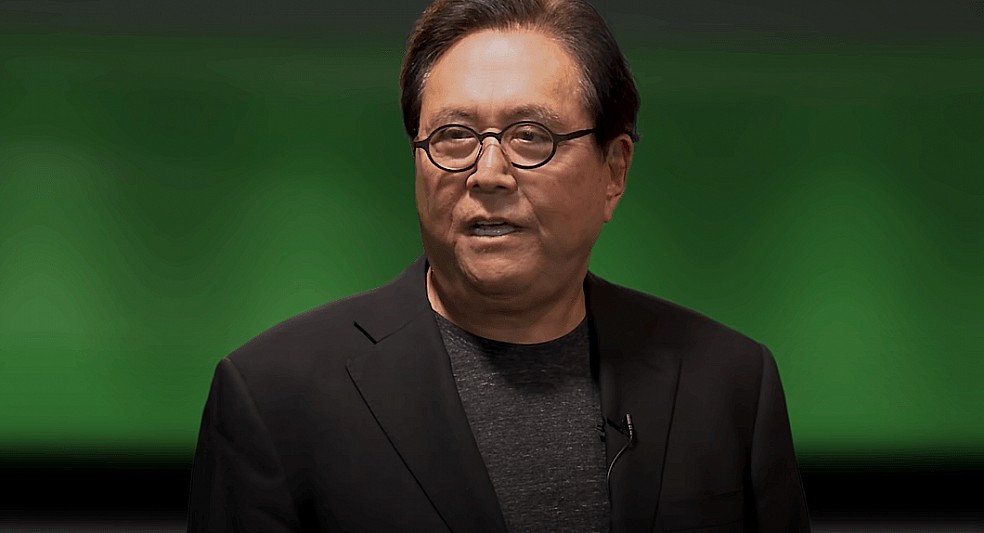

Global Economic Crash is Coming, Warns “Rich Dad, Poor Dad” Author

23.12.2024 19:00 1 min. read Alexander Stefanov

Robert Kiyosaki, the author of Rich Dad Poor Dad, has issued a stark warning about an imminent global economic downturn.

Kiyosaki claimed that a worldwide market collapse is already underway, pointing to significant financial troubles in Europe, China, and the United States. He suggested that this could mark the beginning of a deeper “depression” phase.

The renowned author urged individuals to take precautions, emphasizing the importance of securing their finances and holding onto stable employment. He highlighted the potential value of tangible assets during turbulent times, stating, “Crashes are often the best opportunities to build wealth,” and recommended gold, silver, and Bitcoin as key investments to weather the storm.

This warning follows his earlier prediction of what he described as the “largest crash in history.” Kiyosaki previously encouraged proactive financial planning, urging his followers to prepare for the fallout he believes will impact aging populations and traditional markets.

Despite the volatility in the cryptocurrency market, Kiyosaki reaffirmed his faith in Bitcoin, suggesting it could serve as a hedge against traditional market instability. Alongside gold and silver, he noted that Bitcoin may attract increased attention as economic uncertainty grows, positioning it as a potential safe haven during financial upheaval.

-

1

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

2

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

3

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

4

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

5

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

2

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

3

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

4

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

5

Peter Thiel-Backed Bullish Quietly Files for IPO as Crypto Firms Eye Wall Street

11.06.2025 22:00 1 min. read