Bitcoin Network Hits New Difficulty Peak as Mining Power Surges

06.11.2024 21:00 2 min. read Kosta Gushterov

Bitcoin's network has experienced its third consecutive difficulty increase, setting a new all-time high, according to on-chain data.

This adjustment reflects the ongoing evolution of Bitcoin’s mining process, where the “difficulty” metric determines how hard it is for miners to mine new blocks.

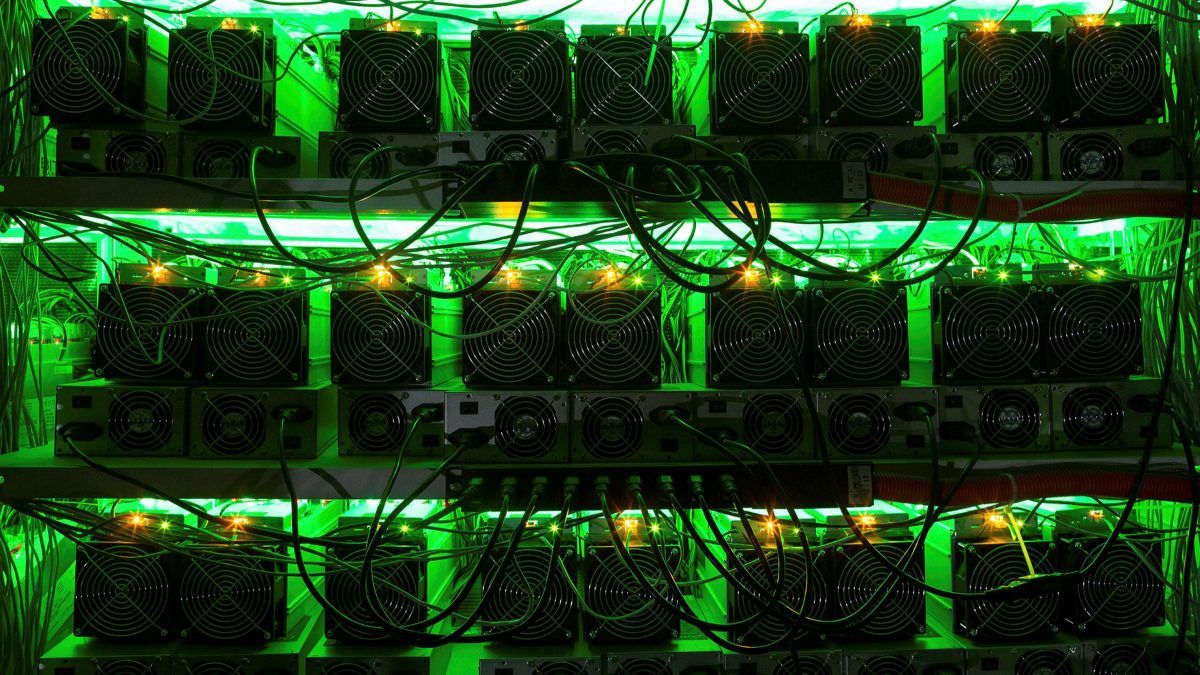

The latest adjustment, which occurred just over the past day, shows the largest increase—over 6%—compared to the two previous adjustments. This surge in difficulty is tied to Bitcoin’s growing hashrate, a measure of the total computing power used by miners. Over the past few weeks, the hashrate has steadily climbed, reaching new record highs.

This rise indicates that more mining power is being added to the network, with miners expanding their operations.

The network automatically adjusts its difficulty every two weeks, based on the hashrate, to maintain a consistent block time of around 10 minutes. When miners contribute more computational power, they mine blocks faster than usual. To balance this out, the network increases difficulty, ensuring that the time it takes to mine a block stays steady at 10 minutes.

This mechanism helps maintain the predictable rate of Bitcoin issuance. The difficulty increase keeps the supply of new coins growing at a steady, controlled pace, avoiding inflationary spikes. The recent uptick in mining activity and difficulty reflects how the Bitcoin network is designed to adjust itself to ensure stability and predictability in its monetary policy.

-

1

IMF Pushes Back as Pakistan Bets Big on Bitcoin Mining

31.05.2025 18:00 2 min. read -

2

Bitcoin’s Drop Sparks New Focus on Money Supply Trends

02.06.2025 12:00 2 min. read -

3

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

4

BlackRock’s Bitcoin ETF Sees Largest Daily Withdrawal, Ending Month-Long Inflow Streak

31.05.2025 19:00 1 min. read -

5

Will Musk Double Down on Bitcoin as U.S. Debt Soars?

04.06.2025 12:00 2 min. read

Is Bitcoin Becoming the New Core Holding for Investors?

Bitcoin’s roller-coaster days may be fading, and that shift could push the world’s largest digital asset into more professional portfolios, according to Coatue Management founder Philippe Laffont.

Corporate Bitcoin Buying Spree Adds 2,500 BTC in Five Days

Corporate interest in Bitcoin exploded between June 9 and 13, as public filings reveal more than 60 separate announcements tied to the cryptocurrency.

Quantum Advances Put Bitcoin’s Security to the Test

Quantum computing is no longer just a theoretical threat to Bitcoin — it’s fast becoming a real one.

Bitcoin’s Biggest Holders Could Trigger Next Major Crash, Analyst Warns

A well-known crypto analyst is sounding the alarm on a potential storm brewing for Bitcoin—one that could be fueled not by speculators, but by institutions themselves.

-

1

IMF Pushes Back as Pakistan Bets Big on Bitcoin Mining

31.05.2025 18:00 2 min. read -

2

Bitcoin’s Drop Sparks New Focus on Money Supply Trends

02.06.2025 12:00 2 min. read -

3

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

4

BlackRock’s Bitcoin ETF Sees Largest Daily Withdrawal, Ending Month-Long Inflow Streak

31.05.2025 19:00 1 min. read -

5

Will Musk Double Down on Bitcoin as U.S. Debt Soars?

04.06.2025 12:00 2 min. read