Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Solana (SOL) vs Ethereum (ETH) Price Prediction: Which Will Be Number 2 Crypto In 2026

14.02.2025 15:13 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Solana and Ethereum have been battling for the number two crypto spot over the past year—assuming you don’t count XRP, of course.

Ethereum still holds that position for now, but Solana’s growing adoption and its recent ETF filing could shake up the rankings before 2026.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Bitcoin, meanwhile, remains firmly at number one, but its lack of utility and scalability is becoming harder to ignore. Whether it can hold that top spot long-term is anyone’s guess.

That’s where PlutoChain ($PLUTO) might be able to help. This hybrid Layer-2 solution could be exactly what Bitcoin needs—faster transactions, lower fees, and DeFi integration. If it delivers, it could push BTC into a new era of adoption.

Let’s take a closer look.

Ethereum – Can Ether Hit $10,000 By the End of 2025?

Ethereum remains the top smart contract platform, even with high fees and some lingering scalability issues.

Adoption in retail and business settings hasn’t taken off as fast as some expected, mostly because gas fees can get ridiculous. But Ethereum 2.0 brought a full shift to Proof-of-Stake (PoS), and a lot of those problems were finally sorted.

Now, Ethereum should be faster and cheaper to use, which would make it a lot more competitive. Some analysts believe ETH could hit $10,000 by 2026, especially if big institutions jump in and the network keeps improving.

Another thing working in Ethereum’s favor is its deep ties to mainstream finance—between ETFs and partnerships, it’s already got a foothold that other blockchains are still chasing. Whether it stays on top depends on how smoothly these upgrades roll out and if developers stick around to build on it.

Solana Could Enter Top Three Cryptos If Adoption Sustains

Solana built a reputation as one of the fastest and cheapest blockchains. Developers use it to scale apps without paying sky-high fees. It handles over 65,000 transactions per second, which puts it in direct competition with Ethereum.

But speed isn’t everything—Solana’s biggest problem has been reliability. Multiple well-known outages have raised questions about whether it can stay stable over the long run.

Even with those setbacks, analysts believe Solana’s price has room to grow as institutions take interest and the tech improves. Some expect it to push into the top three cryptos soon, as long as adoption keeps moving in the right direction.

A big part of Solana’s appeal comes from its low costs and straightforward design. Businesses and developers see it as a strong choice for a scalable blockchain that doesn’t add unnecessary complexity.

Whether it ever overtakes Ethereum remains to be seen, but one thing is clear—Solana isn’t fading away anytime soon.

PlutoChain ($PLUTO) Could Help Bitcoin Become Faster, Cheaper, and More Versatile

Bitcoin has cemented itself as digital gold, but using it for anything beyond holding has never been easy. Transactions take too long, fees get out of hand during congestion, and the network has barely changed while others like Ethereum and Solana continue evolving.

