Analyst Predicts Significant Altcoin Decline Before Potential Rally

16.02.2025 11:00 1 min. read Kosta Gushterov

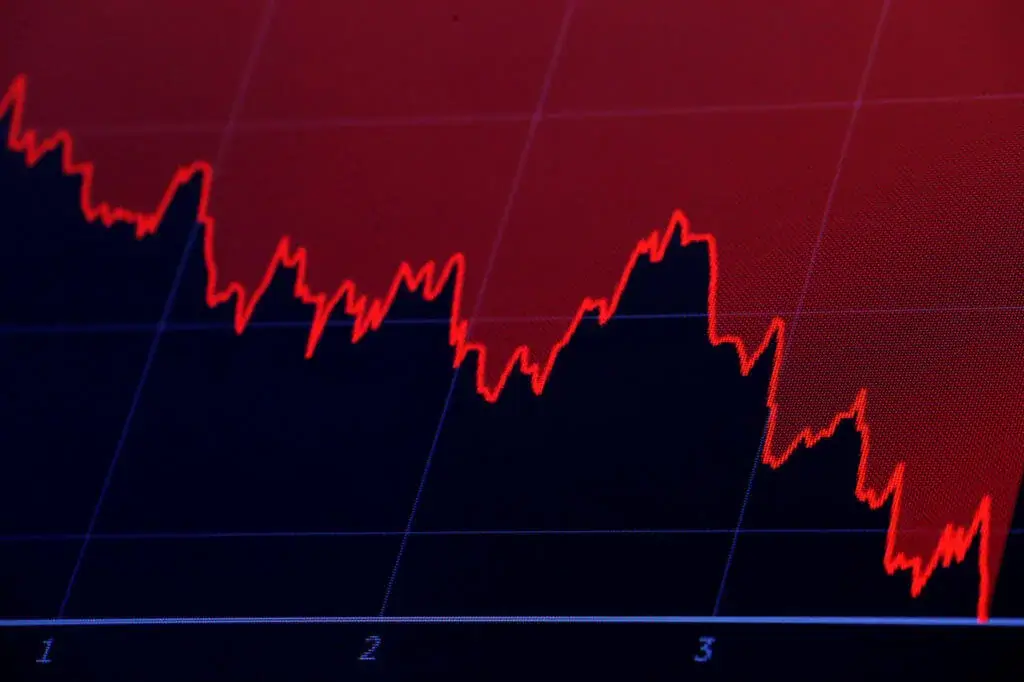

Crypto analyst il Capo of Crypto, a prominent figure in the cryptocurrency community, shared his latest insights regarding altcoins, forecasting a potential decline before a new rally could begin.

He stated that altcoins could experience further losses ranging from 20% to 40%, which might then set the stage for an altcoin season.

In his analysis, il Capo suggested that Bitcoin would likely be the least affected asset, with a potential drop of around 15%, and projected that its price could reach between $80,000 and $85,000.

However, he acknowledged the possibility of a sudden market drop, with price fluctuations potentially dipping lower.

He further predicted that the most resilient altcoins could fall by 20% to 30%, while weaker altcoins may face even steeper declines of 30% to 40%.

Memecoins, in particular, would bear the brunt of the downturn, with drops of up to 50% to 60%.

Despite not wishing for such a scenario, il Capo emphasized that market outcomes are driven by forces beyond individuals’ control, urging followers to brace for whatever may come.

-

1

Analyst Sees Signs of a Potential Dogecoin Comeback as Memecoin Market Shows Early Strength

08.06.2025 15:00 2 min. read -

2

Is Ethereum (ETH) Gearing Up for a Major Breakout?

11.06.2025 10:00 2 min. read -

3

Altcoin Rally May Be Closer Than It Seems—But This Cycle Looks Very Different

09.06.2025 13:15 1 min. read -

4

A Memecoin ETF? Analysts Say It’s Possible by 2026

09.06.2025 13:07 2 min. read -

5

XRP: Technical Insights Point to a Potential Bullish Reversal

10.06.2025 19:00 2 min. read

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

Solana (SOL) has gone down by nearly 21% in the past month as rising tensions in the Middle East triggered some selling pressure for cryptos. After the cease-fire agreement between Iran and Israel, the token recovered some of the territory it had lost and now trades above a key support at $140. Market participants are […]

Eclipse Labs Bans Team from ES Token Airdrop to Prevent Insider Abuse

As airdrop controversies continue to shake confidence across the crypto sector, Eclipse Labs is taking proactive steps to distance itself from recent missteps by other projects.

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

Crypto infrastructure firm Bit Digital is making a bold strategic pivot, abandoning Bitcoin mining entirely in favor of Ethereum staking and asset management.

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

Coinbase has taken another step toward boosting DeFi participation by launching wrapped versions of Cardano and Litecoin on its Base Layer 2 network.

-

1

Analyst Sees Signs of a Potential Dogecoin Comeback as Memecoin Market Shows Early Strength

08.06.2025 15:00 2 min. read -

2

Is Ethereum (ETH) Gearing Up for a Major Breakout?

11.06.2025 10:00 2 min. read -

3

Altcoin Rally May Be Closer Than It Seems—But This Cycle Looks Very Different

09.06.2025 13:15 1 min. read -

4

A Memecoin ETF? Analysts Say It’s Possible by 2026

09.06.2025 13:07 2 min. read -

5

XRP: Technical Insights Point to a Potential Bullish Reversal

10.06.2025 19:00 2 min. read