Litecoin’s Active Addresses Surge, Indicating Growing Network Adoption

24.12.2024 14:00 1 min. read Alexander Stefanov

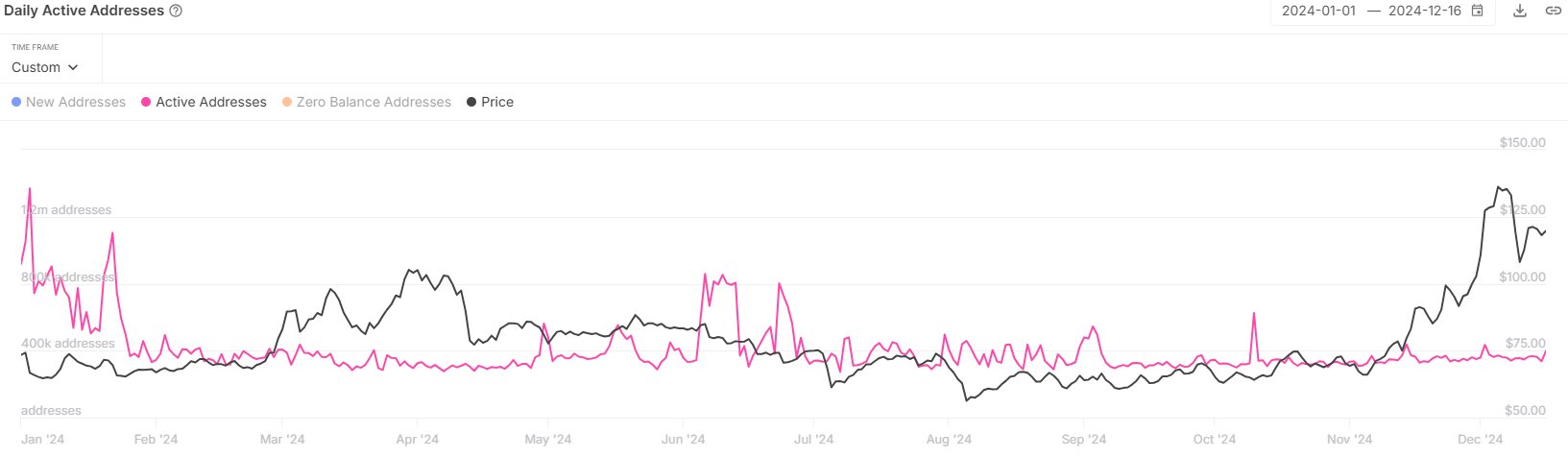

Litecoin has experienced a notable uptick in user engagement in 2024, with daily active addresses reaching an average of 401,000, marking a 10% increase from the previous year's 366,000.

This growth demonstrates Litecoin’s sustained relevance in the cryptocurrency space.

Early in 2024, the network saw a record surge in activity, with 1.37 million active addresses in a single day, surpassing the activity levels of Bitcoin and Ethereum during the same period. This spike was attributed to increased adoption of Litecoin for transactions, alongside its reputation for lower transaction fees and faster settlement times compared to other blockchains.

The uptick in activity also coincided with a rebound in Litecoin’s price. After miners paused significant sell-offs in late December—having previously offloaded 210,000 LTC—Litecoin’s price rose from a low of $87 to surpass the $100 resistance level.

Grayscale Investments has also been steadily increasing its holdings, purchasing over 41,000 LTC in the past month alone, making the firm one of the largest institutional holders of the token. At present, Litecoin’s market cap stands at $7.7 billion, and analysts predict the price could see a breakout, with potential gains reaching as high as $150 or even $200 in an extended rally.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

Altcoins are being pulled off the world’s largest exchange in droves, signaling a wave of institutional accumulation and long-term holding, according to new data from CryptoQuant.

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

Solana (SOL) is approaching a critical technical level that could trigger a major breakout. According to crypto analyst Ali Martinez, a weekly close above $170 may ignite a new bull run and potentially open the door for a rally toward the $2,000 mark.

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

Smart contract platforms Ethereum and Solana are shaping the crypto market’s future with big upgrades and shifting strategies.

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

Arthur Hayes has radically changed his stance on crypto markets. After months of caution, the BitMEX co-founder now believes a powerful altcoin rally is on the horizon.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read