Bitcoin Registers New All-Time High, Reaching Just Over $75,000

06.11.2024 7:26 1 min. read Kosta Gushterov

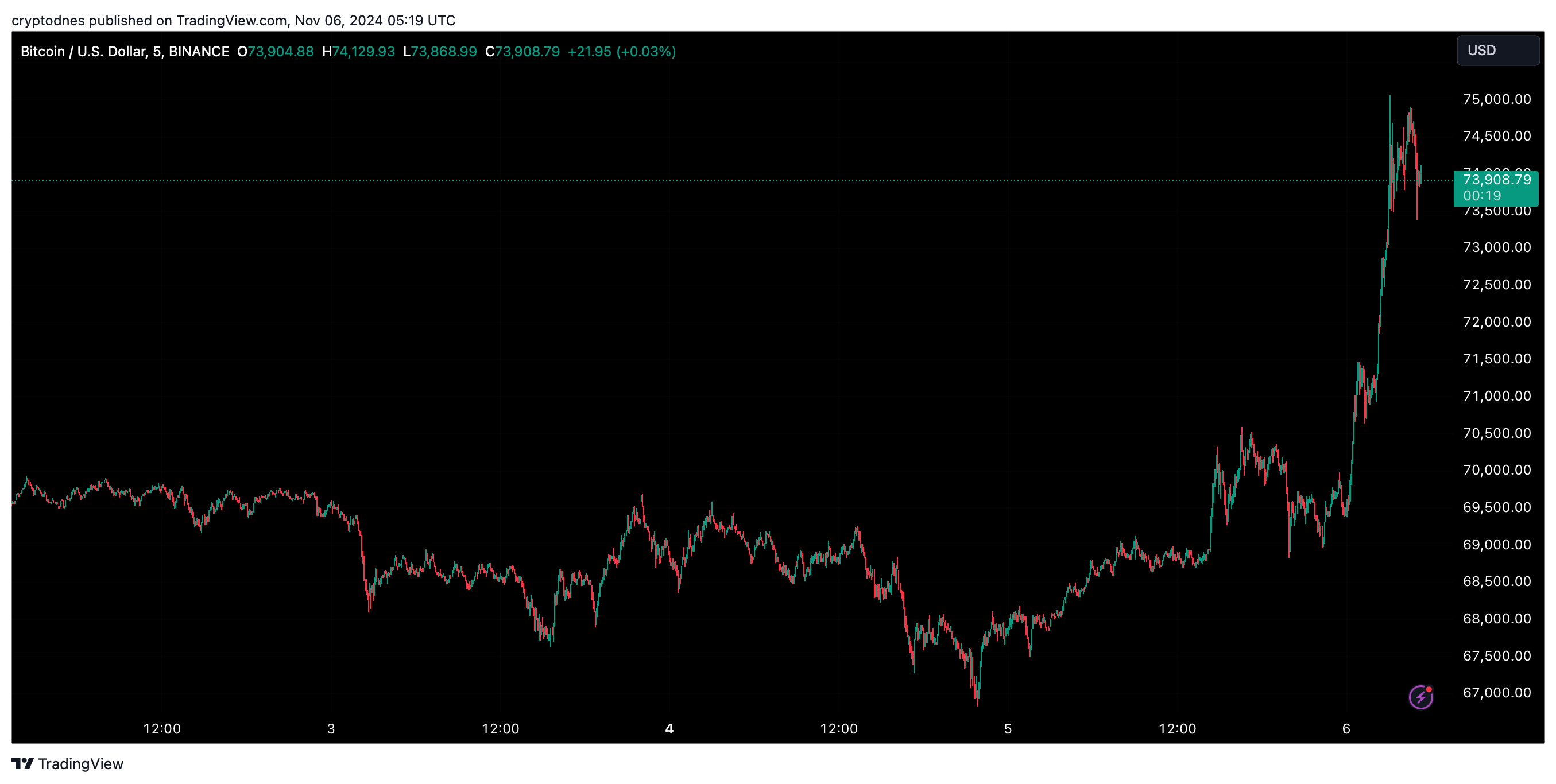

On Wednesday morning, Bitcoin reached a new all-time high at just over $75,000 on Binance, gaining over 10% within 24 hours.

These gains are supported by the initial results of the U.S. presidential election, which sparked optimism among crypto investors about former President Donald Trump’s chances of returning to office.

The rally marks Bitcoin’s second record high this year; previously, it reached a peak in March, signaling the end of the prolonged “crypto winter” that had kept prices down for years.

Investor excitement over a potential Trump victory intensified as he embraced cryptocurrencies as part of his campaign.

Trump has also promised to replace U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler, whose strict regulatory stance has often frustrated the crypto community. Additionally, Trump proposed the creation of a national Bitcoin reserve, drawing the attention of crypto supporters.

Bitcoin’s surge supported the broader cryptocurrency market.

However, BTC lost some of its gains and, at the time of writing, is trading at $73,900, reflecting an 8.4% increase over the last 24 hours.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read