BNB Chain Enhances Network to Tackle Rising Gas Fees Amid Memecoin Frenzy

16.02.2025 15:00 1 min. read Alexander Stefanov

BNB Chain has introduced a key upgrade to its BSC network as surging memecoin speculation leads to higher transaction fees and congestion issues.

Currently, BSC validators finalize bids once they reach the block limit, with new blocks produced every three seconds. However, when network activity spikes, certain time-sensitive transactions—such as those involving memecoins—fail to be processed in time.

To address this, the network’s latest adjustment allows validators to evaluate more bids within the same three-second timeframe. This increases the likelihood of prioritizing higher-value transactions over less urgent ones, particularly benefiting users involved in rapid trading.

The update aims to improve block efficiency and ensure that transactions interacting with volatile assets, like memecoins, have a better chance of inclusion during peak periods.

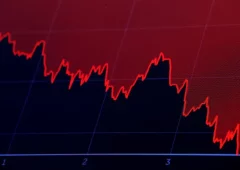

Recent network activity has driven BNB transaction fees to historic highs. Over the past week, users have spent nearly $15 million on fees—far surpassing Ethereum’s $7 million and second only to Solana’s $29 million, per Nansen data. This marks a staggering 388% increase from previous levels.

Analysts suggest that a key factor behind this surge could be the temporary halt in Binance’s legal proceedings with the SEC. Meanwhile, memecoins inspired by Binance founder Changpeng “CZ” Zhao’s dog, Broccoli, have fueled further activity, benefiting platforms like PancakeSwap.

-

1

Solana Partners with Kazakhstan to Launch Digital Economy Zone

22.06.2025 18:00 2 min. read -

2

Top 10 AI and Big Data Crypto Projects by Development Activity

01.07.2025 19:00 2 min. read -

3

Binance Prepares for THORChain Upgrade, Temporarily Halts RUNE Transfers

17.06.2025 16:55 1 min. read -

4

Ford Tests Cardano-Powered Data Solution for Its Legal Archives

19.06.2025 10:00 1 min. read -

5

Hyperliquid Chosen as Core Reserve in Lion Group’s Blockchain Expansion

19.06.2025 12:00 1 min. read

Top 10 AI and Big Data Crypto Projects by Development Activity

According to new insights from market intelligence platform Santiment, development activity in the crypto sector’s AI and Big Data segment remains strong, with several major projects showing notable GitHub activity over the past 30 days.

XRP Ledger Deploys EVM-Compatible Sidechain to Expand Multichain Utility

The XRP Ledger (XRPL) has officially launched its Ethereum Virtual Machine (EVM) sidechain on mainnet — marking a major milestone in its effort to bridge XRP’s payment efficiency with Ethereum’s smart contract capabilities.

What the U.S. Blockchain Act Means for Crypto’s Future

The U.S. House of Representatives has taken a major step toward digital asset regulation by passing the Deploying American Blockchains Act of 2025.

Top 10 DeFi Projects by Development This Month

According to a new report by Santiment, Chainlink ($LINK) has maintained its dominant position as the most actively developed DeFi project over the past 30 days.

-

1

Solana Partners with Kazakhstan to Launch Digital Economy Zone

22.06.2025 18:00 2 min. read -

2

Top 10 AI and Big Data Crypto Projects by Development Activity

01.07.2025 19:00 2 min. read -

3

Binance Prepares for THORChain Upgrade, Temporarily Halts RUNE Transfers

17.06.2025 16:55 1 min. read -

4

Ford Tests Cardano-Powered Data Solution for Its Legal Archives

19.06.2025 10:00 1 min. read -

5

Hyperliquid Chosen as Core Reserve in Lion Group’s Blockchain Expansion

19.06.2025 12:00 1 min. read