Ethereum ETFs See Significant Surge as Institutions Offset Whale Sell-Offs

28.09.2024 16:00 1 min. read Alexander Stefanov

After a stretch of sluggish activity, spot Ethereum ETFs are seeing renewed momentum, largely attributed to increased liquidity following recent Federal Reserve rate cuts.

Despite a slow start to the week, institutional interest in Ethereum investment products has returned, pushing prices up even as large-scale ETH holders have been selling off.

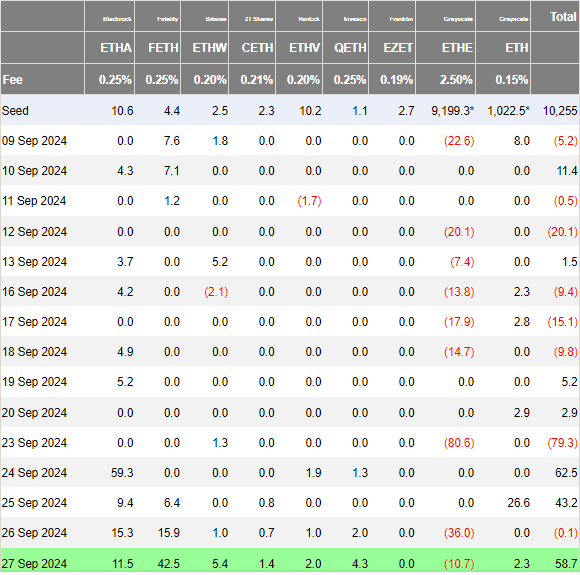

On September 27, Fidelity’s FETH led the pack with $42.5 million, followed by BlackRock’s ETHA with $11.5 million.

At the same time, Grayscale’s ETHE saw $10.7 million in outflows. Earlier in the week, the market had seen nearly $80 million in outflows, but BlackRock’s move quickly restored positive momentum.

Meanwhile, on-chain data reveals significant Ethereum sell-offs. Two major institutions offloaded large sums, including 11,800 ETH by Cumberland and 5,134 ETH from ParaFi Capital.

Additionally, a long-dormant whale sold nearly 13,000 ETH for over $34 million. Despite these large liquidations, the strong ETF inflows seem to be cushioning the market from a deeper decline.

-

1

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read -

5

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read

Bonk Price Prediction: BONK Nears Key Area of Support – Is It Ready for a Big Bounce?

Bonk (BONK) has gone down by 7.6% in the past 24 hours and currently stands at $0.00002800. Although the token has been on a downtrend for a few days, it is approaching a key area of support that could favor a bullish Bonk price prediction. Trading volumes have gone down by 18% during this period, […]

Santiment Highlights 6 Most Discussed Altcoins Amid Crypto Volatility

As Bitcoin and the broader altcoin market continue to swing unpredictably, blockchain analytics firm Santiment has identified six altcoins that have sparked intense interest across social media platforms.

Ethereum Turns 10: Celebrating the Genesis Block That Changed Crypto Forever

On this day ten years ago—July 30, 2015—a revolutionary chapter in blockchain history began.

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

-

1

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

16.07.2025 8:34 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

These Blockchains are Quietly Heating up—Sonic Leads With 89% Address Growth

14.07.2025 16:00 1 min. read -

5

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read