Ripple’s RLUSD Hits $120M Supply as XRP Ledger Adoption Grows

18.02.2025 19:00 1 min. read Alexander Stefanov

Ripple’s regulated stablecoin, RLUSD, has surpassed a total supply of $120 million, marking a significant milestone.

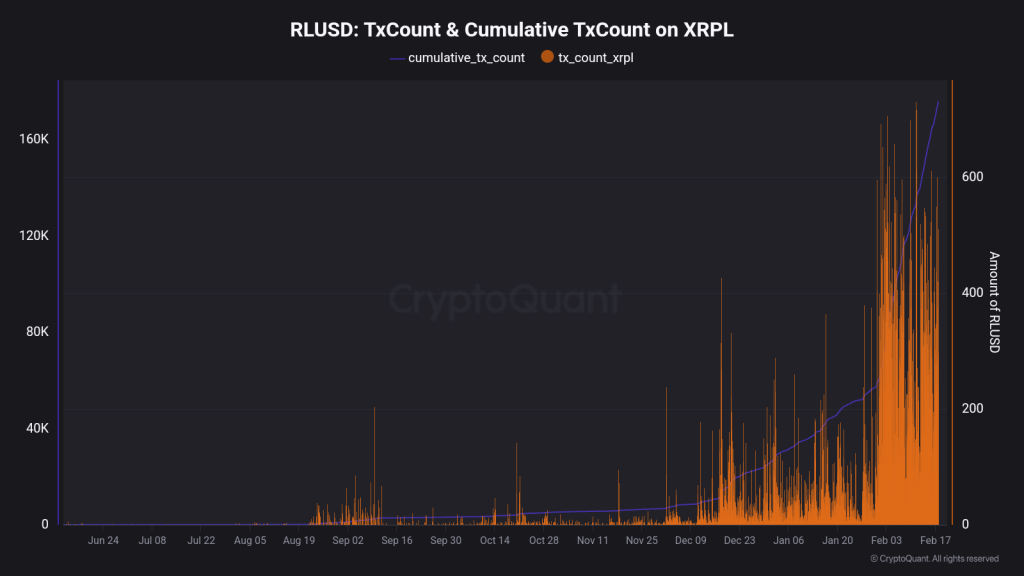

According to CryptoQuant analyst Maartunn, its growth on the XRP Ledger has outpaced Ethereum, where adoption has slowed. The XRP Ledger currently holds 37.4 million RLUSD, while Ethereum remains below 83.3 million.

The shift is largely attributed to lower transaction fees on XRPL, making it a more attractive option for stablecoin transactions.

Initially, RLUSD saw faster growth on Ethereum, but interest has since shifted toward XRPL. Maartunn predicts further adoption, particularly in Europe, where MiCA regulations have led to USDT delistings.

Recent data shows RLUSD transaction volume has risen sharply, with over 160,000 cumulative transactions and daily counts exceeding 600 in February.

Since launching in December with regulatory approval, RLUSD has expanded to platforms like Bitstamp, Revolut, and Zero Hash. Ripple’s continued token minting suggests further supply growth, but RLUSD still lags behind major stablecoins like USDC and USDT, which dominate the market.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read

Solana Reclaims $200 as Short Squeeze, ETF hopes, and Institutional Flows Collide

Solana surged 5.6% to reclaim the $200 level for the first time since February, fueled by a confluence of bullish technical, fundamental, and institutional catalysts.

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read