Bitcoin Bull Market Could Have More to Offer, Glassnode Suggests

02.02.2025 12:00 1 min. read Alexander Zdravkov

Glassnode, a leading on-chain analytics company, suggests that Bitcoin (BTC) still has potential for growth, according to its analysis of a key indicator.

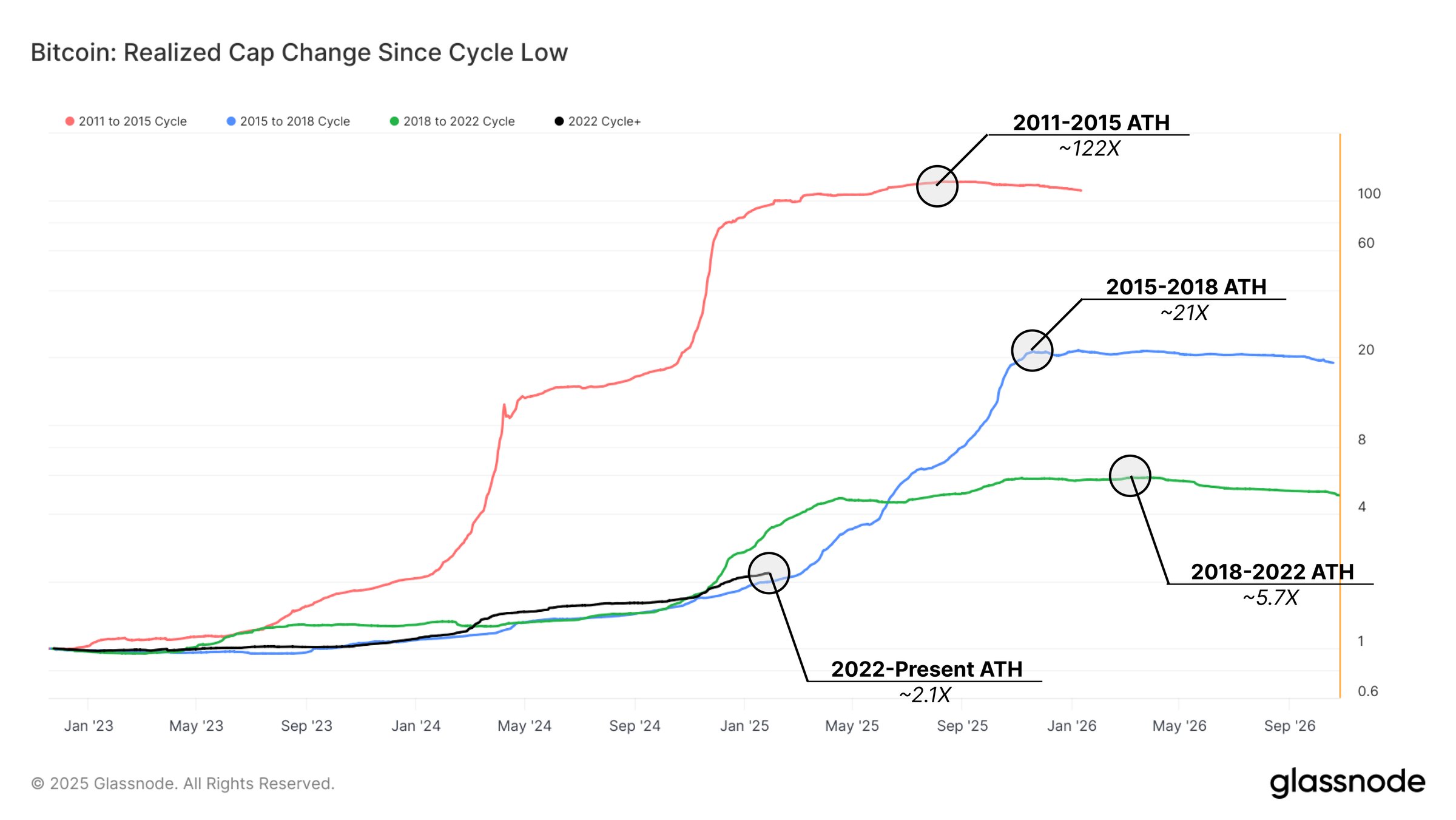

The company highlights Bitcoin’s Realized Cap, which measures the price at which each coin last moved. This indicator helps determine whether holders are in profit or loss and is seen as a reflection of net capital inflows into Bitcoin.

Glassnode notes that the Realized Cap has increased by 2.1 times from its 2022 lows, but is still far from the 5.7 times peak seen in the last bull cycle. The firm suggests that Bitcoin is still in the earlier stages of growth, as the usual surge seen during a market’s euphoric phase hasn’t fully emerged.

Furthermore, Glassnode observes that the current Bitcoin cycle appears similar to the 2015-2018 bull run, which was largely driven by spot market investors.

Despite the market’s significantly larger size now, Bitcoin has remained resilient, with price pullbacks rarely exceeding 25%. This stability is attributed to strong demand, ongoing ETF inflows, and Bitcoin’s growing role as a macro asset.

Glassnode concludes that while it may not be realistic to expect a massive 100x rally like the one seen in 2015, the potential for further expansion remains if demand continues to rise.

-

1

Bitcoin Hits New Historic Record Above $109,000, Pushing Market Cap Past $2.17 Trillion

21.05.2025 18:10 1 min. read -

2

Bitcoin Price Prediction From Galaxy Digital’s CEO

18.05.2025 9:00 2 min. read -

3

Eric Trump Unveils Bold Plan to Lead U.S. Bitcoin Mining

16.05.2025 22:00 1 min. read -

4

Could Bitcoin’s Market Value Catch Up to Gold by 2030? Some Think So

19.05.2025 16:00 2 min. read -

5

U.S. States Boost Bitcoin Exposure Through Strategy Stock Surge

17.05.2025 9:00 1 min. read

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

Bitcoin tumbled sharply today, shedding more than 3.5% in a matter of hours and briefly flirting with the critical $100,000 level.

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

Bitcoin is treading water near $105,000, but pressure is building on both sides of the trade as macro forces tighten.

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

BlackRock is making another assertive move into digital assets, quietly expanding its crypto portfolio with sizable purchases of both Bitcoin and Ethereum.

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

In a move that signals changing tides in traditional finance, JPMorgan is preparing to accept Bitcoin ETF holdings as collateral for loans—starting with BlackRock’s iShares Bitcoin Trust, according to insiders familiar with the plan.

-

1

Bitcoin Hits New Historic Record Above $109,000, Pushing Market Cap Past $2.17 Trillion

21.05.2025 18:10 1 min. read -

2

Bitcoin Price Prediction From Galaxy Digital’s CEO

18.05.2025 9:00 2 min. read -

3

Eric Trump Unveils Bold Plan to Lead U.S. Bitcoin Mining

16.05.2025 22:00 1 min. read -

4

Could Bitcoin’s Market Value Catch Up to Gold by 2030? Some Think So

19.05.2025 16:00 2 min. read -

5

U.S. States Boost Bitcoin Exposure Through Strategy Stock Surge

17.05.2025 9:00 1 min. read