Binance Founder Claims Europe Needs Bitcoin in Its Reserves

01.02.2025 12:15 2 min. read Alexander Stefanov

Christine Lagarde, the head of the European Central Bank (ECB), has dismissed the idea of Bitcoin playing a role in the EU’s financial reserves, sparking a heated debate.

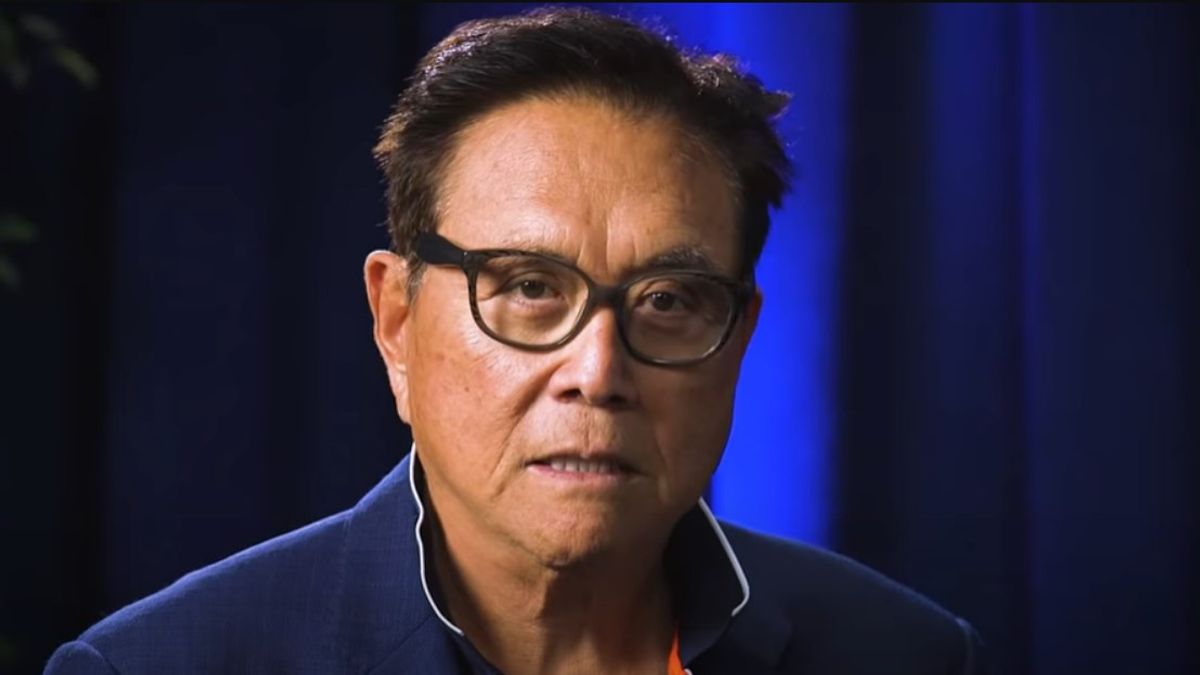

Meanwhile, former Binance CEO Changpeng Zhao (CZ) has taken a contrasting stance, insisting that Europe must embrace the cryptocurrency. His remarks have reignited discussions on Bitcoin’s relevance in global finance.

CZ’s recent social media post simply stated, “EU needs Bitcoin,” yet it quickly gained attention, as it directly challenged Lagarde’s firm opposition to the asset. Many within the crypto industry believe Bitcoin should be considered essential rather than optional, arguing that it provides financial security and independence in an era of economic uncertainty.

While the ECB remains skeptical, some experts see Bitcoin as the backbone of the financial future. Growing concerns over inflation and the increasing influence of central banks have led many to view decentralized currencies as a viable alternative. The argument is further reinforced by political figures like Donald Trump, who has expressed ambitions to make the United States a dominant force in the Bitcoin sector.

One of the key points of contention is security. Critics of Lagarde’s stance argue that Bitcoin’s decentralized structure makes it one of the most secure assets in existence. Unlike traditional financial systems vulnerable to centralized control and inflation, Bitcoin operates on a network protected by cryptographic principles and a robust blockchain infrastructure.

Despite these arguments, Lagarde has remained firm in her position, insisting that Bitcoin does not meet the necessary criteria for inclusion in the ECB’s reserves. She has cited concerns over liquidity, safety, and stability as reasons for her refusal to consider the cryptocurrency.

Lagarde’s skepticism has been met with strong opposition, with some voices in the crypto industry calling for leadership that understands the transformative potential of Bitcoin. Pierre Rochard, VP of Research at Riot Platforms, has openly criticized the ECB’s approach, suggesting that Europe may eventually be forced to reconsider its stance.

-

1

Metaplanet Ramps Up Bitcoin Holdings with $117.5M Buy

02.06.2025 19:00 2 min. read -

2

Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

02.06.2025 9:00 1 min. read -

3

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

4

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

China’s biggest crypto hardware manufacturers are redrawing their maps. Faced with mounting U.S. tariffs on tech imports, Bitmain, Canaan, and MicroBT — firms that collectively dominate over 90% of the global bitcoin mining rig market — are moving parts of their production to the United States.

Bitcoin Miner Bitdeer Boosts War Chest With New Convertible Notes Deal

Bitdeer Technologies, a Bitcoin mining firm based in Singapore, is gearing up to raise $330 million through a fresh offering of senior convertible notes maturing in 2031.

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

Bitcoin’s recent surge to $109,000 has been overshadowed by renewed conflict in the Middle East, with heightened tensions between Israel and Iran putting pressure on the market.

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

Macro strategist Luke Gromen believes that surging energy costs could set the stage for a dramatic rise in Bitcoin and gold, as inflationary pressure shakes confidence in traditional financial markets.

-

1

Metaplanet Ramps Up Bitcoin Holdings with $117.5M Buy

02.06.2025 19:00 2 min. read -

2

Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

02.06.2025 9:00 1 min. read -

3

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

4

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read