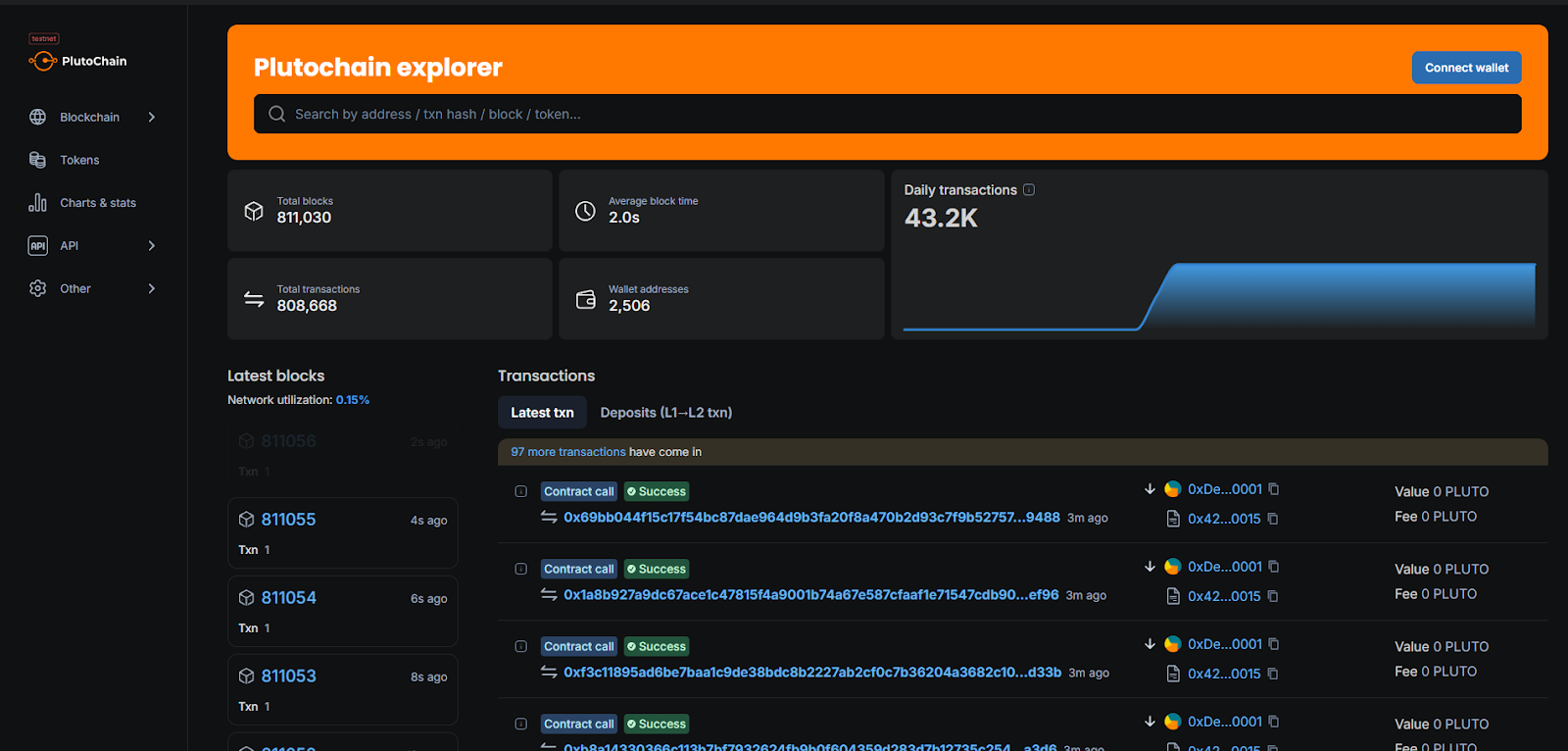

PlutoChain ($PLUTO) may have what it takes to fix some of these issues without messing with Bitcoin’s core structure. Instead of waiting 10 minutes for confirmation, PlutoChain settles blocks in just two seconds.

That kind of speed could make Bitcoin far more useful for everyday payments, cross-border transfers, and even microtransactions—areas where it has struggled.

Fees are another problem PlutoChain looks to solve. By cutting costs, it could make Bitcoin more practical for businesses and regular users. On top of that, it comes with Ethereum Virtual Machine (EVM) compatibility, which could allow Ethereum-based apps, DeFi platforms, and NFT marketplaces to integrate with Bitcoin’s ecosystem.

Early tests show PlutoChain handling over 43,200 blocks in a single day without issues. Security remains a top focus, with audits from SolidProof, QuillAudits, and Assure DeFii, plus regular code reviews. Its governance model also gives the community a say in important decisions, making it more decentralized.

PlutoChain could make Bitcoin more scalable, efficient, and ready for wider adoption.

Closing Words

Ethereum and Solana continue fighting for the number two spot, with ETH holding strong thanks to institutional adoption and deep financial ties, while Solana pushes forward with speed, low fees, and growing use cases.

Both have a chance to dominate in the coming years, but neither has fully secured its position.

Meanwhile, Bitcoin faces its own challenges, struggling with slow transactions and high fees. Luckily, with PlutoChain’s faster block times, lower costs, and EVM compatibility, Bitcoin’s problems might get fixed.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as Bitcoin Price Crashes Below $103K Amid Israel-Iran Conflict

13.06.2025 17:16 7 min. read -

2

Best Crypto to Buy Now as Bitcoin Price Holds $100k Despite Iran-Israel Middle East Conflict

15.06.2025 16:43 8 min. read -

3

Best Crypto to Buy Now as Metaplanet Overtakes Coinbase’s Bitcoin Stash

17.06.2025 18:51 8 min. read -

4

The Bitcoin Speed Upgrade Everyone’s Been Waiting For Is Finally Here

13.06.2025 13:26 5 min. read -

5

Best Crypto to Buy Now as Iran-Israel Conflict Worsens – Will The Market Crash?

19.06.2025 18:22 9 min. read

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

When Ripple withdrew its final appeal against the SEC on June 27, it didn’t just end years of courtroom battles. It cemented a landmark verdict that reshapes regulatory precedent for digital assets. This decisive move locks in a $125 million penalty and an ongoing ban on XRP sales, underscoring how U.S. courts view token offerings. Ripple […]

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

Snorter Token ($SNORT) is a new meme coin and utility token designed to enhance crypto trading with its Telegram-native trading bot, Snorter Bot. This bot is equipped with sniping capabilities, copy trading, and swap functionalities, offering traders the ability to profit from the volatile crypto markets. As the presale has garnered significant attention, raising over […]

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

Bitcoin continues to test support at $107K, with traders and investors positioning for the next push higher. Many think it’s just a matter of time before Bitcoin makes another big move, especially with new money flowing into the market and more people bringing up crypto in mainstream media. As a result, some of the biggest […]

BTC Bull Token Enters Final 3 Days of Viral Presale: Next 100x Crypto?

Bitcoin’s (BTC) latest recovery from the sub-$100,000 level has reignited optimism about a potential bull run in Q3. The benchmark cryptocurrency now remains firmly above $105,000, and crucially, it does so against a backdrop of mounting institutional conviction. US spot Bitcoin ETFs have now posted a 12-day streak of net inflows, while corporate treasuries continue […]

-

1

Best Crypto to Buy Now as Bitcoin Price Crashes Below $103K Amid Israel-Iran Conflict

13.06.2025 17:16 7 min. read -

2

Best Crypto to Buy Now as Bitcoin Price Holds $100k Despite Iran-Israel Middle East Conflict

15.06.2025 16:43 8 min. read -

3

Best Crypto to Buy Now as Metaplanet Overtakes Coinbase’s Bitcoin Stash

17.06.2025 18:51 8 min. read -

4

The Bitcoin Speed Upgrade Everyone’s Been Waiting For Is Finally Here

13.06.2025 13:26 5 min. read -

5

Best Crypto to Buy Now as Iran-Israel Conflict Worsens – Will The Market Crash?

19.06.2025 18:22 9 min. read