Dormant Bitcoin Wallet Holding $2.6M Revives After a Decade

02.10.2024 8:30 1 min. read Alexander Stefanov

A long-dormant Bitcoin wallet has been reactivated after more than 10 years, sparking interest in the crypto community.

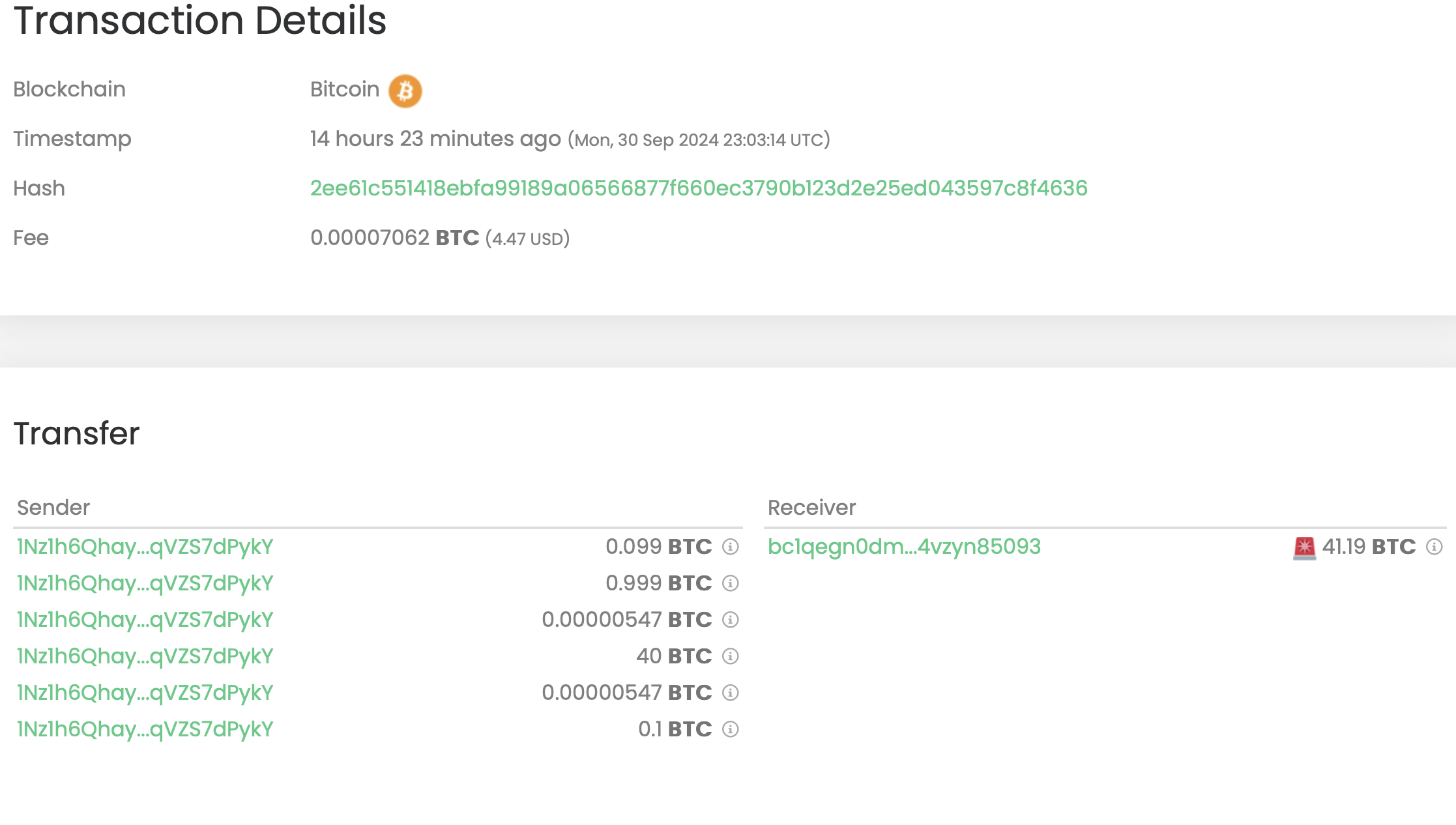

Whale Alert, a platform that tracks blockchain transactions, reported that an address holding 41 BTC, valued at over $2.6 million, suddenly became active after nearly 11 years of inactivity, transferring its entire balance to another wallet.

Interestingly, this address stayed inactive throughout Bitcoin’s major price surges, making the recent transfer a notable event tied to Bitcoin’s shifting market cycles.

Ki Yong Joo, CEO of CryptoQuant, recently explained the phases of Bitcoin’s market evolution. He described how older whales tend to reactivate their holdings first, followed by the emergence of new whales who later transition into retail investors.

Eventually, these retail holders mature into long-term players in the market. Joo also highlighted that Bitcoin inflows to exchanges remain steady, a contrast to previous bear market trends.

-

1

Bitcoin’s Evolution and Solana’s Rise: Scaramucci Outlines Crypto Outlook

14.05.2025 8:00 1 min. read -

2

Why Coinbase Chose Caution Over a Bitcoin-Maximalist Strategy

12.05.2025 8:00 2 min. read -

3

Bitcoin Surge May Be Early Stages of Major Rally, Says S2F Analyst

13.05.2025 12:00 2 min. read -

4

Panama City Steps Into the Spotlight as Latin America’s Next Crypto Gateway

18.05.2025 20:00 1 min. read -

5

Bitcoin Miners Reverse Course, Shift from Selling to Strategic Accumulation

14.05.2025 19:00 1 min. read

Bitcoin’s Drop Sparks New Focus on Money Supply Trends

Bitcoin’s recent price dip has stirred fresh debate around its connection to global liquidity, with analysts highlighting the relationship between BTC’s trajectory and the expanding M2 money supply.

Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

On-chain analyst Willy Woo is signaling a possible cooldown in Bitcoin’s trend, suggesting the asset could be heading into a prolonged consolidation phase if it doesn’t reclaim strength soon.

Bitcoin Defies Trade War Jitters, Enters June with Bullish Setup

Bitcoin is entering June with renewed strength as institutional appetite and fresh capital flows continue to shape its trajectory.

BlackRock’s Bitcoin ETF Sees Largest Daily Withdrawal, Ending Month-Long Inflow Streak

After more than four weeks of uninterrupted investor enthusiasm, BlackRock’s iShares Bitcoin Trust has reported its steepest daily outflow since its inception, signaling a potential shift in sentiment.

-

1

Bitcoin’s Evolution and Solana’s Rise: Scaramucci Outlines Crypto Outlook

14.05.2025 8:00 1 min. read -

2

Why Coinbase Chose Caution Over a Bitcoin-Maximalist Strategy

12.05.2025 8:00 2 min. read -

3

Bitcoin Surge May Be Early Stages of Major Rally, Says S2F Analyst

13.05.2025 12:00 2 min. read -

4

Panama City Steps Into the Spotlight as Latin America’s Next Crypto Gateway

18.05.2025 20:00 1 min. read -

5

Bitcoin Miners Reverse Course, Shift from Selling to Strategic Accumulation

14.05.2025 19:00 1 min. read