Memecoin Trader Makes 38,399x Return on His Investment – Here is How

01.12.2024 14:00 1 min. read Alexander Stefanov

Bitcoin has been steadily gaining traction, but the spotlight has recently shifted back to memecoins, which continue to capture the imagination of investors with their high-risk, high-reward appeal.

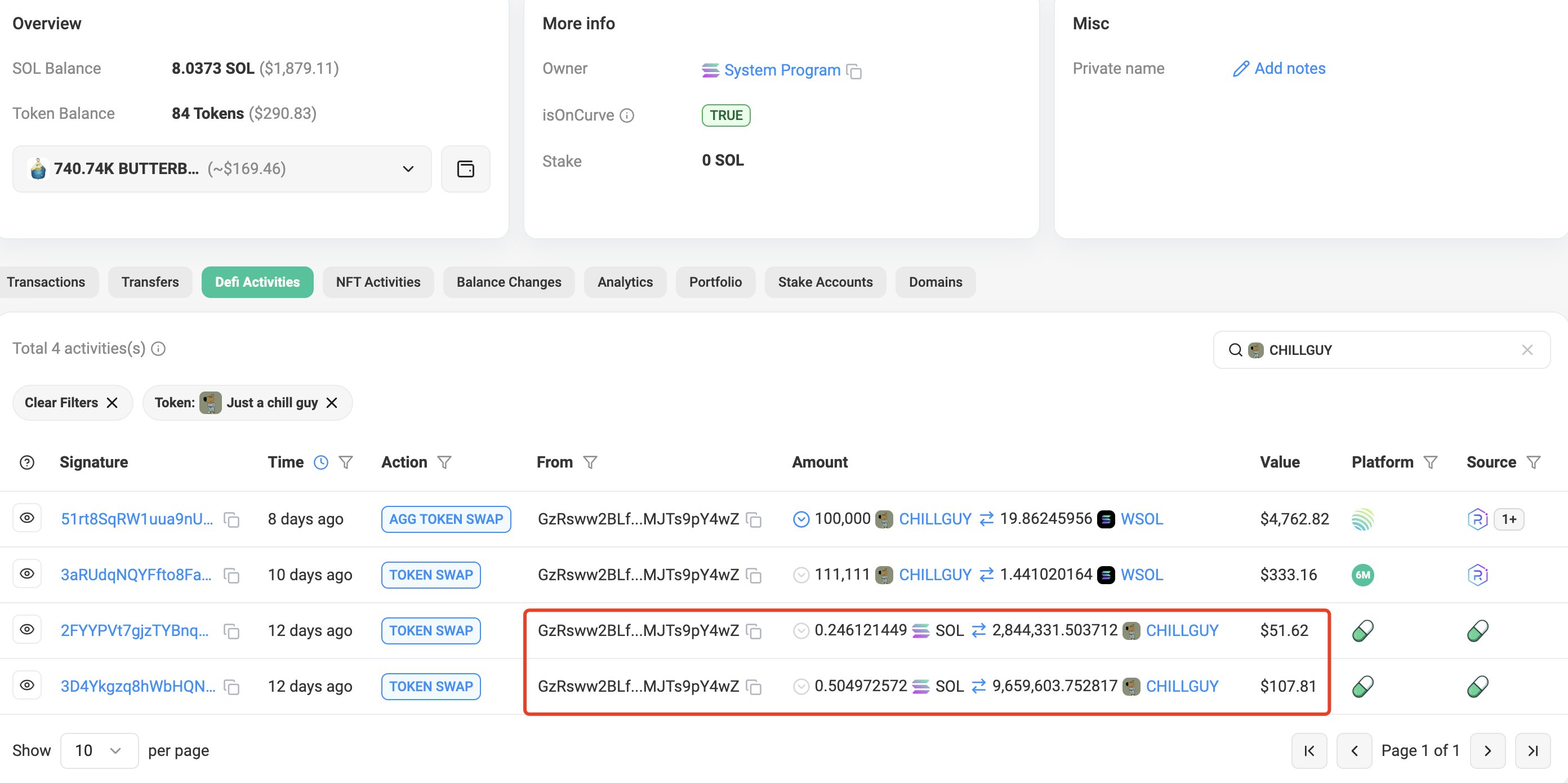

One trader exemplified this trend by reportedly turning a $160 investment into a staggering $6.14 million through a Solana-based memecoin called “Just a Chill Guy” (CHILLGUY).

The coin, inspired by a viral cartoon, has skyrocketed in popularity over the past month.

Blockchain tracker Lookonchain revealed that the trader initially bought 12.5 million CHILLGUY tokens for 0.75 SOL and later sold a portion, netting $35,400. With 9.62 million tokens still in their wallet, the trader’s total profit stands at over $6 million—a 38,399x return on the original investment.

However, the memecoin’s viral rise faces a legal hurdle. Phillip Banks, the creator of the original “Chill Guy” cartoon, announced plans to take legal action against unauthorized uses of his copyrighted work.

On the platform X, Banks warned that takedowns targeting for-profit ventures related to the cartoon are imminent, after which the token’s price plummeted.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

This Solana Memecoin Poised for Breakout, Says Analyst

20.06.2025 8:00 1 min. read -

3

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

4

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

5

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

According to a new report by CryptoQuant, Chainlink (LINK) is locked in a prolonged accumulation phase between $12 and $15, driven by aggressive whale behavior amid muted retail participation.

Fartcoin Price Prediction: FARTCOIN Eyes $1.5 as ETF Approval Hopes Boost Meme Coins

Fartcoin (FARTCOIN) has gone up by 14.4% in the past 24 hours as meme coins as a whole are rallying during today’s session. The launch of a Solana exchange-traded fund (ETF) this week along with Canary Capital’s positive steps toward getting a Pudgy Penguins (PENGU) ETF approved are favoring a bullish Fartcoin price prediction. Fartcoin. […]

Solana Staking ETF Ranks in Top 1% of ETF Launches on Day One

The newly launched SSK Solana Staking ETF delivered a standout performance on its first trading day, ranking in the top 1% of all ETF launches, according to Bloomberg ETF analyst Eric Balchunas.

Swiss Bank Becomes First Global Bank to Support Ripple’s RLUSD Stablecoin

In a landmark move for regulated digital finance, AMINA Bank AG, a FINMA-regulated Swiss crypto bank, has officially launched custody and trading services for Ripple’s U.S. dollar-pegged stablecoin RLUSD, becoming the first bank globally to directly support the asset.

-

1

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

2

This Solana Memecoin Poised for Breakout, Says Analyst

20.06.2025 8:00 1 min. read -

3

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

4

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

5

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read