Crypto Betting Booms Ahead of U.S. Presidential Election

05.11.2024 15:30 2 min. read Kosta Gushterov

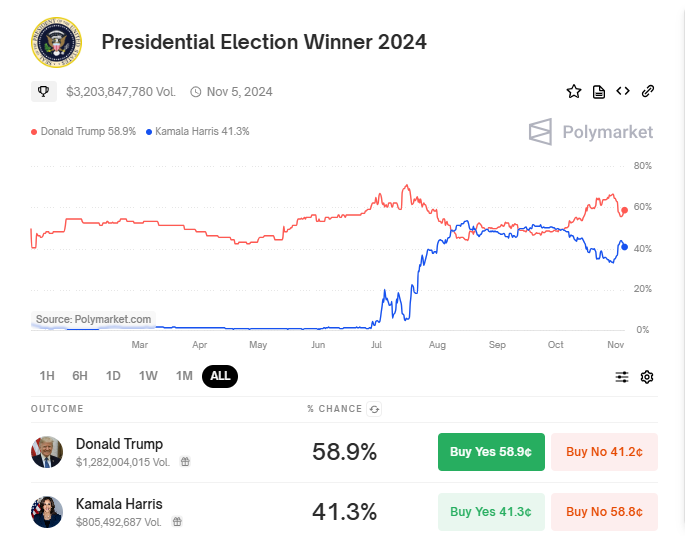

Ahead of the U.S. presidential election on Nov. 5, Polymarket has seen a major spike in activity, with its prediction market volume climbing to an impressive $3.2 billion.

This surge underscores the intense interest in the election, with many bettors showing confidence in Donald Trump’s potential victory over Kamala Harris.

Polymarket’s data currently assigns Trump a 58.3% chance of winning, compared to Harris at 41.8%. Wagers on Trump now total $1.279 billion, surpassing Harris’s $804.7 million, with a single high-stakes bet of $15 million placed in Trump’s favor. Polymarket has outlined that payouts will be determined based on a consensus among three major outlets—Associated Press, Fox News, and NBC News. If they don’t align, the final outcome will hinge on the official inauguration.

Interest in election predictions on Polymarket has soared. Between September and October, trading volumes rose 368%, reaching a high of $2.5 billion. This rapid growth speaks to the enthusiasm around forecasting the election, as well as the larger trend of using prediction markets to gauge political outcomes. Bloomberg’s integration of Polymarket data into its terminal in August further signaled a shift, and Robinhood’s new event contracts rolled out in October highlight the rising appeal of this alternative asset.

Despite its success, Polymarket is facing some scrutiny. Questions have surfaced over potential market manipulation in Trump’s favor, with instances of “wash trading” possibly inflating his odds. In response, Polymarket has enhanced its monitoring of user accounts, especially those linked to unusual trading behavior.

As Election Day nears, the dynamics on Polymarket will be closely watched. Whether this intense betting activity accurately reflects the political landscape or simply a speculative surge remains to be seen, but Polymarket’s ascent illustrates the expanding influence of prediction markets in political forecasting.

-

1

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

2

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

3

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

4

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

5

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

2

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

3

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

4

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

5

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read