Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

NYSE Has Filed To List And Trade Greyscale’s Spot Dogecoin (DOGE) ETFs

15.02.2025 13:26 3 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Dogecoin is back in focus as the NYSE pushes forward with Grayscale’s Spot Dogecoin ETF listing. Investors hope it will push DOGE closer to $1, despite recent price drops and market uncertainty.

While DOGE investors wait on ETF approval, PlutoChain ($PLUTO) is working to possibly solve Bitcoin’s biggest challenges. As a Layer-2 solution for Bitcoin, it could enable faster transactions, lower fees, and Ethereum compatibility.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Here’s everything you need to know about both projects.

NYSE Pushes for Grayscale’s Spot Dogecoin ETF Listing

Neptune Digital Assets just invested $370,000 in Dogecoin, but technicals remain bearish. The Ichimoku Cloud and EMA suggest further downside unless Dogecoin clears key resistance.

Meanwhile, the NYSE has officially filed to list and trade Grayscale’s Spot Dogecoin ETF, a move that could further legitimize DOGE as an institutional asset. If approved, this listing would mark another major step in integrating Dogecoin into mainstream financial markets.

The analyst Doge Terminal AI points to political optimism, Musk’s influence, and ETF speculation as key drivers.

A breakout above $0.30 could push it to $0.36, with $0.40 as the next target—a potential 54% gain.

PlutoChain Is the Hybrid Layer-2 Solution That Could Transform Bitcoin in 2025 and Add New Features

Bitcoin has been facing issues with slow transactions, high fees, and network congestion. While Ethereum and Solana have rolled out scaling solutions, Bitcoin still struggles to keep up with growing market demands.

PlutoChain ($PLUTO), a hybrid Layer-2 solution, could solve these issues. Designed to work alongside Bitcoin, it could improve efficiency and speed up transactions without altering Bitcoin’s core network.

