Bitcoin Funding Rates Remain Positive, But Risks of Market Shift Loom

10.02.2025 11:00 1 min. read Alexander Zdravkov

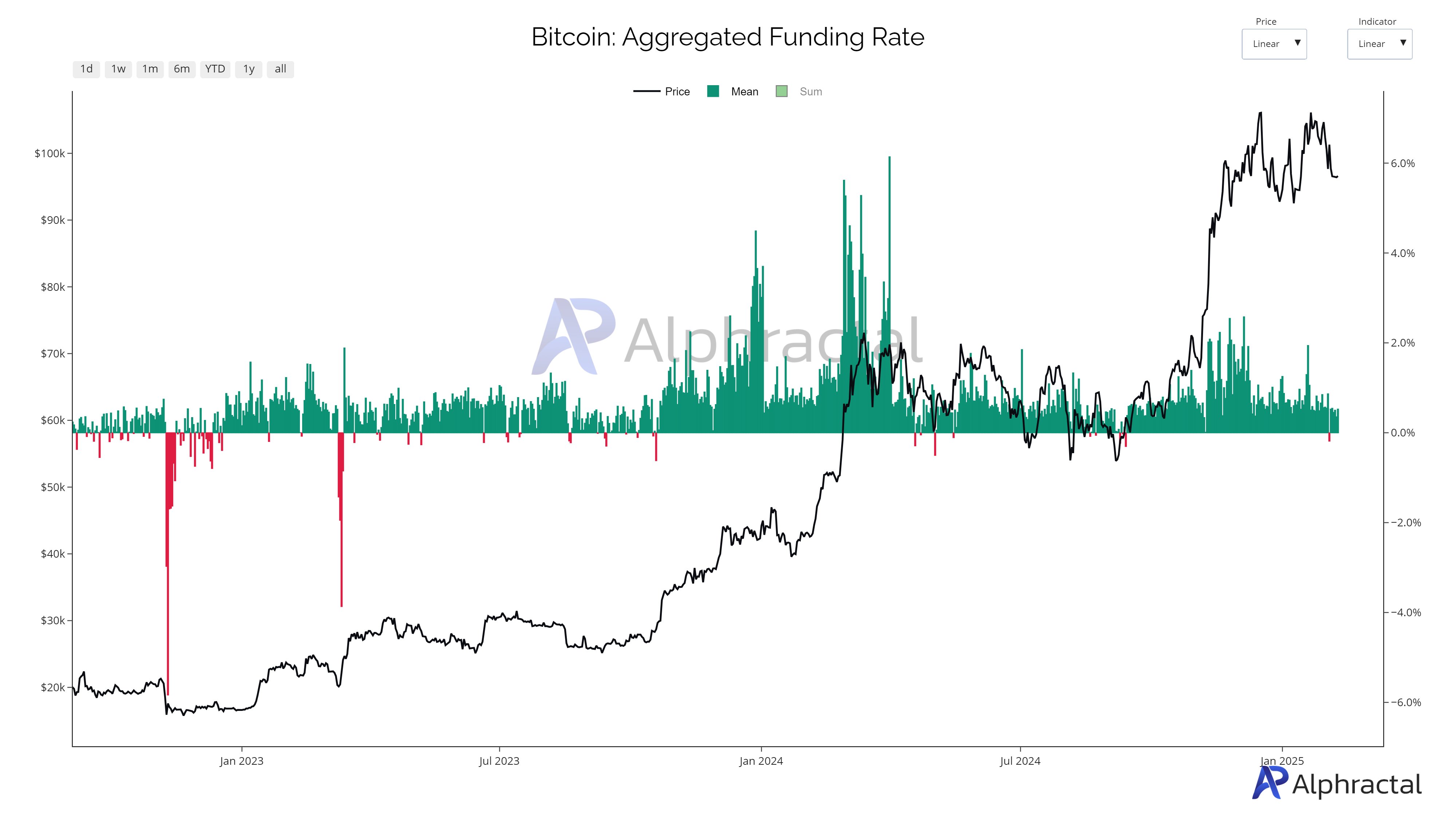

Alphractal, a cryptocurrency analytics firm, has released a new analysis of Bitcoin, highlighting that despite recent price drops, the overall funding rate across major exchanges remains positive.

This indicates that more traders are betting on Bitcoin’s price to rise, with long positions paying fees every eight hours, while short positions receive compensation.

Currently, the funding rates are mostly positive, except for BitMEX and OKX, which are seeing negative rates. Bitfinex stands out with the highest positive rate.

Alphractal has outlined two possible scenarios based on these funding trends: one suggests that sustained positive rates could reflect over-optimism, potentially leading to a risk of liquidation if Bitcoin’s price falls further.

On the other hand, if funding rates turn negative across all platforms, it could mark the start of a bearish phase dominated by short traders.

While Bitcoin has seen some downward movement, the overall positive funding rate suggests that market sentiment hasn’t completely turned bearish yet. However, Alphractal advises caution, as sudden shifts in funding rates could indicate a significant change in market dynamics.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

Bitcoin ETFs Attract Over $2 billion in Weekly Inflows: What’s Driving the Gains?

Bitcoin ETFs in the U.S. recorded $2.39 billion in net inflows over the past week, according to data from Farside Investors, marking one of the strongest capital surges since their launch.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read