Forbes Reveals the Most Trusted Crypto Exchanges of 2025

30.01.2025 17:30 1 min. read Alexander Zdravkov

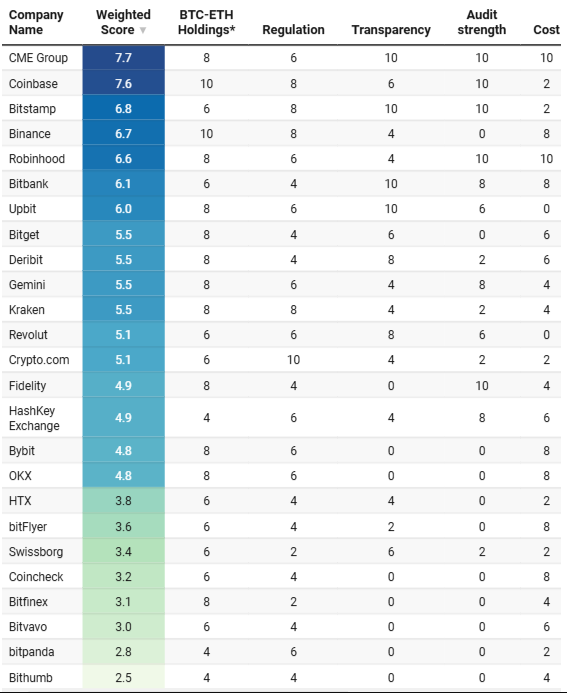

Forbes has released its annual ranking of the most reliable cryptocurrency exchanges, analyzing over 200 platforms based on security, compliance, and trading volume.

The report highlights that asset protection remains the top priority for retail traders.

At the top of the list is CME Group, a global leader in derivatives trading. Though not retail-focused, its regulated Bitcoin futures market gives it a strong reputation for security and institutional trust.

Coinbase secured the second position, standing out as the largest Bitcoin custodian with 2.4 million BTC held across 8 million active accounts, totaling $245 billion in assets. The exchange also oversees $300 billion in digital holdings, including Ethereum and Solana.

Bitstamp landed at third place, strengthened by its upcoming acquisition by Robinhood, pending board approval. Meanwhile, Binance, the largest exchange by trading volume, ranked fourth, maintaining its dominance in Europe and BRICS nations with 245 million users and a $14 billion daily spot trading volume.

Rising to fifth place, Robinhood saw a 780% increase in trading activity, driven by its election-themed prediction markets and zero-fee trading model. The platform has also become the leading marketplace for memecoins like Dogecoin.

The Forbes ranking also included Bitbank, Upbit, Bitget, Deribit, and Gemini, recognized for their strong security measures and regulatory compliance.

-

1

Inside the Strategy Paradox: Tech Firm or Bitcoin vault?

18.09.2025 16:00 6 min. read -

2

Europe’s 19th Sanctions Round Hits Russia’s Shadow Fleet and Crypto Channels

20.09.2025 13:21 2 min. read -

3

Strategy Stock Faces New Pressure as Dilution Risks Grow

23.09.2025 11:30 5 min. read -

4

9 European Banks Team Up to Launch MiCA-Compliant Euro Stablecoin

25.09.2025 10:00 1 min. read -

5

PayPal’s PYUSD expands to Tron, Avalanche, and Sei with LayerZero integration

19.09.2025 11:00 1 min. read

Stablecoins Enter Multichain Era as Usage Hits Record Highs

For years, stablecoin activity was concentrated across just two networks, Ethereum and Tron.

Ripple’s Privacy-First Vision Aims to Put XRPL at the Center of Institutional Finance

Ripple is sharpening its push into institutional finance with a privacy-first vision for blockchain.

Coinbase Applies for National Trust Charter to Expand Digital Asset Oversight

Coinbase has filed an application with the U.S. Office of the Comptroller of the Currency (OCC) for a National Trust Company Charter, marking a pivotal step in its bid to expand regulatory oversight and strengthen institutional trust.

