Michael Saylor Fires Up the Crypto Community With His Latest Tweet

01.10.2024 14:30 2 min. read Kosta Gushterov

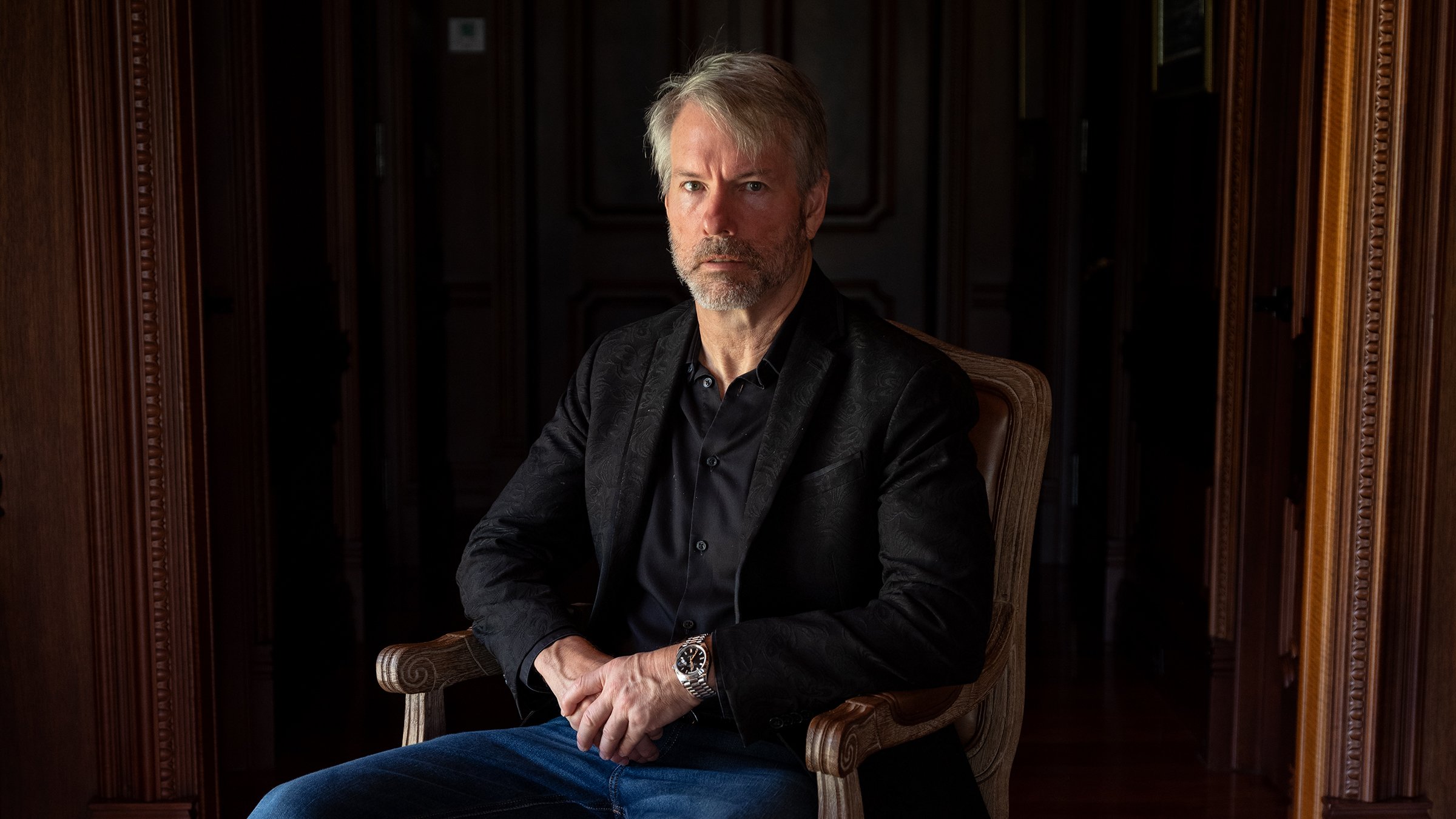

MicroStrategy's Michael Saylor stirred excitement in the cryptocurrency community with a recent post titled "Hodl On."

In this viral infographic, Saylor showcased the price trends of various assets, including Bitcoin (BTC), MicroStrategy’s stock (MSTR), and the S&P 500, following the company’s decision to adopt a Bitcoin-centric strategy on August 20.

The data revealed that MicroStrategy’s stock emerged as the standout performer over the past four years, soaring by an impressive 1,325%. Bitcoin secured the second spot, delivering a remarkable 451% return to its investors. Since summer 2020, Bitcoin reached a peak of $69,000, plummeted to $15,500 during the FTX collapse, and subsequently climbed back to a record high of $74,000.

In contrast, the S&P 500 index showed a modest gain of 71% during the same period. While this increase is notable, it pales in comparison to the extraordinary returns from MicroStrategy and Bitcoin.

Saylor’s post isn’t merely a display of pride but rather an affirmation of his unwavering belief in Bitcoin’s potential. Recently, Bitcoin’s price briefly rose above $65,000, but a subsequent dip brought it down to $63,500. Although the fluctuations are not drastic, they have sparked concerns among traders, raising fears that Bitcoin might test critical support levels around $62,300 or even $58,000.

Whether this scenario unfolds remains uncertain, but Saylor’s perspective indicates that he focuses on the long-term potential of Bitcoin rather than short-term market movements.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read