Ethereum’s Recent Performance Suggests Possible Market Rebound

18.02.2025 16:00 1 min. read Alexander Zdravkov

Over the past day, Ethereum (ETH) has managed to outperform the general cryptocurrency market, marking a rare occurrence that led to a 12-day high, signaling potential signs of recovery.

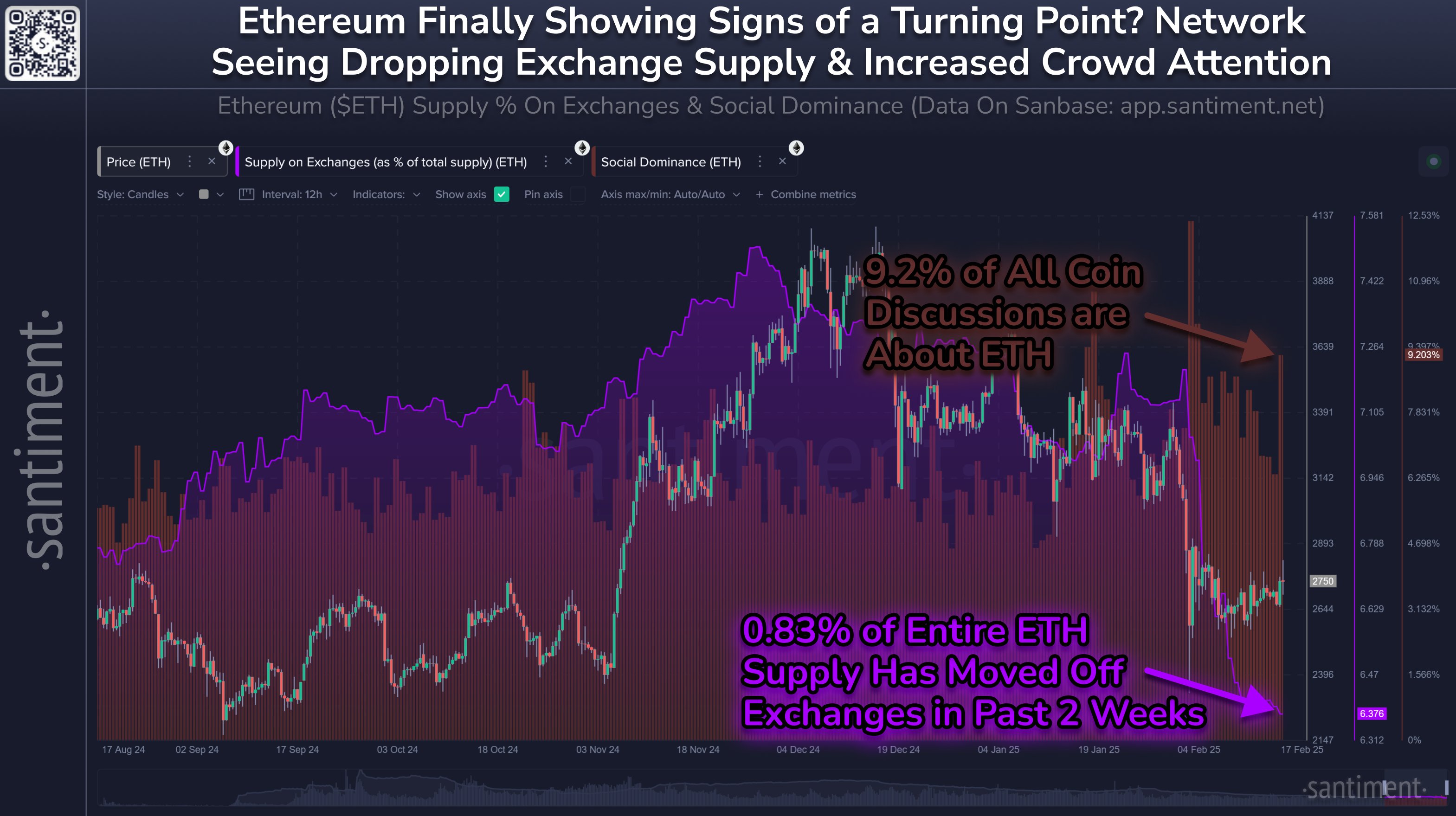

According to analytics firm Santiment, Ethereum displayed “mild signs” of a rebound, moving ahead of most altcoins as the week began.

Santiment highlighted that a significant portion of Ethereum’s supply continues to be moved off exchanges, with only 6.38% remaining on platforms. This behavior indicates long-term holding by investors, reducing the likelihood of a sudden sell-off.

The analysts observed that Ethereum has gained renewed attention from the crypto community in February, following a period of underperformance compared to other major cryptocurrencies.

While some, like crypto YouTuber Lark Davis, remain skeptical, the recent price movement has improved the ETH/BTC ratio slightly.

This metric, which compares Ethereum’s value to Bitcoin, has been at multi-year lows but saw a 7% increase on February 17, although it remains close to its weakest levels since December 2020.

-

1

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

2

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

5

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read

Ethereum Price Prediction: New ETH Whale Accumulates $400M Worth of Ether – Is $5K in Sight?

Ethereum (ETH) has gone up by 62% in the past month as the passing of the Genius and Clarity Acts in the United States may have kicked off altcoin season. Combined with the tailwind provided by the Pectra upgrade, market conditions favor a bullish Ethereum price prediction and we could see this crypto rising to […]

Top Trending Cryptos: Spark, SLP, Flare Lead Breakout Surge

Three altcoins—Spark (SPK), Smooth Love Potion (SLP), and Flare (FLR)—are dominating market momentum today, according to CoinMarketCap’s algorithm tracking social buzz, price action, and news catalysts.

21Shares Files for ETF Tracking Ondo’s Real-World Asset Token

21Shares has submitted an application to launch an exchange-traded product (ETP) that tracks Ondo (ONDO), the native token of Ondo Finance.

BNB Hits New All-time High Above $803 Amid Altcoin Surge

BNB soared past $803, setting a new all-time high before pulling back slightly.

-

1

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

2

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

5

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read