Raoul Pal Predicts Bitcoin Could Follow 2016 Patterns for Major Gains

14.01.2025 9:30 1 min. read Kosta Gushterov

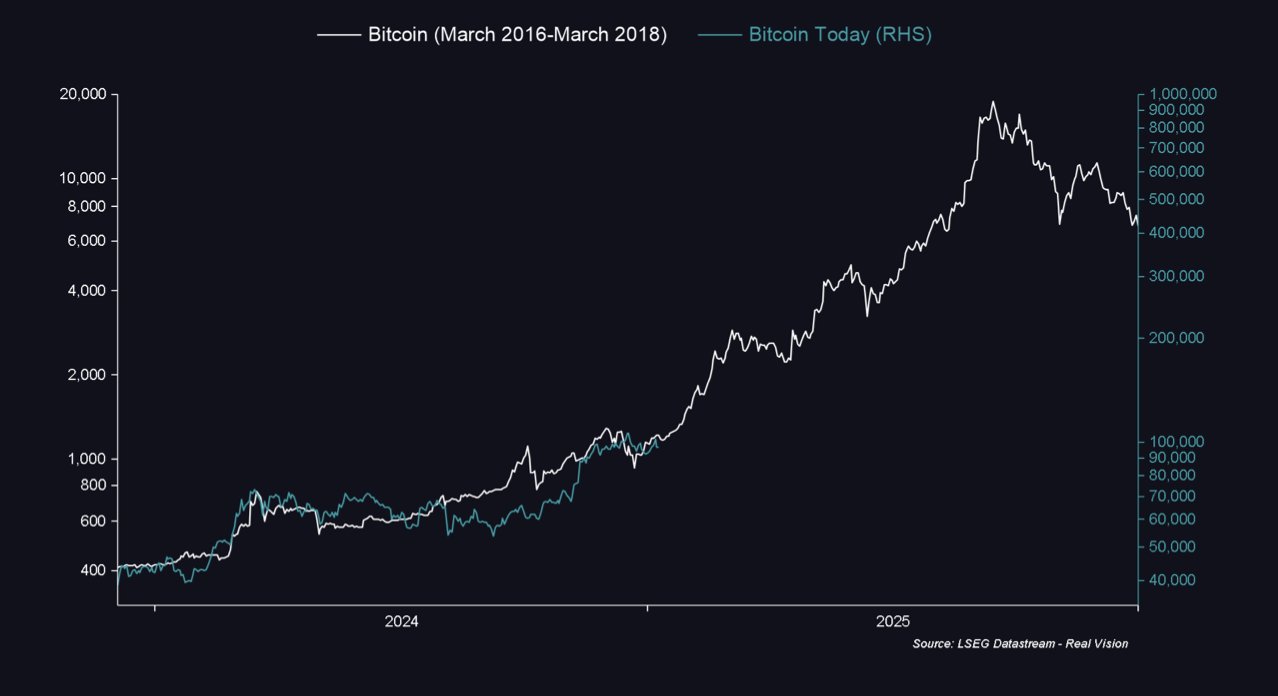

Macro strategist and ex-Goldman Sachs executve Raoul Pal believes Bitcoin may be on the cusp of a significant surge, drawing parallels to its behavior in 2016.

The macro expert pointed out similarities in market conditions, suggesting Bitcoin could see a dramatic move upward, though not an exact replay of past events.

Pal noted that while the trajectory might not mirror 2016 perfectly, the overall pattern indicates upward momentum for Bitcoin. Back in 2016, the cryptocurrency traded near $1,000 before skyrocketing to $20,000 in 2017. He advised investors to remain patient and focus on the long-term trend, adding, “Don’t expect an exact repeat but a rhyme. Valhalla waits.”

The global M2 money supply, a broad measure of liquidity in the global economy, is another key metric Pal is monitoring. He highlighted that M2 is following a pattern similar to the 2016-2017 period, which coincided with Bitcoin’s historic rally. This alignment, according to Pal, could signal another significant move for the cryptocurrency.

Pal also emphasized the importance of building personal conviction about market trends rather than relying solely on external opinions, encouraging investors to focus on Bitcoin’s long-term potential amidst short-term volatility.

-

1

Top Asset Manager Launches Bitcoin Fund With Gold-Backed Safety Net

31.05.2025 8:00 1 min. read -

2

David Marcus: U.S. Banks Are Quietly Preparing to Enter the Bitcoin Network

30.05.2025 11:00 2 min. read -

3

Metaplanet Ramps Up Bitcoin Holdings with $117.5M Buy

02.06.2025 19:00 2 min. read -

4

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

5

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read

Chinese Bitcoin Mining Giants Shift to U.S. Amid Rising Tariff Pressures

China’s biggest crypto hardware manufacturers are redrawing their maps. Faced with mounting U.S. tariffs on tech imports, Bitmain, Canaan, and MicroBT — firms that collectively dominate over 90% of the global bitcoin mining rig market — are moving parts of their production to the United States.

Bitcoin Miner Bitdeer Boosts War Chest With New Convertible Notes Deal

Bitdeer Technologies, a Bitcoin mining firm based in Singapore, is gearing up to raise $330 million through a fresh offering of senior convertible notes maturing in 2031.

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

Bitcoin’s recent surge to $109,000 has been overshadowed by renewed conflict in the Middle East, with heightened tensions between Israel and Iran putting pressure on the market.

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

Macro strategist Luke Gromen believes that surging energy costs could set the stage for a dramatic rise in Bitcoin and gold, as inflationary pressure shakes confidence in traditional financial markets.

-

1

Top Asset Manager Launches Bitcoin Fund With Gold-Backed Safety Net

31.05.2025 8:00 1 min. read -

2

David Marcus: U.S. Banks Are Quietly Preparing to Enter the Bitcoin Network

30.05.2025 11:00 2 min. read -

3

Metaplanet Ramps Up Bitcoin Holdings with $117.5M Buy

02.06.2025 19:00 2 min. read -

4

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

5

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read