Cardano Investors Show Growing Confidence, Extending Holding Times Surge

15.01.2025 19:00 1 min. read Kosta Gushterov

Cardano (ADA) has seen a notable rise in the average time investors are holding their tokens, signaling increased confidence in the cryptocurrency's near-term prospects.

This trend reflects a shift in sentiment, with holders expecting the coin to maintain stability above the $1 mark.

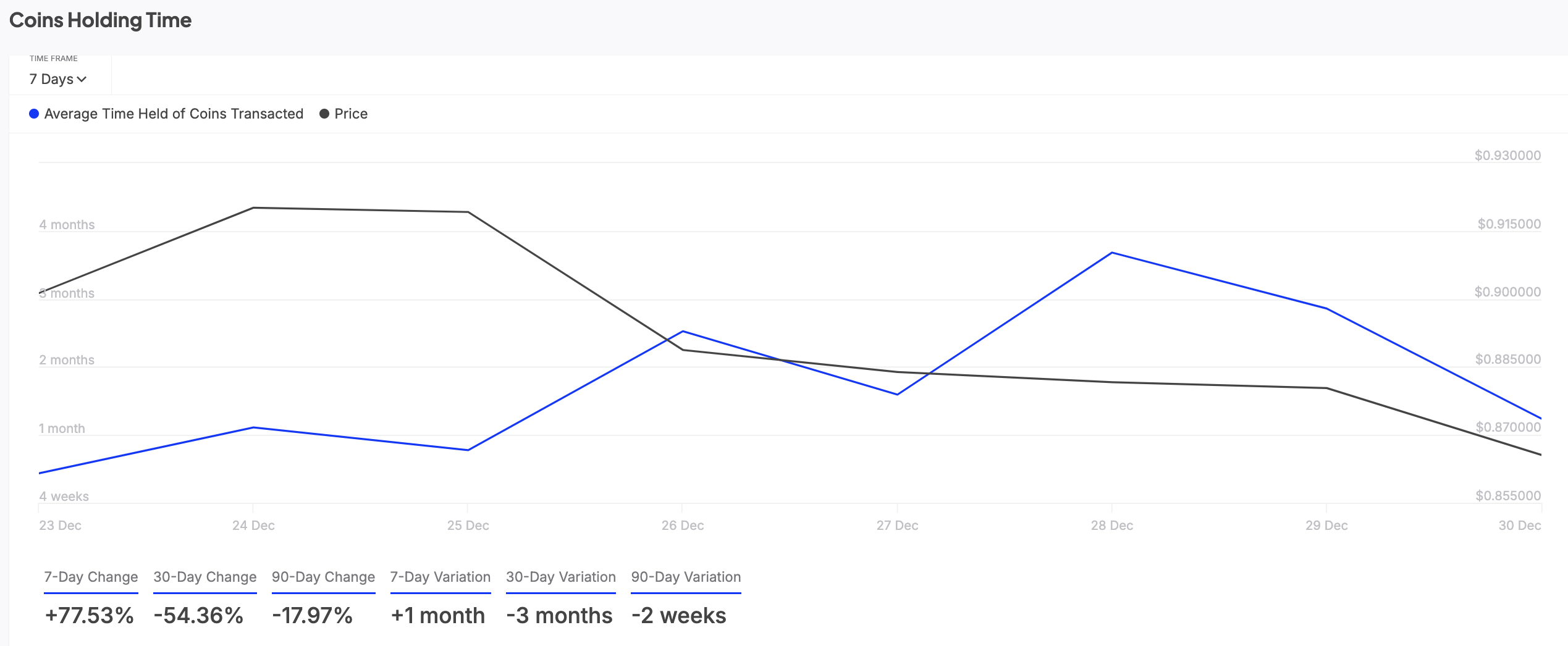

Recent on-chain data highlights a sharp increase in the average holding period for ADA tokens over the last week. Analysis from IntoTheBlock shows that this duration has surged by 78% within the review period.

This metric represents the average time tokens remain in wallets before being moved or sold, and longer holding times often indicate reduced market selling pressure.

This decrease in selloffs has contributed to an 8% rise in ADA’s value over the past week, showcasing growing conviction among investors.

Additionally, the funding rate for ADA in perpetual futures contracts remains positive, currently standing at 0.01%. A positive funding rate typically signals strong demand for long positions, reinforcing bullish sentiment in the market.

-

1

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

6 Altcoins Gaining Attention After Market Rally, Says Analyst

15.07.2025 12:05 2 min. read -

4

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read

Ethereum Turns 10: Celebrating the Genesis Block That Changed Crypto Forever

On this day ten years ago—July 30, 2015—a revolutionary chapter in blockchain history began.

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

-

1

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

6 Altcoins Gaining Attention After Market Rally, Says Analyst

15.07.2025 12:05 2 min. read -

4

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

5

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read