BlackRock’s Ethereum ETF Leads Market With Strong Inflows

15.10.2024 19:00 1 min. read Alexander Stefanov

BlackRock's Ethereum ETF is currently at the forefront of the market, indicating increased investor confidence in ETH as a suitable investment.

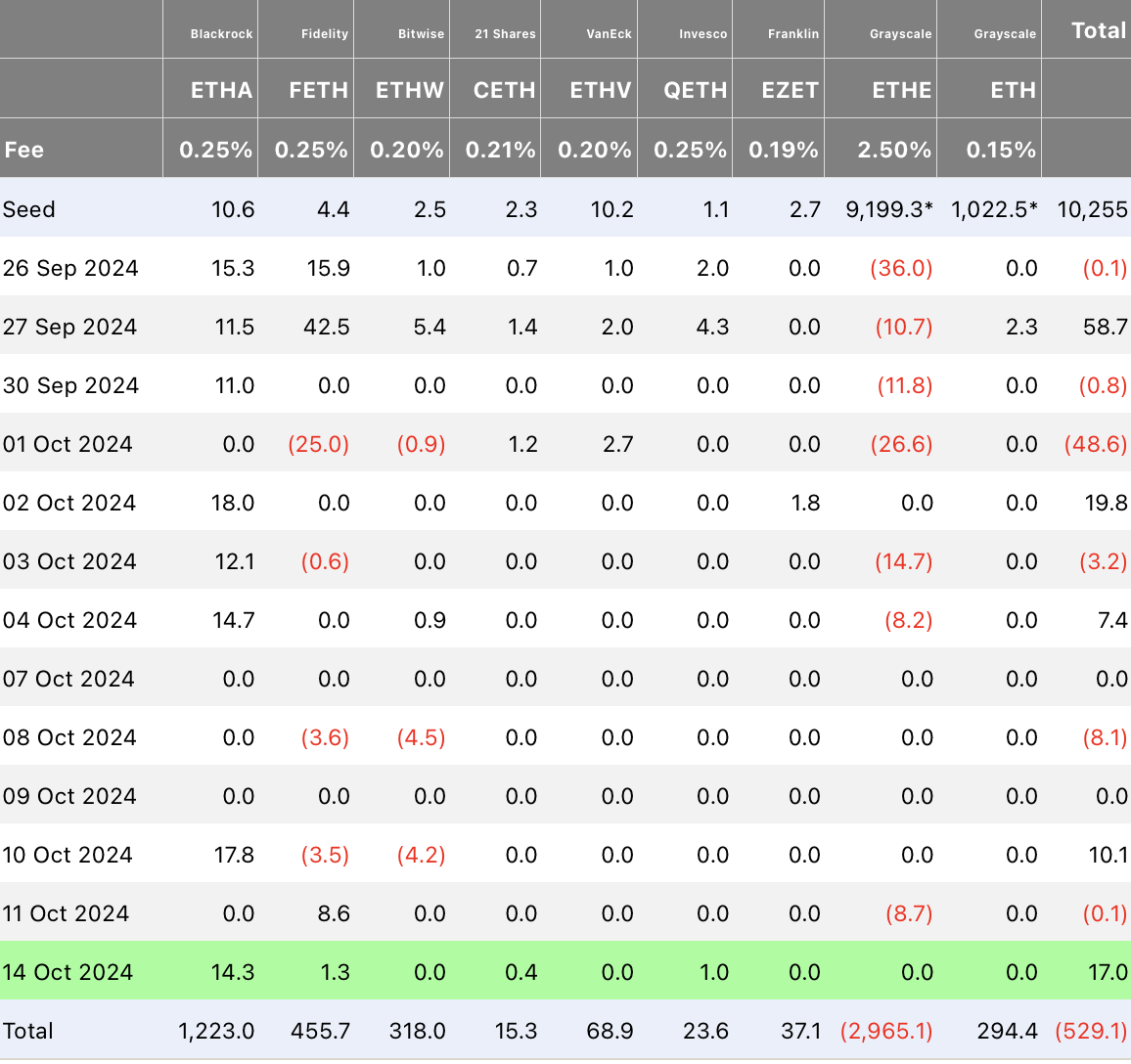

BlackRock’s ETHA led the way with a remarkable $14.3 million in daily net inflows, bringing its total historical net inflows to $1.223 billion.

Close behind was Fidelity’s Ethereum ETF, FETH, which recorded daily net inflows of $1.3 million and amassed historical net inflows of $456 million.

In contrast, Grayscale’s Ethereum Trust showed no daily net inflows or outflows, as did the Ethereum Mini Trust (ETH).

At last count, the net value of all spot Ethereum ETFs totaled $7.195 billion, with a ratio of net assets to total cryptocurrency market value of 2.28%.

Despite cumulative net outflows of $542 million, the inflows to spot ETFs suggest that Ethereum remains an attractive investment, a signal that investor interest in this dynamic asset class has not completely waned.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read -

5

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

The crypto market’s well-known skeptic, Il Capo of Crypto, has once again sounded the alarm—arguing that the worst may still be ahead, even as Bitcoin remains above the $100,000 mark.

Solana Price Prediction: Trend Reversal and EMA Crossovers Favor Retest of $100

Solana (SOL) has gone down by 6% in the past week and although the token has recovered in the past 24 hours, technical indicators favor a bearish outlook. Trading volumes have gone up by nearly 18% as bulls managed to reverse an early sell-off during the Asian session. However, meme coins, an important segment of […]

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

A growing number of publicly traded companies are turning to XRP as a potential reserve asset, signaling a shift in how institutions view the utility of digital assets in treasury management.

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

Coinbase has taken another step toward boosting cross-chain utility by introducing wrapped versions of XRP and Dogecoin on its Layer 2 network, Base.

-

1

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

2

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

3

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read -

4

Binance Announces 70th Launchpool Project with Token Farming Starting May 23

22.05.2025 20:00 1 min. read -

5

Sui Network Moves to Restore $162M After Cetus Hack

30.05.2025 19:00 2 min. read