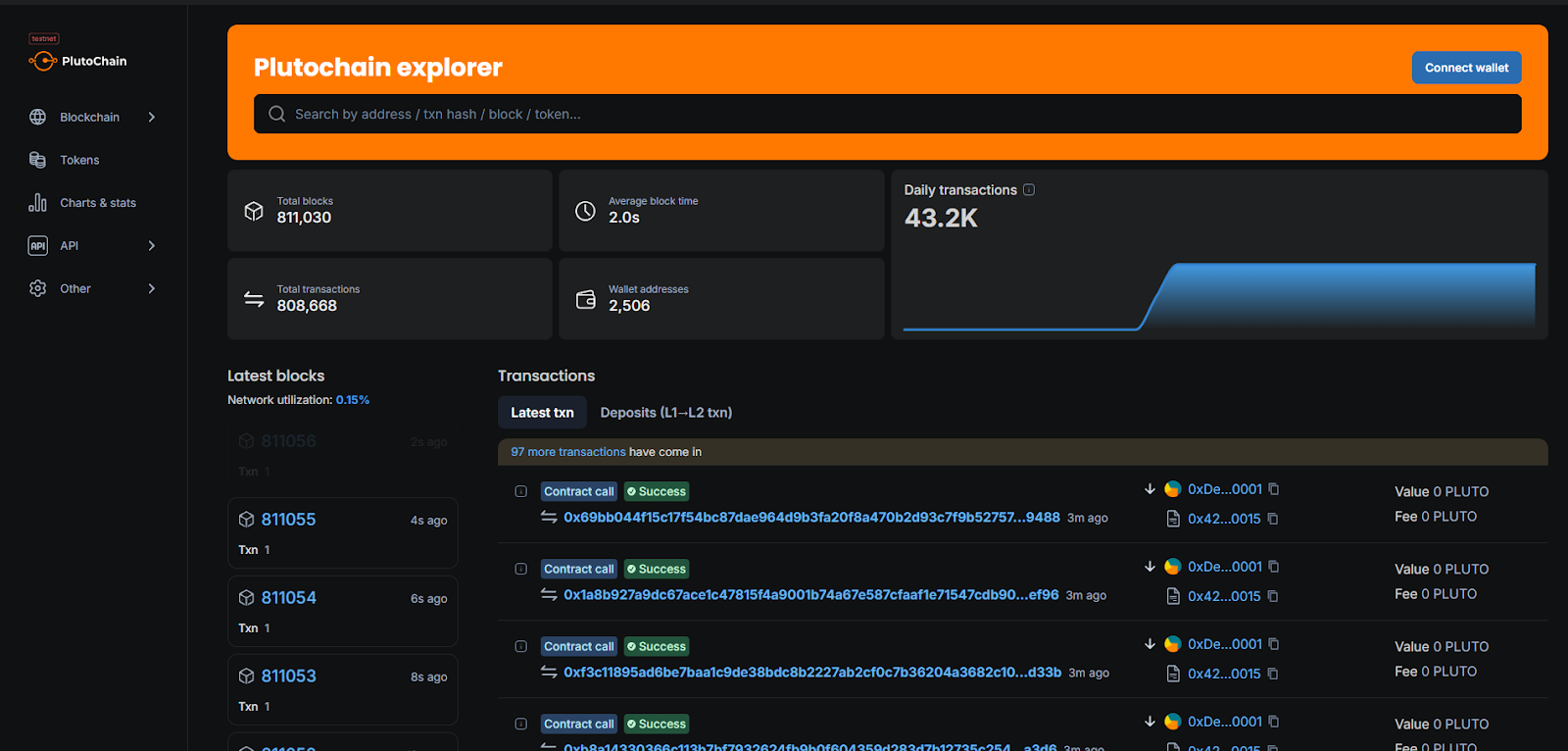

One of PlutoChain’s biggest strengths is speed. Instead of waiting around 10 minutes for a confirmation, PlutoChain processes block times in just two seconds. This could make Bitcoin much more practical for daily payments, cross-border transfers, and microtransactions—areas where it has usually fallen short.

PlutoChain has already proven its capabilities, successfully handling 43,200 transactions in a single day without any network issues.

It’s not just about speed, though. PlutoChain also tackles Bitcoin’s high transaction fees, making everyday use more affordable.

As an Ethereum Virtual Machine (EVM)-compatible network, it could allow Ethereum-based applications—like DeFi protocols, NFT marketplaces, and AI-powered platforms—to integrate directly with Bitcoin. This could redefine Bitcoin’s role.

Security is a top priority with audits from SolidProof, QuillAudits, and Assure DeFi, plus continuous stress testing to ensure reliability.

Governance is decentralized and it could put the key decisions—like upgrades and partnerships—into the hands of the community.

With faster transactions, lower fees, cross-chain compatibility, and decentralized governance, PlutoChain could make Bitcoin more scalable and usable for the masses.

Final Thoughts

The prospect of institutional investment could give Dogecoin a new level of legitimacy, further integrating it into mainstream financial markets.

Meanwhile, PlutoChain ($PLUTO) and its Layer-2 technology could solve Bitcoin’s biggest challenges, bring faster block times, and lower costs.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

2

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

3

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

4

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

5

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read

Best Crypto to Buy Now as $8.6B Bitcoin Whale Awakens After 14 Years

When a Bitcoin whale that had lain dormant since 2011 sprang to life this week, it unleashed a colossal 80,000 BTC, worth about $8.6 billion, onto the blockchain. Such a historic stir not only shattered records for daily movements of decade‑old coins but also underscored how long‑term holders can reshape market dynamics in a heartbeat. THE FINAL […]

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

One of the most talked-about new meme coin launches of 2025, BTC Bull Token (BTCBULL) has already raised over $8 million through its presale, signalling huge investor confidence. BTC Bull Token stands out by tracking Bitcoin’s performance and rewarding BTCBULL holders whenever BTC hits specific milestones for the first time. The concept blends meme coin culture […]

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

When U.S. President Donald Trump made a historic trade deal with Vietnam, cutting tariffs on Vietnamese goods from 46% to 20%, world markets stirred into action. Bitcoin surged more than 3% as institutional investors welcomed lowered friction in international trade, and the Nasdaq and S&P 500 rose in tandem. BREAKING: Trump announced a trade deal with […]

Best Crypto to Buy Now as BlackRock Bitcoin ETF Outvalues S&P 500 Fund

BlackRock’s iShares Bitcoin Trust (IBIT) has quietly surged past the asset manager’s flagship S&P 500 ETF (IVV) in annual fee revenue, upending long‑standing expectations in the traditional fund world. #BlackRock’s Bitcoin ETF now generates more revenue than its S&P 500 ETF. pic.twitter.com/UhvEIbC1jM — Christiaan (@ChristiaanDefi) July 2, 2025 This shift matters because it signals institutional money […]

-

1

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

2

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

3

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

4

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

5

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read