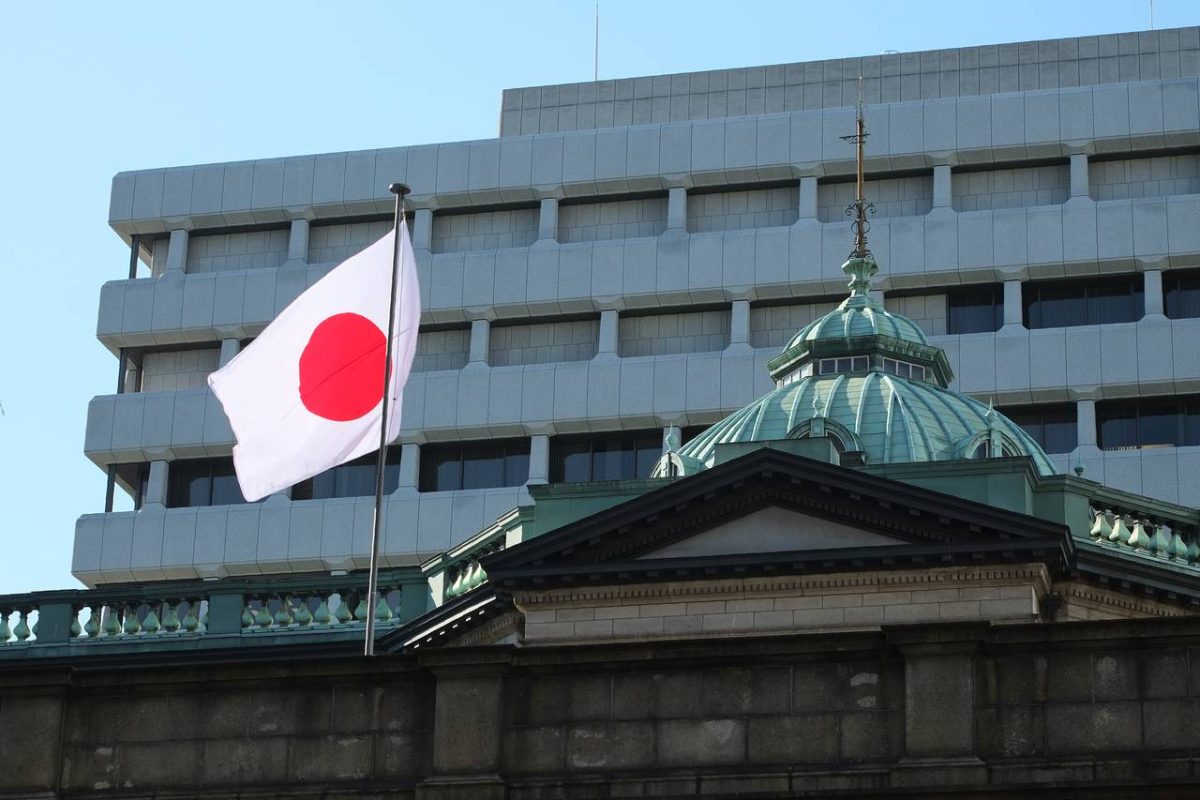

Bank of Japan Holds Interest Rates Amid Election Uncertainty

02.11.2024 13:00 1 min. read Alexander Stefanov

The Bank of Japan (BOJ) has chosen to hold its benchmark policy rate steady at 0.25% amid political uncertainties following Japan’s recent election.

BOJ Governor Kazuo Ueda confirmed the decision after the central bank’s October 30-31 policy meeting, stating that the bank remains focused on meeting its inflation target. The BOJ raised its rate to 0.25% earlier this year, moving out of a long period of negative interest rates.

In his remarks, Ueda discussed Japan’s current economic and political landscape, noting that the BOJ will analyze global and domestic factors before any future rate hikes.

Despite political shifts and recent losses by the ruling Liberal Democratic Party, Ueda assured that political changes won’t directly impact the bank’s inflation forecasts, though adjustments will be considered if needed.

Economists view the BOJ’s recent report as signaling a potential rate hike, with some experts forecasting an increase by year-end as the yen weakens.

Goldman Sachs Japan’s senior advisor, Akira Otani, predicted a rate rise by early next year, largely influenced by global economic trends. Meanwhile, Prime Minister Shigeru Ishiba, if re-elected, plans to propose a supplementary budget and may convene a new Diet session in November.

-

1

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

4

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

Fresh data on Personal Consumption Expenditures (PCE) — the Federal Reserve’s preferred inflation gauge — shows inflation ticked higher in May, potentially delaying the long-awaited Fed rate cut into September or later.

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

Federal Reserve Chair Jerome Powell is once again under fire, this time facing renewed criticism from Donald Trump over the Fed’s decision to hold interest rates steady in June.

U.S. National Debt Surge Could Trigger a Major Crisis, Says Ray Dalio

Billionaire investor Ray Dalio has sounded the alarm over America’s soaring national debt, warning of a looming economic crisis if no action is taken.

-

1

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

4

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read