Bitcoin Liquidations Surge to Three-Year High as Smaller Traders Drive Market Downturn

10.12.2024 15:30 1 min. read Alexander Stefanov

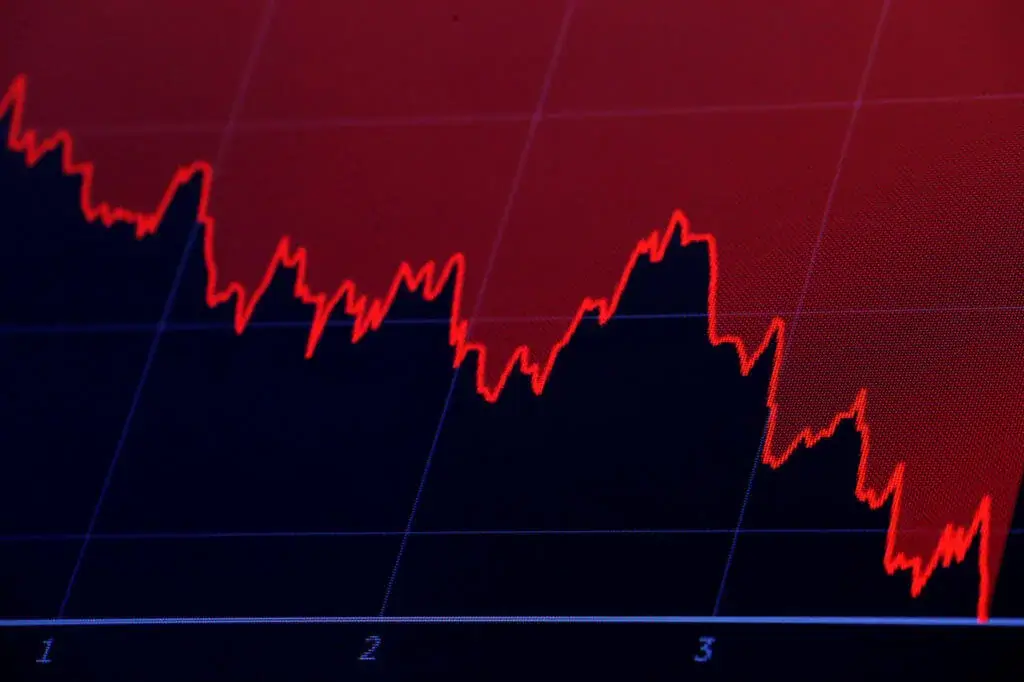

Bitcoin’s recent price drop has sparked a record surge in liquidations, with the total crypto market losing up to 11% on December 9.

Research from Ltrd revealed that smaller traders, rather than large investors, drove this crash. Bitcoin dipped to $94,000, fulfilling predictions made earlier in the week and filling a market gap created on December 5.

Coinbase was identified as a key player, with aggressive selling beginning nearly an hour before the price collapse. This selling pressure triggered a liquidation cascade, forcing overleveraged positions to close.

The total value of crypto liquidations reached $1.57 billion, with Bitcoin longs suffering $171.27 million in losses, while Ethereum longs saw $235.04 million in liquidations. Ltrd pointed out that this marked the largest liquidation event since 2021, signaling a massive shift in market dynamics.

Despite the carnage, some traders view the wipeout of excessive leverage as a positive step toward market stability. The forced liquidations are seen as a necessary correction, helping to reset the market and stabilize altcoins, with several flipping key resistance levels into support.

Ltrd also noted unusual behavior in the altcoin market, with assets like XRP dropping by over 5%, sparking speculation about potential market manipulation or other factors behind the sudden volatility. The overall market’s reaction reflects both a reset and lingering uncertainty about underlying forces at play.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

Philippe Laffont, the billionaire behind Coatue Management, is beginning to question his stance on Bitcoin.

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

Personal finance author Robert Kiyosaki is urging investors to rethink their approach to money as digital assets reshape the economic landscape.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read