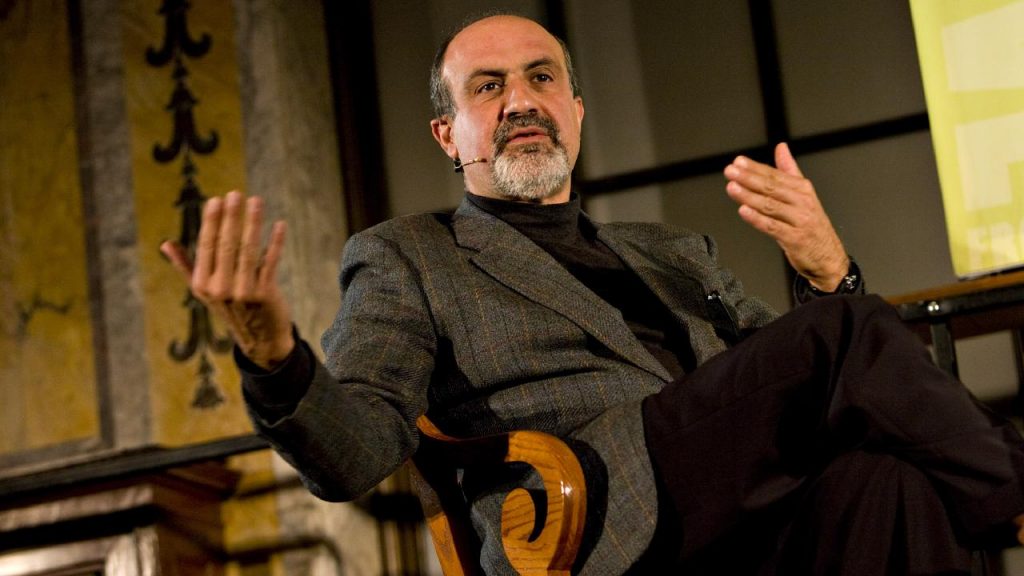

Nassim Taleb Warns of Fragile Markets and Cautions on AI Investment Hype

13.10.2024 10:00 1 min. read Kosta Gushterov

Nassim Nicolas Taleb, renowned for his influential books like The Black Swan, and Skin in the Game, recently shared his insights on financial markets and the future of AI companies from an investment perspective.

Speaking on Bloomberg TV, Taleb expressed concerns about the increasing fragility of the markets, noting that the current environment is more precarious than it has been in the past two to three decades.

While gold prices have been rising, Taleb emphasized that he isn’t relying on gold as a safeguard, preferring instead to hedge against a potential market downturn.

He pointed out that the recent rally in the S&P 500 is largely driven by a few firms involved in AI, but he cautioned that the best investment opportunities in AI may not lie with those companies.

Taleb compared the current hype around AI to the early days of the internet, when Alta Vista dominated search engines before being overtaken by Google.

Reflecting on the possibility of a market crash this year, he noted that such events tend to occur when investors are overconfident and heavily exposed, drawing parallels to previous economic collapses.

-

1

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read -

4

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

5

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read

TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

Michael Saylor’s STRC IPO Tops U.S. Charts with $2.5B Raise

Michael Saylor, the high-profile Bitcoin advocate and executive chairman of MicroStrategy, has made headlines again—this time with the largest initial public offering (IPO) of 2025.

-

1

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read -

4

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

5

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read