Billionaire Ray Dalio Warns of U.S. Debt Crisis, Calls for Urgent Action

16.02.2025 20:00 2 min. read Kosta Gushterov

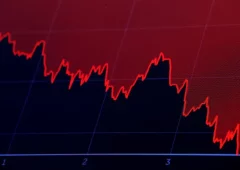

Billionaire investor Ray Dalio has issued a stark warning about the U.S. economy, suggesting that the country is heading toward a dangerous "debt death spiral" due to its growing fiscal deficits.

Speaking in a CNBC interview, the Bridgewater Associates founder explained that a healthy credit system benefits all participants, from borrowers to lenders, as long as debt is used productively to generate income.

However, he believes the U.S. government is now borrowing at an unsustainable pace, potentially outstripping demand from buyers. This could force the government to take on more debt just to cover existing obligations, a scenario that Dalio says could spiral out of control.

He compares the situation to a clogged circulatory system, where excessive debt functions like plaque restricting blood flow. With interest payments alone approaching $1 trillion annually, the ability to allocate funds elsewhere is becoming increasingly constrained.

Dalio also highlights a critical supply-and-demand imbalance in the credit markets. With the U.S. deficit projected at around 7.5% of GDP, the government must sell a significant amount of debt to cover its shortfall. But if investor appetite fails to keep pace, the situation could deteriorate rapidly. He describes this as a classic debt cycle where borrowing becomes self-perpetuating, leading investors to lose confidence and offload government debt—pushing the system closer to collapse.

To prevent a full-blown crisis, Dalio argues that the U.S. must take decisive action by reducing its deficit to 3% of GDP, a strategy he calls “the 3% solution.” Achieving this, he says, would require both spending cuts and lower interest rates. He warns that failure to implement these measures could lead to dire consequences, urging political leaders to take responsibility before it’s too late.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

Digital banking platform SoFi Technologies is making a strong return to the cryptocurrency space, relaunching its crypto trading and blockchain services after stepping away from the sector in late 2023.

Chinese Tech Firms Turn to Crypto for Treasury Diversification

Digital assets are gaining ground in corporate finance strategies, as more publicly traded companies embrace cryptocurrencies for treasury diversification.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read