Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Cardano Price Prediction: Grayscale Files for Spot Cardano ETFs – Can This Bring a 10X ADA Surge?

17.02.2025 18:16 3 min. read Alexander ZdravkovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Grayscale’s spot Cardano ETF filing and institution interest in the project has brought predictions of a potential surge in ADA’s value - we’ll explore this further below.

At the same time, PlutoChain ($PLUTO) might take on Bitcoin’s biggest challenges with its hybrid Layer-2 solution. By making Bitcoin faster and more efficient, PlutoChain could bridge the gap between a store of value and a practical system.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Let’s look at the deets below.

Cardano Price Prediction: Can ADA Surge 10X in 2025? Grayscale’s Spot ETF Filing Sparks Bullish Predictions

Grayscale Investments has taken a big step by filing for a spot ADA ETF with the U.S. Securities and Exchange Commission (SEC), in partnership with NYSE Arca. This would be Grayscale’s first standalone investment product for Cardano.

If approved, the ETF would provide investors with a regulated and more accessible way to gain exposure to ADA. Coinbase Custody Trust Company has been chosen as the custodian for the fund’s assets, while BNY Mellon Asset Servicing will handle administrative duties.

Grayscale believes this ETF could increase competition in the market, which would benefit both investors and the broader crypto industry.

Fisher predicts ADA could hit $10 this cycle and points to Charles Hoskinson’s possible role as Trump’s crypto advisor, the launch of a Cardano ETF in 2025, and Cardano’s growing role as Bitcoin’s DeFi layer.

PlutoChain ($PLUTO) Brings The Hybrid Layer-2 Upgrade That Could Make Bitcoin Fast, Affordable, and Practical

Bitcoin may be the most well-known cryptocurrency, but its slow transactions and high fees make it frustrating for everyday use. PlutoChain ($PLUTO) could come in as a hybrid Layer-2 scaling solution to potentially speed up Bitcoin and lower costs.