Tether And Antalpha Seek $200M To Build Digital Asset Treasury For Gold-Backed Token

Tether, the world’s largest stablecoin issuer, is teaming up with Antalpha Platform Holding to raise at least $200 million for a new digital asset treasury company, according to a Bloomberg report published Friday.

-

1

Inside the Strategy Paradox: Tech Firm or Bitcoin vault?

18.09.2025 16:00 6 min. read -

2

Europe’s 19th Sanctions Round Hits Russia’s Shadow Fleet and Crypto Channels

20.09.2025 13:21 2 min. read -

3

Strategy Stock Faces New Pressure as Dilution Risks Grow

23.09.2025 11:30 5 min. read -

4

9 European Banks Team Up to Launch MiCA-Compliant Euro Stablecoin

25.09.2025 10:00 1 min. read -

5

PayPal’s PYUSD expands to Tron, Avalanche, and Sei with LayerZero integration

19.09.2025 11:00 1 min. read

Cardano startup Iagon has recruited Ford Motor Company to help shape a decentralized cloud prototype aimed at corporate document management.

Discover the promising $0.08 AI altcoin that's raising excitement in 2023, surpassing Cardano and already securing $6.7M in funding. Don't miss out!

As Dogecoin’s price plateaus after what has been a volatile January, many investors are turning their sights to a project touted ‘the new XRP’ as a more reliable alternative.

Discover Skyren's advanced blockchain technology and why it's the real deal compared to meme coins. Learn how Skyren's SKYRN token simplifies crypto airdrops, rewards users, and empowers a community through decentralized governance.

The crypto market never sleeps, and neither do meme coin traders looking for the next explosive growth.

Robert Kiyosaki, the renowned investor and author of Rich Dad Poor Dad, recently shared his thoughts on the ongoing debate between Bitcoin (BTC) and gold.

Sam Trabucco, former co-CEO of Alameda Research, has agreed to relinquish assets including two San Francisco apartments valued at $8.7 million and a 53-foot yacht in a settlement with FTX.

Shan Hanes, the former CEO of Heartland Tri-State Bank (HTSB), has been implicated in a major fraud scheme involving cryptocurrency, resulting in the bank's collapse.

Changpeng “CZ” Zhao, the former CEO of Binance, has indicated he might welcome a presidential pardon from U.S. President-elect Donald Trump following his recent legal troubles.

Changpeng Zhao, the former CEO of Binance, made his first public appearance at Binance Blockchain Week in Dubai following his recent release.

A former senior employee of Binance Europe has filed a lawsuit against the company, claiming she was wrongfully terminated after blowing the whistle on an alleged bribery incident.

Alex Mashinsky, the former CEO of Celsius serving a 100-year prison sentence, is seeking the testimony of six ex-employees as part of his criminal case.

Alex Mashinsky, co-founder and former CEO of the defunct crypto lending platform Celsius, is scheduled to be sentenced on May 8, 2025, following his guilty plea to two federal criminal charges late last year.

Alex Mashinsky, the co-founder of Celsius Network, has admitted to charges of fraud related to his role in the company's downfall.

Christopher Giancarlo, the former chair of the U.S. Commodity Futures Trading Commission and a prominent advocate for digital assets, has joined Swiss crypto bank Sygnum as a senior adviser.

Christopher Giancarlo, the former chair of the Commodity Futures Trading Commission (CFTC), dismissed rumors suggesting he was being considered for the role of SEC Chair or any position related to crypto within the U.S. Treasury Department.

During a recent interview with FOX Business, former CFTC Chairman Chris Giancarlo, known as "Crypto Dad" for his progressive stance on digital assets, shared his views on the future of U.S. cryptocurrency policy.

Former Chinese billionaire Yang Bin has been sentenced to six years in a Singapore prison for orchestrating a fraudulent crypto investment scheme.

Speaking at the Tsinghua Wudaokou 2024 Chief Economists Forum in Beijing, former Chinese Finance Minister Lu Jiwei urged China to carefully assess the progress and risks associated with cryptocurrencies.

The former CEO of Australian crypto exchange Mine Digital, Grant Colthup, has been charged with fraud for allegedly misappropriating $1.47 million from a customer trying to convert funds into Bitcoin.