Dogecoin Could Hit $10, Says Analyst Amid Recent Market Pullback

22.12.2024 16:00 1 min. read Alexander Zdravkov

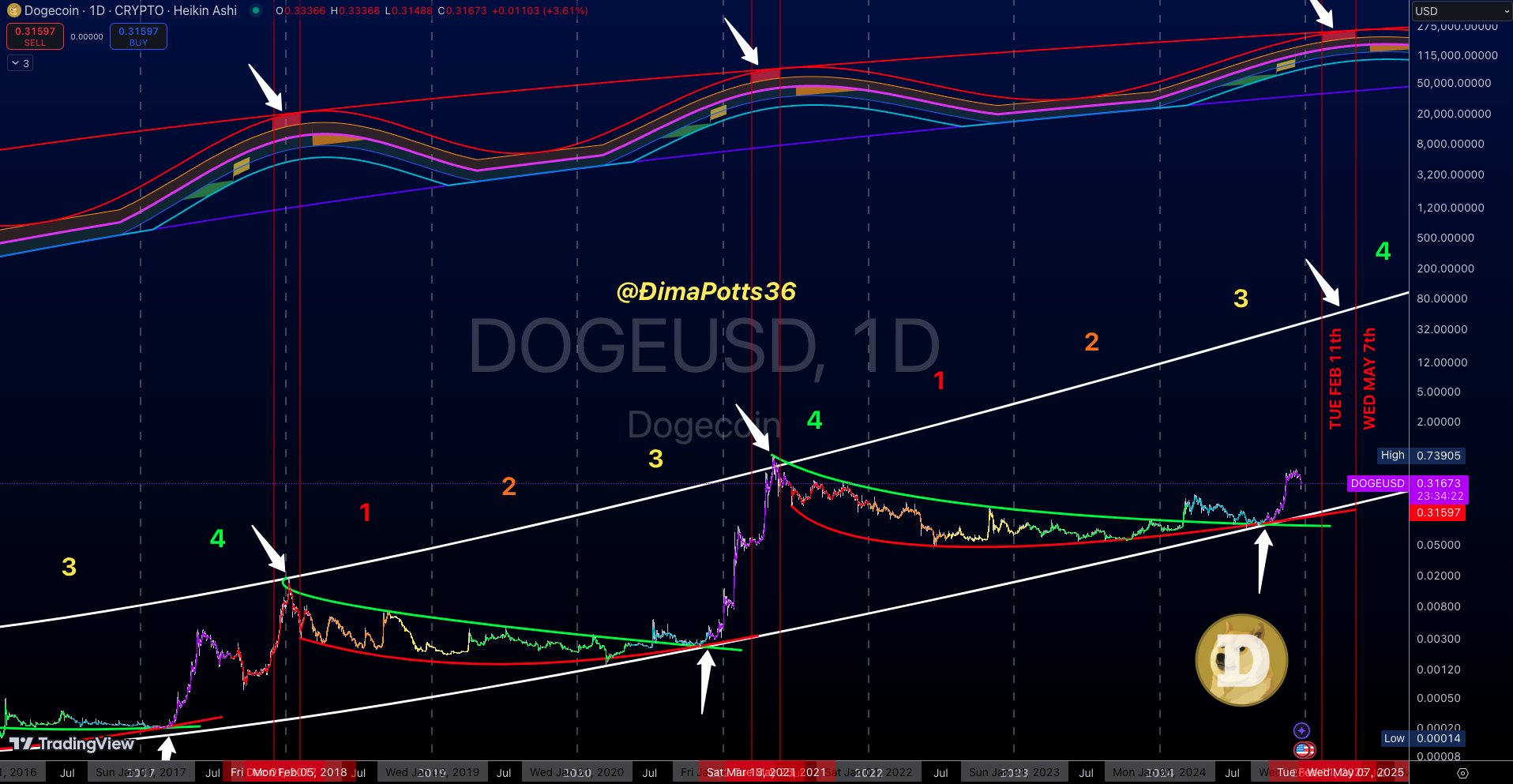

A prominent crypto analyst has expressed confidence in Dogecoin (DOGE), stating that despite a 46% decline from its yearly high, the $10 price target is still achievable.

While recent market downturns may have unsettled some, the expert remains optimistic, predicting a rapid recovery for DOGE followed by a sustained upward movement toward this ambitious goal.

The analyst’s forecast is based on historical trends, particularly the cyclical relationship between Bitcoin and Dogecoin. After a dip to $0.2615 on December 20, DOGE rebounded strongly, supporting the analyst’s view of a bullish outlook.

By studying Dogecoin’s daily chart, the expert predicts that DOGE could reach the $10 mark between February 11 and May 7, 2025. This timeline aligns with the expected peak in Dogecoin’s cycle, which typically follows Bitcoin’s highest price within a few weeks.

This year, despite market fluctuations, DOGE saw impressive growth, climbing 545% and nearly recovering from the 2021 bear market losses. On December 8, Dogecoin reached $0.4846, nearing its all-time high. While the meme coin remains dominant in its category, many analysts foresee further growth in the near future.

As the bull cycle progresses, traders will closely monitor Dogecoin’s performance, particularly as it surges with increased momentum, currently trading at $0.3367 after a 33% rally in under 24 hours.

-

1

New Data Shows Shiba Inu is at Risk Due to Centralization

04.07.2025 10:30 2 min. read -

2

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

14.07.2025 8:00 2 min. read -

3

These Altcoins Just Took Over CoinGecko’s Trending List

26.06.2025 12:00 1 min. read -

4

Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read -

5

Swiss Bank Becomes First Global Bank to Support Ripple’s RLUSD Stablecoin

03.07.2025 14:24 2 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

Fartcoin (FARTCOIN) is once again leaving a trail of strong gains as the crypto market rallies. In the past 24 hours alone, the token has produced an 18.2% return as trading volumes have exploded. Data from CoinMarketCap shows that Fartcoin’s volumes have more than doubled during this period. More than $500 million worth of this […]

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

-

1

New Data Shows Shiba Inu is at Risk Due to Centralization

04.07.2025 10:30 2 min. read -

2

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

14.07.2025 8:00 2 min. read -

3

These Altcoins Just Took Over CoinGecko’s Trending List

26.06.2025 12:00 1 min. read -

4

Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read -

5

Swiss Bank Becomes First Global Bank to Support Ripple’s RLUSD Stablecoin

03.07.2025 14:24 2 min. read