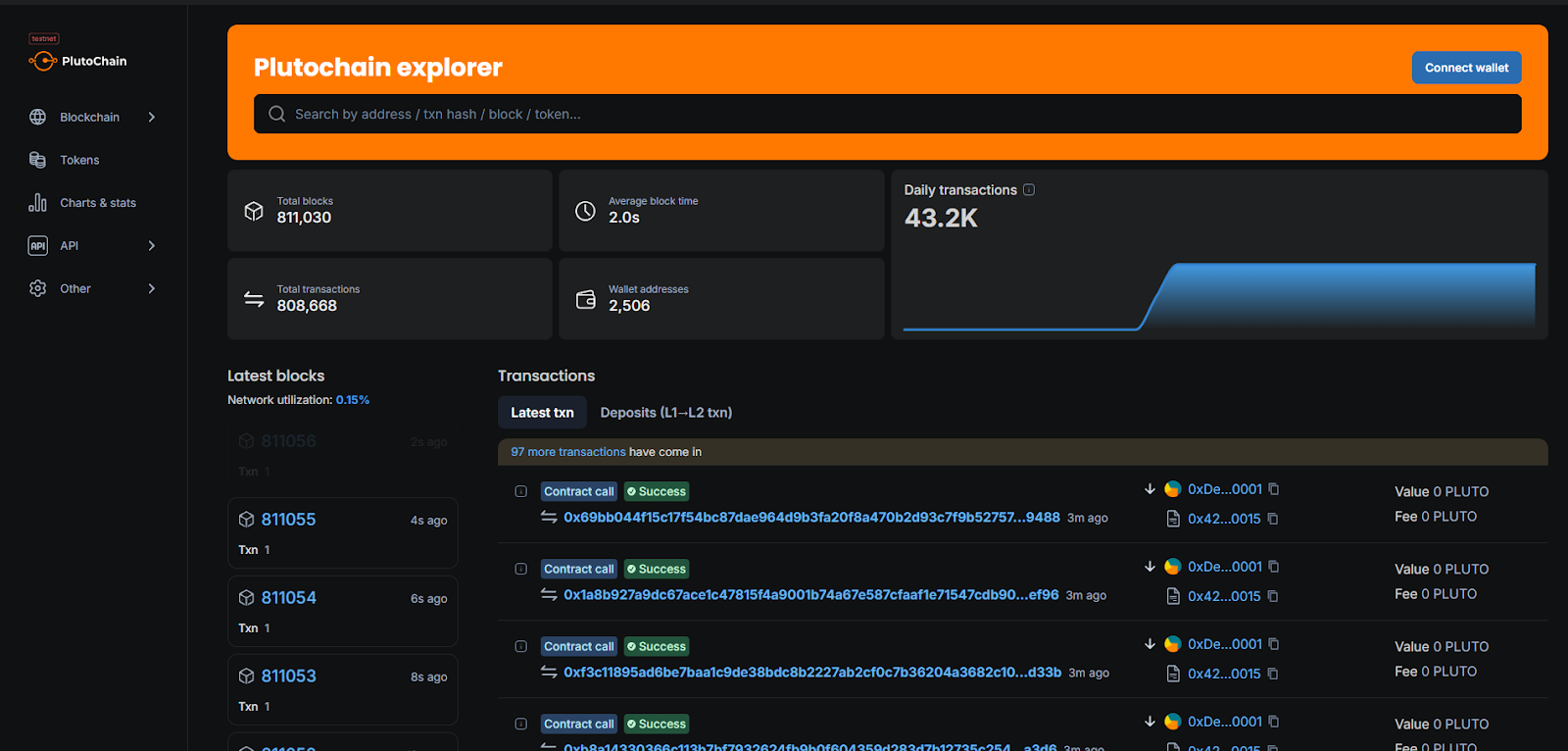

PlutoChain operates on its own blockchain and offers block times of just 2 seconds, a major improvement over Bitcoin’s 10-minute block times.

This could mean faster, smoother payments, whether for microtransactions, global transfers, or everyday purchases. Instead of waiting around for confirmations, users could send BTC almost instantly.

Lowering fees might be another key advantage. High transaction costs have made Bitcoin more of a digital gold than a practical currency. PlutoChain could change that by reducing fees, which could make BTC more accessible to both businesses and individuals.

Beyond payments, PlutoChain supports Ethereum Virtual Machine (EVM) compatibility and could enable DeFi applications, NFT marketplaces, and AI-powered blockchain solutions. This could create a bridge between Bitcoin’s security and Ethereum’s flexibility and expand BTC’s real-world use cases.

PlutoChain’s testnet has already handled over 43,200 transactions in a single day, which proves it can support high demand. Security is also a priority. PlutoChain has undergone rigorous audits from SolidProof, QuillAudits, and Assure DeFi, along with ongoing stress tests and code reviews.

On top of all this, PlutoChain embraces community-driven governance and gives users a direct say in network decisions. With faster speeds, lower costs, and expanded functionality, PlutoChain could transform Bitcoin from a slow, expensive asset into an efficient, everyday currency.

Final Thoughts

Cardano’s future looks bright with Grayscale’s ETF filing and growing institutional interest, which could push ADA to new highs.

Meanwhile, PlutoChain ($PLUTO) might also be worth watching. With 2-second block times and EVM compatibility, PlutoChain’s Layer-2 solution could finally make Bitcoin a fast, practical payment system.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

The recent ceasefire between Iran and Israel brought temporary calm to global markets, and the crypto sector responded quickly. Bitcoin is back above $106K as buying pressure returns and investor confidence stabilizes. With traders now positioning for a potential move to $120K and beyond, one project stands to benefit the most. BTC Bull Token (BTCBULL) […]

Best Crypto to Buy Now as Bitcoin ETFs Log a 9-Day Inflow Streak

Institutional investors just extended their love affair with Bitcoin ETFs to a ninth consecutive day, even as the post-Juneteenth trading session delivered only a murmur of activity. Despite a modest $6.37 million net inflow on Friday, the streak underscores how major players remain committed to on-chain exposure. This publication is sponsored. CryptoDnes does not endorse […]

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

The crypto market is gearing up for the third quarter with renewed optimism following several positive developments. Bitcoin (BTC) fell under $100,000 after the US struck Iran with airstrikes over the weekend. But the leading cryptocurrency has now surged to over $104,000 amid the expectation of a complete ceasefire between Iran and Israel. Meanwhile, the […]

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

Over the weekend, escalations of the conflict in the Near East shook global markets after the US launched an airstrike on Iran’s nuclear sites. The impact was felt in crypto too, with Bitcoin pushed into a resistance test and slipping just below the $100,000 level for the first time in six weeks, before rebounding. The […]

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read