Stablecoins Help Latin Americans Cope With Inflation

10.10.2024 19:30 1 min. read Alexander Zdravkov

Stablecoins like USDT have become vital in Latin America, assisting people in managing ongoing economic difficulties.

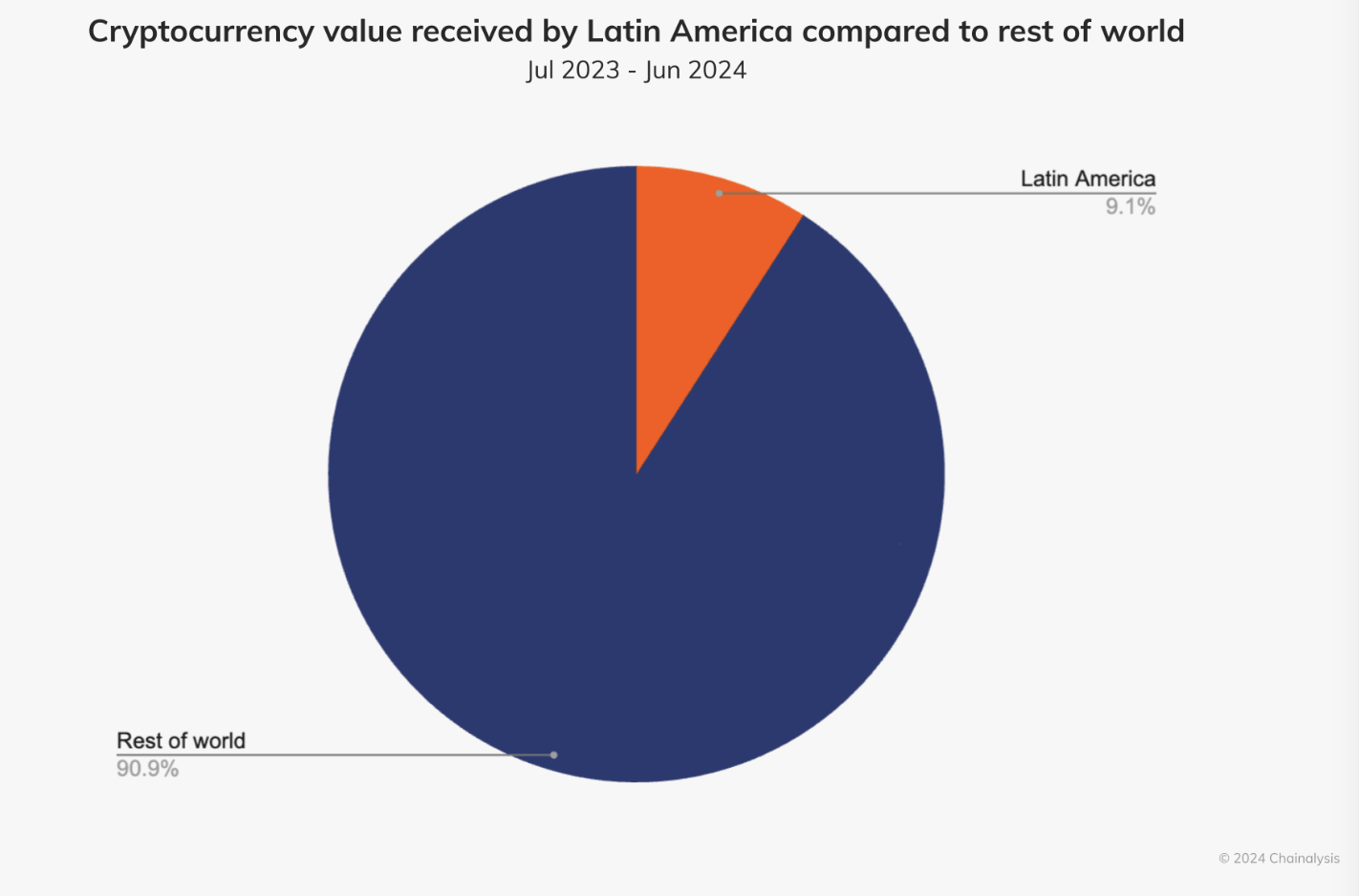

A Chainalysis report reveals that this region accounts for 9.1% of the global cryptocurrency value, with significant growth driven by increased institutional interest and consumer adoption.

From July 2023 to June 2024, Latin America received about $415 billion in crypto, slightly outpacing East Asia despite lower adoption rates.

Argentina led with $91.1 billion, followed by Brazil with $90.3 billion, where institutional activity surged by 48.4% between Q4 2023 and Q1 2024.

In nations like Argentina and Brazil, dollar-pegged stablecoins are crucial for protecting against inflation, especially as local currencies lose value.

Argentina’s inflation hit 143% in 2023, pushing citizens to find ways to secure their savings against the devaluation of the peso. Following President Javier Milei’s new economic policies, stablecoin trading volumes surged past $10 million when the peso fell below $0.002 in December 2023.

Brazil also saw a 29.2% increase in large transactions over $1 million in late 2023, fueled by the SEC’s approval of Bitcoin and Ethereum ETFs.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

Altcoins are being pulled off the world’s largest exchange in droves, signaling a wave of institutional accumulation and long-term holding, according to new data from CryptoQuant.

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read