Is XRP’s Bullish Breakout a Sign of Confidence Amid SEC Uncertainty?

29.09.2024 21:00 1 min. read Alexander Stefanov

XRP has recently broken through the symmetrical triangle resistance at $0.605, signaling a bullish trend in the altcoin's price movement, despite ongoing speculation about potential SEC appeals.

This breakout reflects a surge in buying momentum as investors seize the opportunity to capitalize on the upward shift.

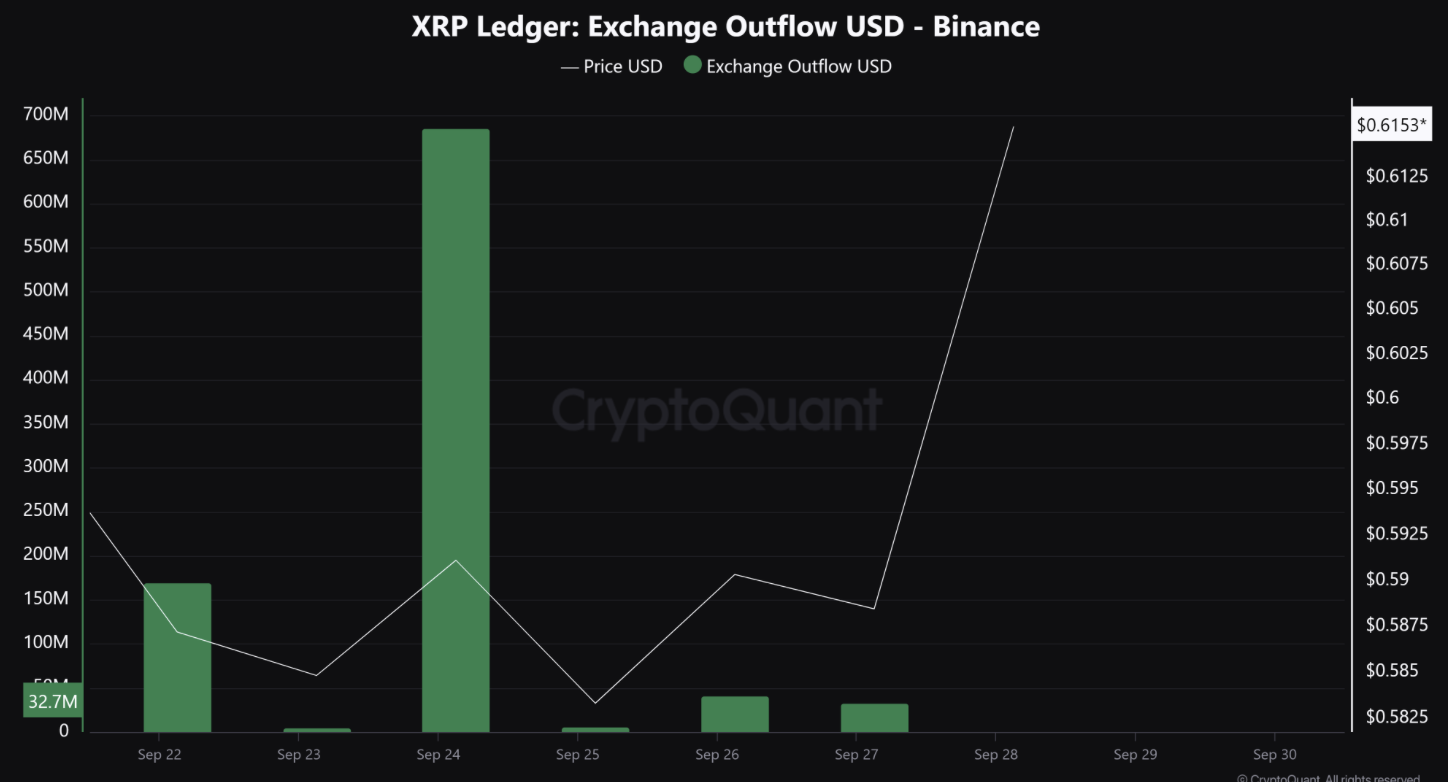

The cryptocurrency has witnessed a notable outflow of assets from exchanges, suggesting a shift in market sentiment. This trend reversal indicates that XRP holders are increasingly confident and prefer to retain their assets instead of withdrawing them. This reduced supply may further bolster the current price rally by alleviating selling pressure.

Additionally, following a significant asset outflow on September 24, XRP has gained traction on social media, with its discussion volume rising steadily.

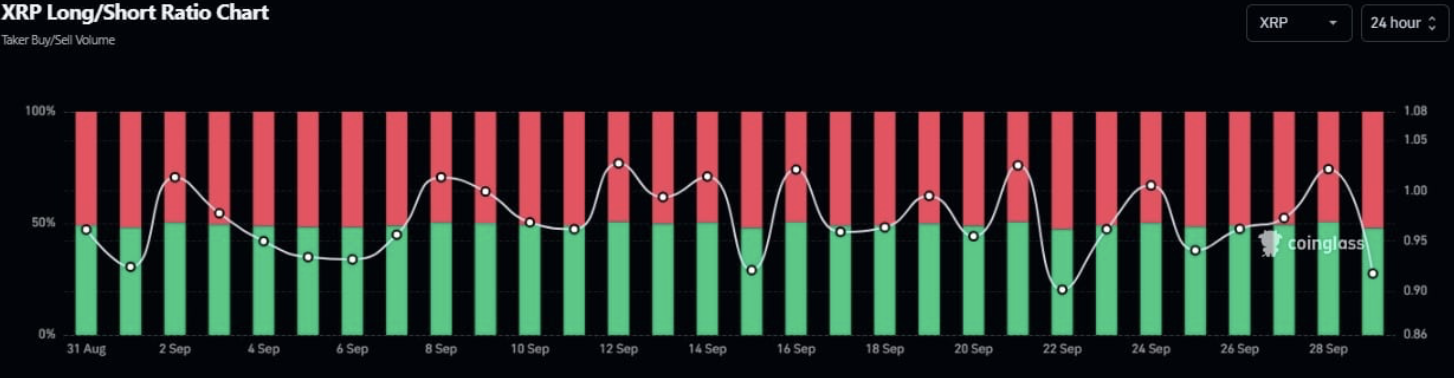

However, not all market indicators are favorable, as the ratio of long to short positions has seen a substantial decline. This drop suggests that fewer traders are choosing to take long positions on XRP, likely due to the uncertainty surrounding the SEC appeal outcome.

The market currently reflects mixed signals, with the price rally occurring alongside a more cautious outlook among traders. While this unexpected rally continues amidst regulatory ambiguity and technical hurdles, investor sentiment remains split. The sustainability of this upward movement will hinge on both technical developments and the unfolding SEC case in the weeks ahead.

-

1

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read -

5

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read

Bonk Price Prediction: BONK Nears Key Area of Support – Is It Ready for a Big Bounce?

Bonk (BONK) has gone down by 7.6% in the past 24 hours and currently stands at $0.00002800. Although the token has been on a downtrend for a few days, it is approaching a key area of support that could favor a bullish Bonk price prediction. Trading volumes have gone down by 18% during this period, […]

Santiment Highlights 6 Most Discussed Altcoins Amid Crypto Volatility

As Bitcoin and the broader altcoin market continue to swing unpredictably, blockchain analytics firm Santiment has identified six altcoins that have sparked intense interest across social media platforms.

Ethereum Turns 10: Celebrating the Genesis Block That Changed Crypto Forever

On this day ten years ago—July 30, 2015—a revolutionary chapter in blockchain history began.

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

-

1

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read -

5

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read