Dogecoin Price Surges as Department of Government Efficiency Adds Memecoin Logo

21.01.2025 14:10 1 min. read Alexander Zdravkov

The launch of a new government department during Trump’s inauguration has sparked widespread discussion in the digital asset community, largely due to its playful nod to the popular meme coin, Dogecoin.

The Department of Government Efficiency (D.O.G.E.), first teased during Trump’s pro-crypto campaign, quickly became a focal point of interest.

Initially set to be led by Elon Musk and Vivek Ramaswamy, the leadership structure shifted as Ramaswamy opted to step away to focus on a potential run for Ohio governor.

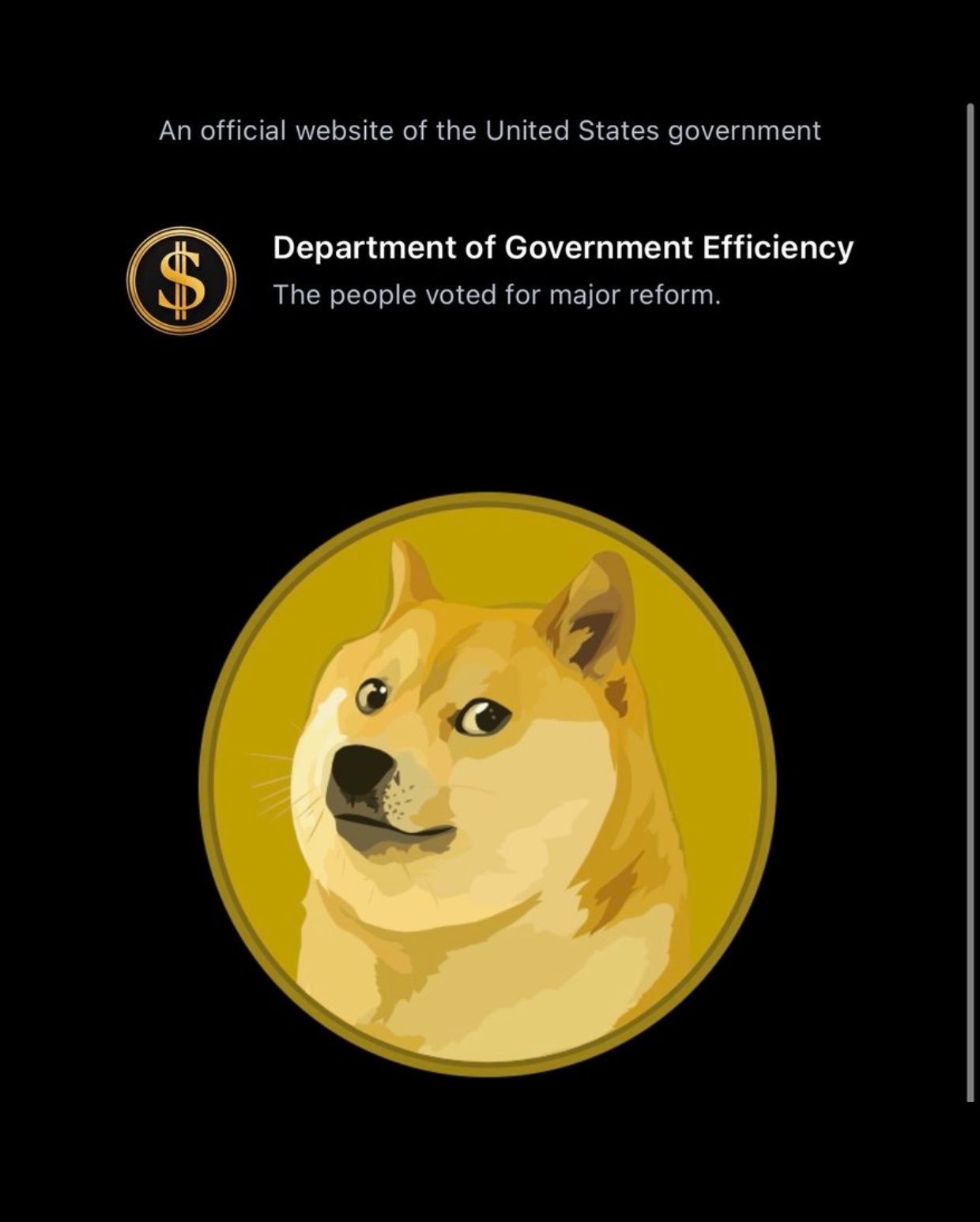

Despite this change, D.O.G.E. was officially introduced during Trump’s inauguration, with its website prominently displaying Dogecoin’s logo—a detail that caught the attention of many.

The impact on Dogecoin’s market value was immediate. Before the announcement, the coin had dropped to $0.345, but the unveiling of the D.O.G.E. branding triggered a surge of over 15%, pushing the price above $0.40.

This marked the highest level for Dogecoin in two days, underscoring the market’s response to the connection between the department and the iconic meme coin.

At the time of writing, DOGE is trading at $0.39 and has a market cap of $57.7 billion.

-

1

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

2

Dogecoin Stuck in a Holding Pattern – Can Bulls Force a Break Above $0.21?

15.06.2025 16:00 2 min. read -

3

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

A new milestone in cryptocurrency investment products is set to unfold this Wednesday, as REX Shares prepares to launch the first-ever U.S.-listed staked crypto exchange-traded fund (ETF), according to a company announcement shared on X.

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

-

1

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read -

2

Dogecoin Stuck in a Holding Pattern – Can Bulls Force a Break Above $0.21?

15.06.2025 16:00 2 min. read -

3

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read