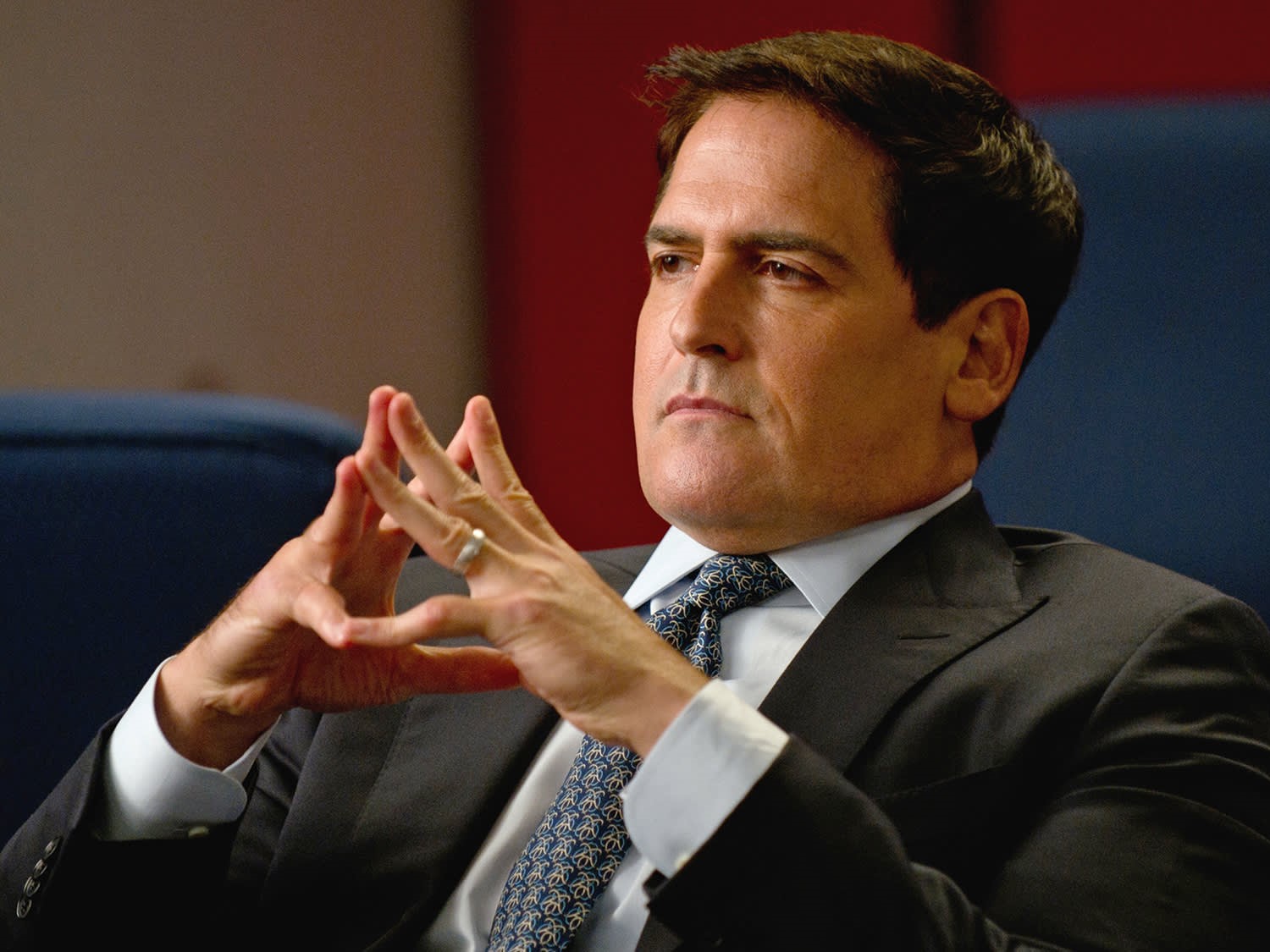

Trump’s Memecoin is a Threat to Crypto’s Future, Warns Mark Cuban

21.01.2025 9:30 2 min. read Kosta Gushterov

Mark Cuban has sharply criticized the TRUMP memecoin, which was launched around the time of Donald Trump’s presidential inauguration.

The coin has stirred significant controversy, with Cuban condemning it as a speculative and self-serving project that lacks real value. He expressed his belief that such tokens only contribute to the growing skepticism surrounding the crypto space, labeling the coin as “the biggest bunch of self-serving nonsense I have ever heard.”

While the TRUMP memecoin has attracted attention due to its volatility and the hype surrounding its release, Cuban argues that it promotes a dangerous mindset of investing in something without substance. He emphasized that this kind of token goes against the principles of ownership and legitimate investment.

On a deeper level, Cuban also raised concerns about the potential regulatory implications of the project. He pointed out the conflict of interest when the president is both the issuer and investor of a coin, creating confusion for both regulators and investors. This could complicate efforts to introduce proper regulations for cryptocurrency, especially as the U.S. Securities and Exchange Commission (SEC) increases its scrutiny on the sector.

Crypto analyst Michaël van de Poppe also weighed in on the TRUMP token, noting its price fluctuations and suggesting that a price correction is needed before it could see long-term gains. However, Cuban’s main concern remains the damage this kind of project could do to the credibility of the cryptocurrency market, as it risks reinforcing the notion that the industry is unserious.

In the face of growing regulation in the crypto space, Cuban fears that the TRUMP memecoin could undermine the push for clearer, more structured legislation, making it harder for legitimate crypto projects to thrive.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read -

5

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read

Here’s How Much Elon Musk Has Lost Since Splitting from Trump

Elon Musk’s financial standing has taken a major hit, with his net worth shrinking by $70 billion since his public fallout with Donald Trump.

Analyst Sees Signs of a Potential Dogecoin Comeback as Memecoin Market Shows Early Strength

Crypto analyst Joao Wedson has sparked renewed interest in Dogecoin with a fresh analysis suggesting the popular memecoin could be gearing up for another major move.

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

The clash within the Trump family over a controversial cryptocurrency project appears to have been settled.

Less Income, No Buybacks: UBS Revises Berkshire Hathaway Forecast

UBS analyst Brian Meredith has revised his outlook on Berkshire Hathaway’s Class B shares, trimming the price target from $606 to $591, while maintaining a “buy” rating.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read -

5

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read