million against bitcoin’s $523 million. This shift underscores a growing institutional appetite for Ethereum, as heavyweight players like BlackRock, Grayscale, and Fidelity pour fresh capital into ETH vehicles. 🇺🇸 ETF FLOWS: Ethereum surpasses bitcoin […]

Best Crypto to Buy Now as Trump Injects Crypto Into $9 Trillion Retirement Plans

President Donald Trump is gearing up to sign an executive order that would give American workers unprecedented access to a $9 trillion retirement market by allowing 401(k) plans to hold alternative assets such as cryptocurrencies, gold, and private equity. This landmark move could usher in a new era of institutional capital for digital assets, shifting retirement […]

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

Ethereum (ETH) has just seen a record-breaking $726.74 million daily inflow into its spot ETFs. This helped send its price above $3,600 for the first time since January, with ETH currently up over 20% from this time last week. ETH has been steadily outperforming Bitcoin (BTC) over the past 30 days, hinting at an altcoin […]

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

The much‑anticipated “Crypto Week” kicked off on July 14 with high hopes for landmark legislation to formalize digital assets in the U.S. Instead, a procedural vote derailed the GENIUS Act, forcing House Speaker Mike Johnson to pull the remaining measures. Stepping into the fray, President Donald Trump convened key Republicans in a last‑ditch effort to […]

-

1

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

2

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

3

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read -

4

Hyperlane Explodes 460% After Upbit Listing, but Bitcoin Hyper Could Pump Even Higher

11.07.2025 17:35 5 min. read -

5

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

15.07.2025 18:20 5 min. read