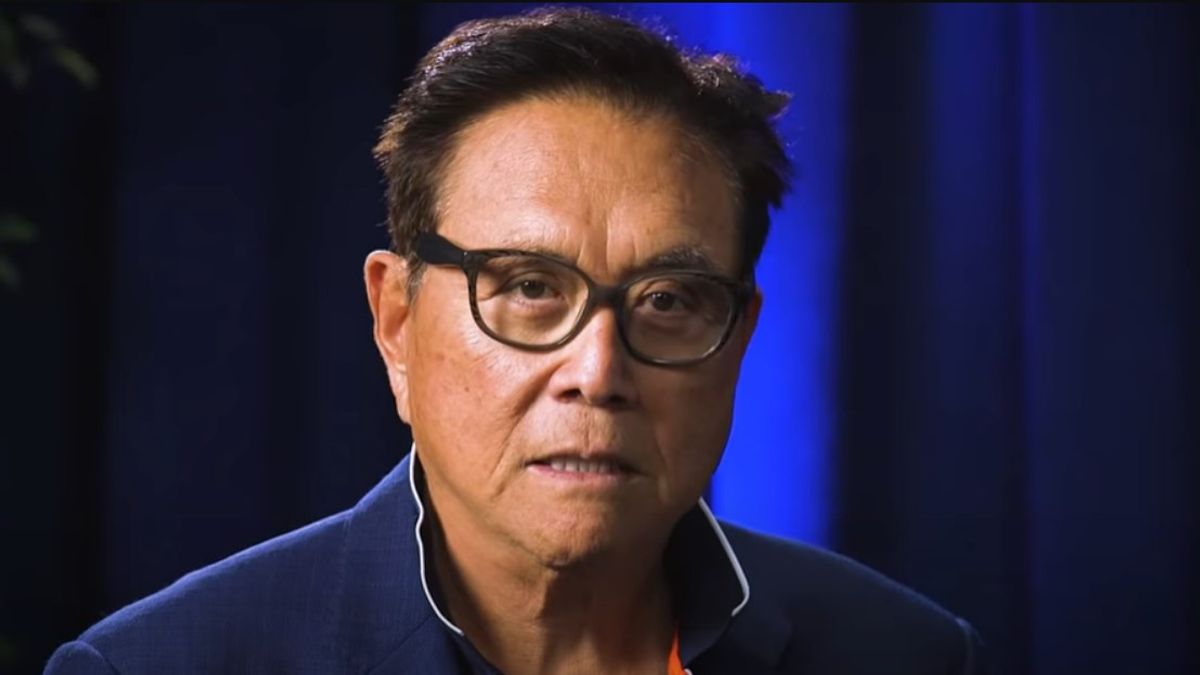

Robert Kiyosaki Ditches Gold and Silver, Goes All-In on Bitcoin

31.01.2025 12:30 1 min. read Alexander Zdravkov

Robert Kiyosaki, best known for Rich Dad Poor Dad, is making a major shift in his investment approach, swapping gold and silver for Bitcoin (BTC).

After decades of favoring precious metals, he now believes Bitcoin holds the most potential for future gains.

Kiyosaki explained that he is rapidly offloading his gold and silver holdings to accumulate Bitcoin, predicting that BTC could soar to $250,000 by 2025. As of now, Bitcoin is valued at $102,011, reinforcing his confidence in its trajectory.

Pointing to America’s ballooning debt, which now exceeds $36.2 trillion, Kiyosaki sees Bitcoin as a hedge against reckless monetary policies. He warned that the U.S. government is printing $1 trillion every 90 days, devaluing traditional currencies.

“For years, I trusted gold and silver to preserve wealth. But now, I’m going all-in on Bitcoin because fiat money is crumbling, and no one in power is addressing it,” he emphasized.

Kiyosaki sees the financial landscape undergoing a historic transformation, calling it the biggest shift in economic history—from paper money to digital assets. He remains committed to embracing Bitcoin, convinced that it will play a central role in the future of finance.

-

1

Are We Witnessing the Final Bitcoin Cycle as We Know It?

07.06.2025 16:00 2 min. read -

2

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

3

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read -

4

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

07.06.2025 12:00 1 min. read -

5

UK Gold Miner Ditches the Precious Metal for Bitcoin, Shares Jump 40%

06.06.2025 14:00 1 min. read

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

Philippe Laffont, the billionaire behind Coatue Management, is beginning to question his stance on Bitcoin.

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

Personal finance author Robert Kiyosaki is urging investors to rethink their approach to money as digital assets reshape the economic landscape.

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

Crypto infrastructure firm Bit Digital is making a bold strategic pivot, abandoning Bitcoin mining entirely in favor of Ethereum staking and asset management.

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

Institutional interest in Bitcoin continues to surge as U.S.-based spot Bitcoin ETFs recorded their twelfth consecutive day of positive net inflows on Wednesday, pulling in nearly $548 million and pushing the total two-week haul to $3.9 billion.

-

1

Are We Witnessing the Final Bitcoin Cycle as We Know It?

07.06.2025 16:00 2 min. read -

2

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

3

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read -

4

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

07.06.2025 12:00 1 min. read -

5

UK Gold Miner Ditches the Precious Metal for Bitcoin, Shares Jump 40%

06.06.2025 14:00 1 min. read