Crypto Market Faces Crisis of FOMO and Scams, Experts Call for Return to Fundamentals

16.02.2025 19:00 2 min. read Alexander Stefanov

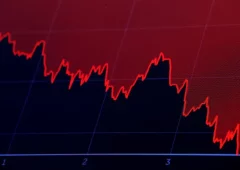

The crypto market is currently dominated by Bitcoin, which controls over 60% of the space, while altcoins are struggling to keep up.

Once known for its rapid innovation, the sector has devolved into a breeding ground for speculative meme coins and scams, leaving investors disillusioned and exhausted.

For years, the crypto world was defined by growth and cutting-edge projects. However, this growth has become overshadowed by a shift in priorities, with the market increasingly focused on quick gains rather than long-term value. Alejandro Navia, co-founder of NFT Now, called attention to a concerning trend, stating that the situation today feels more worrying than a typical market cycle. Macro analyst Lyn Alden also warned that many cryptocurrency projects lack solid economic foundations, with the altcoin market now largely driven by memes and short-term plays.

In the current climate, meme coin trading has reached a fever pitch, with investors rushing to get in on tokens as soon as they launch. This race for quick profits has led to disastrous outcomes, such as the 800,000 investors in the Official Trump Coin who lost billions when the token plummeted within hours. The result is a culture of impulsive trading, fueled by FOMO, and saturated with scams and quick get-rich schemes. Even seasoned investors are feeling the pressure, as they watch legitimate projects struggle to compete with the chaos.

What the market needs now is a return to its foundational principles. To succeed, crypto must focus on sustainable growth and support projects with real-world value. Without a shift back to genuine innovation and community-driven accountability, the space risks further deterioration. As Navia puts it, there’s an urgent need to address the direction of the market, acknowledging that things may get worse before they improve.

-

1

Taiwan’s Secret Trading Giant Is Beating Wall Street at Its Own Game

26.05.2025 15:52 2 min. read -

2

El Salvador Defies IMF Again, Keeps Buying Bitcoin Despite Loan Conditions

28.05.2025 18:00 1 min. read -

3

Tether Reaffirms Global Strategy as U.S. Stablecoin Bill Advances

27.05.2025 9:00 1 min. read -

4

Michael Saylor Questions Proof-of-Reserves Model, Cites Security Risks

27.05.2025 16:00 1 min. read -

5

Tether Becomes Major U.S. Investor With Billions in Strategic Allocations

27.05.2025 21:00 1 min. read

FTX Dumps Another $10M in Solana as Wind-Down Efforts Press On

The slow dismantling of Sam Bankman-Fried’s crypto empire continues, with defunct firms FTX and Alameda Research quietly shifting another $10.3 million in Solana (SOL) as part of their asset liquidation plan.

Gold Glides Toward New Peaks as Middle-East Strife Lifts Safe-Haven Demand

Gold’s relentless climb in 2025 shows no sign of slowing. Spot prices burst above $3,400 this week—within striking distance of April’s record near $3,500—after renewed hostilities in the Middle East rattled global markets.

Trump Turns 79 With Billions in Crypto and a $45M Parade

Washington is gearing up for a grand $45 million military parade on June 14, 2025, marking two milestones: the U.S. Army’s 250th anniversary and Donald Trump’s 79th birthday.

Warren Buffett Narrows His Bets as He Prepares to Step Down

As Warren Buffett edges closer to ending his six-decade reign at Berkshire Hathaway, the legendary investor has tightened his focus, placing nearly $197 billion into just a handful of stocks.

-

1

Taiwan’s Secret Trading Giant Is Beating Wall Street at Its Own Game

26.05.2025 15:52 2 min. read -

2

El Salvador Defies IMF Again, Keeps Buying Bitcoin Despite Loan Conditions

28.05.2025 18:00 1 min. read -

3

Tether Reaffirms Global Strategy as U.S. Stablecoin Bill Advances

27.05.2025 9:00 1 min. read -

4

Michael Saylor Questions Proof-of-Reserves Model, Cites Security Risks

27.05.2025 16:00 1 min. read -

5

Tether Becomes Major U.S. Investor With Billions in Strategic Allocations

27.05.2025 21:00 1 min. read