How Much Cryptocurrency Binance Holds, According to Their Latest Report

08.10.2024 15:00 2 min. read Alexander Stefanov

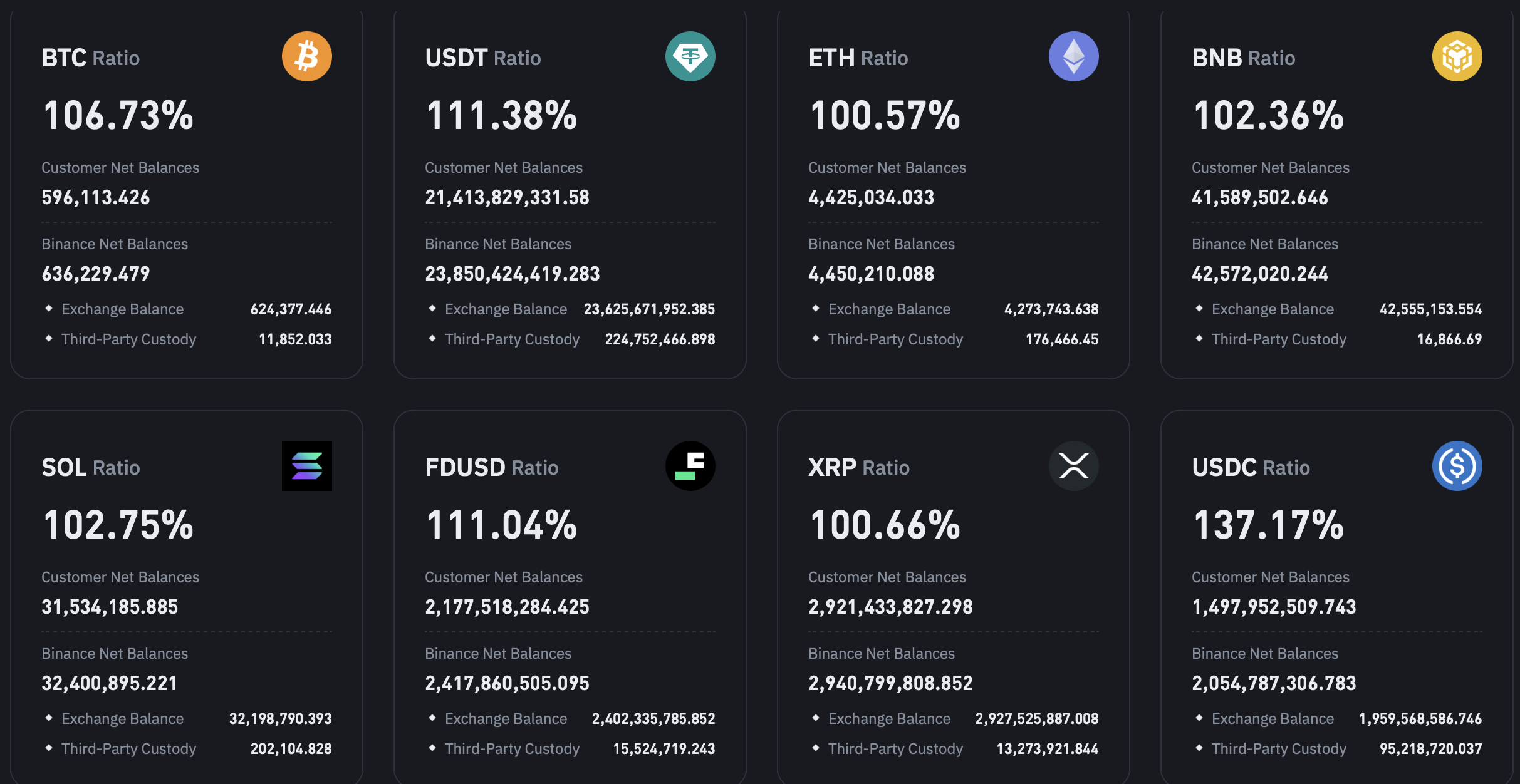

The October 2024 report offers a detailed snapshot of Binance's financial situation at a turbulent time for the crypto market.

Bitcoin (BTC), Ethereum (ETH) and USDT declined, while Binance’s native token, BNB, saw an increase, reflecting changes in the platform’s approach to asset management.

Between September and October 2024, Binance’s Bitcoin reserves showed a 1.58% decline, a decrease of 9,577 BTC, leaving the platform with 596,000 BTC.

Binance released the 23rd proof of reserves (snapshot date October 1). User BTC assets are 596k, down 1.58% from September 1; user ETH assets are 4.425 million, down 1.37%; user USDT assets are 21.41 billion, down 3.16%.https://t.co/jGCPnwd2PR pic.twitter.com/aHJq4Nd3Tj

— Wu Blockchain (@WuBlockchain) October 8, 2024

Similarly, Ethereum’ s holdings are down 1.37%, amounting to a drop of over 61,000 ETH. The most significant decrease was seen in USDT, with a decrease of 3.16%, equating to $698 million.

These declines may indicate a rebalancing or withdrawal phase by clients, reflecting the broader volatility in the cryptocurrency market.

On the other hand, Binance’s BNB reserves grew by 2.17%, which equates to an additional 882,454 tokens. This increase highlights Binance’s focus on its native token as part of its long-term vision. BNB plays a key role in the Binance ecosystem, contributing to everything from transaction fee payments to governance, and the growth in inventory reflects confidence in the token amid market uncertainty.

These changes in asset reserves highlight Binance’s flexibility in responding to market conditions. The decline in BTC, ETH and USDT, along with the increase in BNB stocks, suggests that Binance may adjust its strategy to prioritize its native token, while taking into account changing user demands for other cryptocurrencies.

-

1

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

4

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

5

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read

Ross Ulbricht Receives $31M in BTC — Who Sent It, and Why Now?

Ross Ulbricht, founder of the infamous Silk Road marketplace, is back in the headlines after receiving a mysterious transfer of 300 BTC—valued at roughly $31 million.

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

Bitcoin could be heading for a notable dip if it fails to stay above a key price zone, according to market watcher DonAlt.

Over 7 Million Bitcoins May Be Lost Forever, Study Finds

A new report from Cane Island reveals a startling truth about Bitcoin’s supply: by late 2025, over 7 million BTC could be permanently lost—more than one-third of all coins ever mined.

Strategy Aims for $1B Raise with New Stride Shares to Fuel Bitcoin Buys

In a fresh move to bolster its Bitcoin war chest, Strategy is rolling out a new fundraising vehicle—Stride preferred shares—targeting up to $1 billion in capital.

-

1

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

4

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read -

5

Top Crypto Trader Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

24.05.2025 18:00 1 min. read