Crypto Market Cools Off as $500 Million Gets Wiped Out, Bitcoin and Ethereum Face Losses

24.11.2024 20:03 1 min. read Alexander Zdravkov

After a week of significant gains, the crypto market seems to be cooling-off with most digital assets witnessing declines.

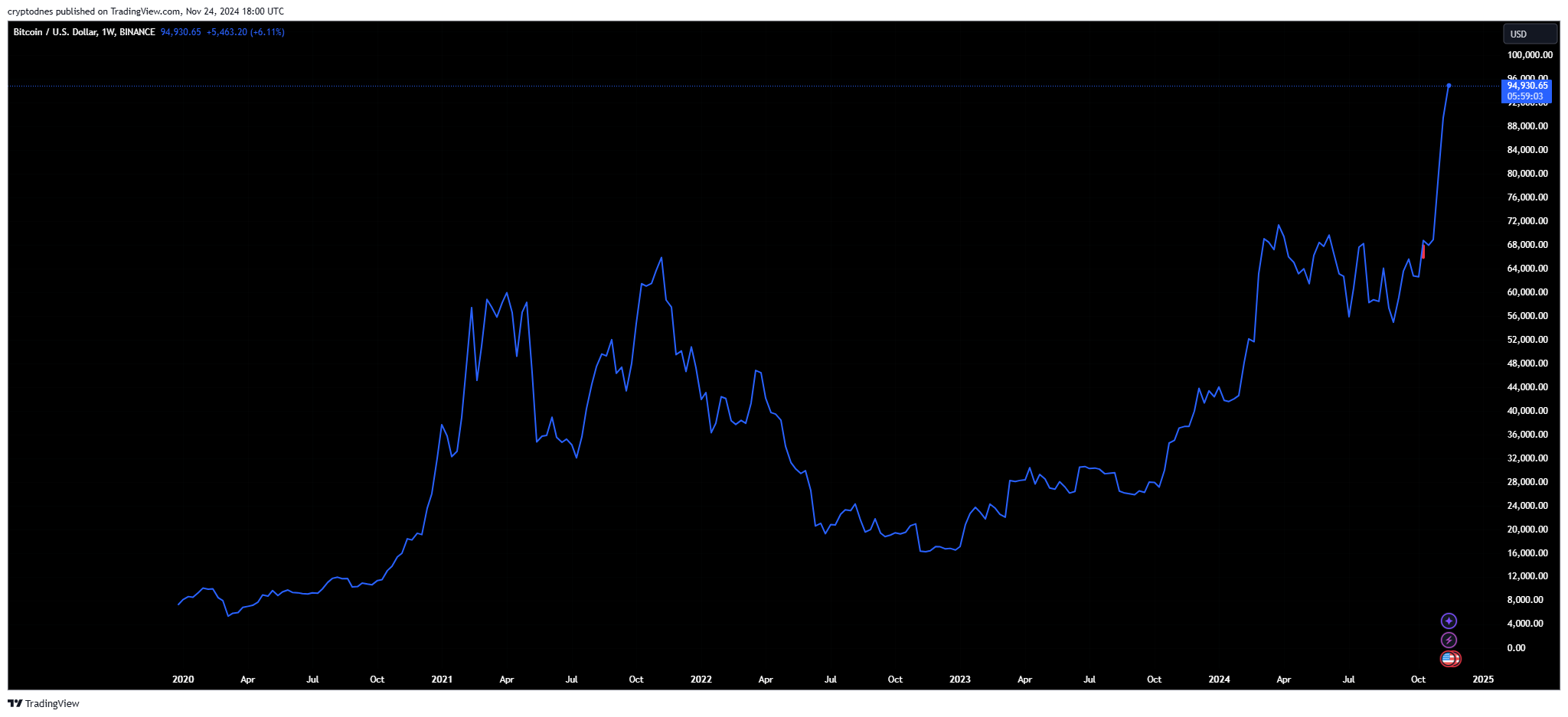

Bitcoin’s price dropped 2.3% in the past 24 hours below $95,000, but is still up 5.8% on the weekly chart. The flagship cryptocurrency has a market cap of $1.896 trillion and a 24-hour trading volume of $48 billion.

During this period, positions worth $493.18 million were wiped out – $385.67 million in longs, and $107.51 million in shorts, according to data from Coinglass.

Despite this price drop, the 1-day technical analysis from TradingView remains bullish with the summary pointing to “buy” at 15, moving averages show “strong buy” at 13, and oscillators remain “neutral” at 7.

The total cap of the crypto market declined by 2.83% in the past 24 hours and is currently at $3.26 trillion.

Ethereum lost 3.6% of its value in this timeframe with a trading volume of $29 billion. Nevertheless, ETH is still up 6.4% in the past 7 days and has a market cap of around $399 billion.

The biggest loser today is XRP, which lost over 11% with volumes reaching $11 billion. The altcoins is still up 24.7% this week, following the major price surge we witnessed some days ago.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

3

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

3

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

4

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

5

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read