Tron Hits New All-Time High, Doubling Price Within Hours

04.12.2024 12:18 1 min. read Alexander Stefanov

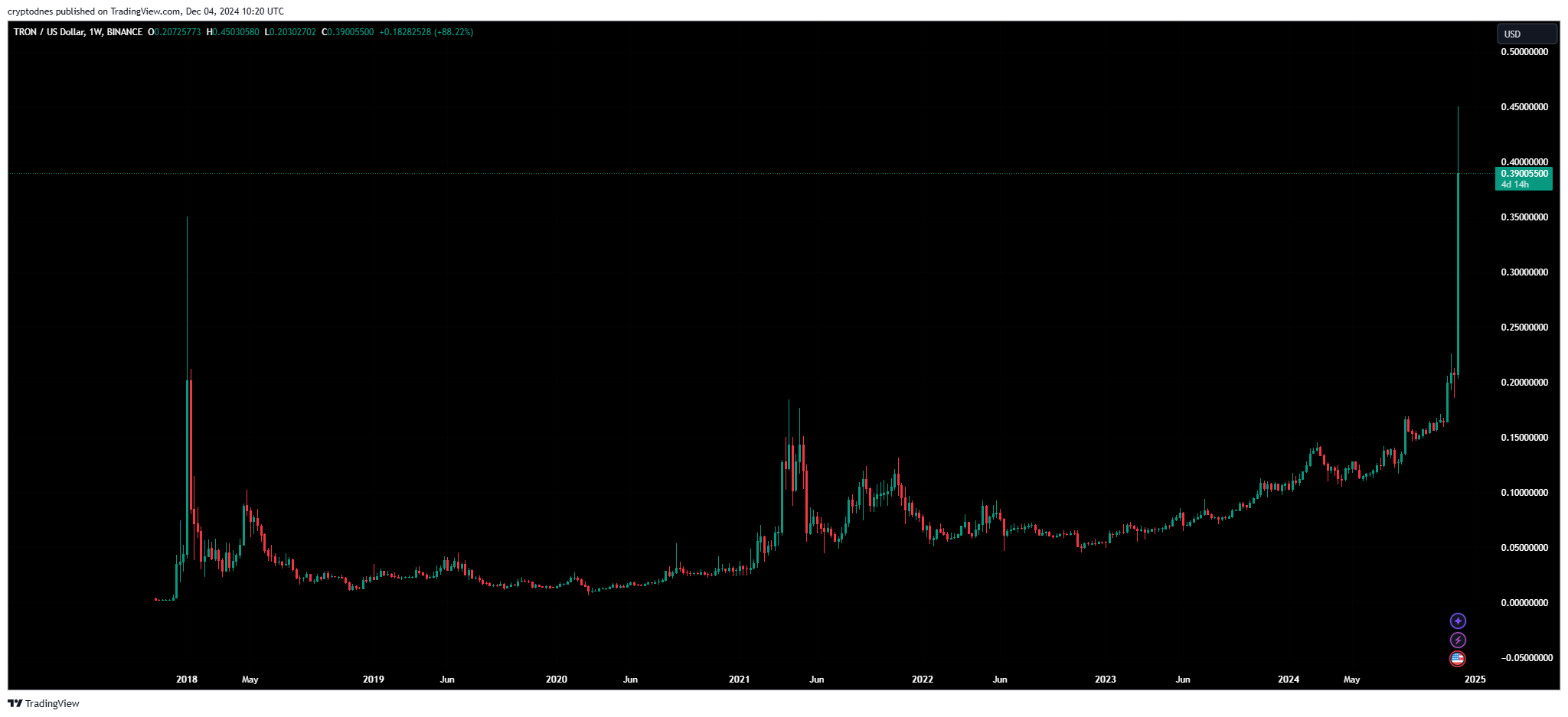

The price of Tron experienced a remarkable rally, more than doubling within hours and reaching a peak of $0.44, a new all-time high.

This dramatic rise was fueled by an influx of liquidity, driven by increased Tether issuance on both Ethereum and Tron networks.

This spike in activity caused Tron’s trading volume to soar by over 500%, ranking it as the fourth most traded asset of the day behind USDT, Bitcoin, Ethereum, and XRP.

While the bulls currently dominate the market, there are signs of a potential pullback. Tron’s price is approaching the upper boundary of a rising wedge pattern.

READ MORE:

Top 4 AI Altcoins Leading Developer Interest

Should it break out, projections suggest a climb to $0.70, followed by a correction to $0.50 before potentially rebounding to $1.

However, with the monthly RSI exceeding 91, there are indications that a cooling-off period might be imminent.

During this phase, the price may consolidate within the wedge until it reaches its apex, setting the stage for a breakout that could surpass $1.

At the time of writing, TRX has retraced back to $0.39 with 538.95% surge in trading volume.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read