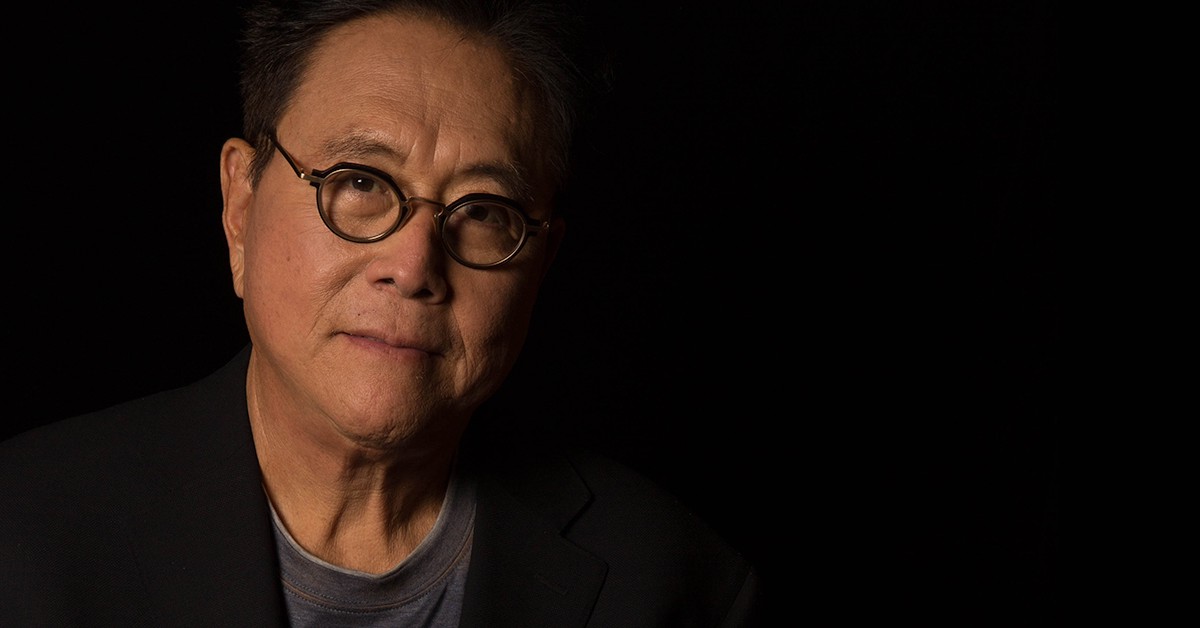

The Banking Crisis Has Already Begun – Robert Kiyosaki

03.11.2024 15:13 2 min. read Kosta Gushterov

Robert Kiyosaki, author of the book "Rich Dad, Poor Dad", issued a serious warning for the US banking sector, saying that the serious downturn has already begun.

Pointing to the recent closure of a bank in Oklahoma as a key indicator, Kiyosaki expressed concern that both the bond and commercial real estate markets are highly vulnerable to such downturns, echoing long-standing concerns about the state of the financial system.

Banking crash has begun. Oklahoma bank shuts its doors. Watch out bonds and commercial real estate markets next to go.

Take care

— Robert Kiyosaki (@theRealKiyosaki) November 2, 2024

Kiyosaki has consistently expressed skepticism about the U.S. banking and economic systems, which he says are heavily influenced by what he describes as a “fake” U.S. dollar – the product of a corrupt and unsustainable monetary system.

READ MORE:

Interest Rate Cuts and Election Speculation Set to Boost Bitcoin Prices, Claims WonderFi CEO

In his view, the dollar’s diminishing value and dependence on flawed financial practices set the stage for the worst economic crisis since the Great Depression of 1929.

As a means of guarding against these risks, Kiyosaki has long recommended investing in assets with intrinsic value and limited supply, such as gold, silver and Bitcoin.

He considers Bitcoin to be “thepeople’s money” because of its decentralized nature and limited supply, which contrasts sharply with traditional currency. In his view, these assets offer the best protection for people who want to preserve their wealth amid what he describes as an ongoing “firestorm” in financial markets.

-

1

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

2

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

3

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

4

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

5

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

2

NFTs Quietly Evolve Into Core Digital Infrastructure

13.06.2025 17:00 2 min. read -

3

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read -

4

MEXC Sets Up $100M Emergency Fund to Protect Users From Major Security Incidents

12.06.2025 11:00 1 min. read -

5

Binance Enters Syrian Market as Sanctions Ease

12.06.2025 22:00 1 min. read