MicroStrategy Stock Hits 25-Year High as Bitcoin Nears $70,000

26.10.2024 8:00 1 min. read Alexander Stefanov

MicroStrategy’s stock has soared to its highest level in 25 years, spurred by Bitcoin’s potential push toward $70,000.

Throughout this year, MSTR’s stock price has steadily climbed, significantly boosted by the company’s substantial Bitcoin holdings.

According to Google Finance, the stock has surged 244% year-to-date and recently reached $235.89 as of October 24, marking a 55% rise over the past month.

This strong performance coincides with Bitcoin’s recent growth, as the digital asset has gained 6% over the month, driven by rising institutional interest.

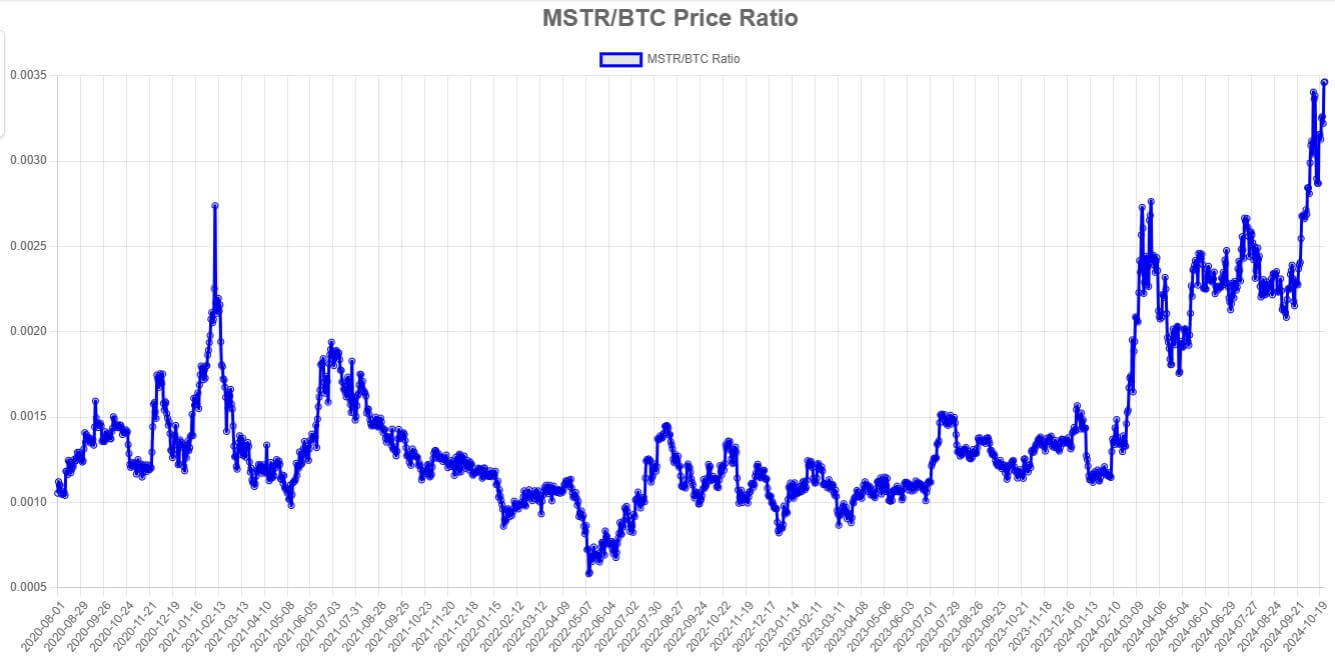

Recent data on the MSTR tracker highlights two core metrics tied to these market rallies: the “MSTR/BTC Ratio,” which measures MicroStrategy’s stock in comparison to Bitcoin’s price, reached an all-time high of 0.00346, surpassing levels seen during Bitcoin’s 2021 peak.

Additionally, the “NAV Premium” chart reveals that MicroStrategy’s stock is trading at its highest premium over its Bitcoin holdings in three years, with the market currently valuing the stock at 2.783 times its Bitcoin-equivalent net asset value.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

AI Becomes Gen Z’s Secret Weapon for Crypto Trading

A new report from MEXC reveals a striking generational shift in crypto trading behavior: Gen Z traders are rapidly embracing AI tools as core components of their strategy.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read