U.S. Bitcoin ETFs See $494 Million Surge in Six-Day Inflow Streak

28.09.2024 15:00 2 min. read Kosta Gushterov

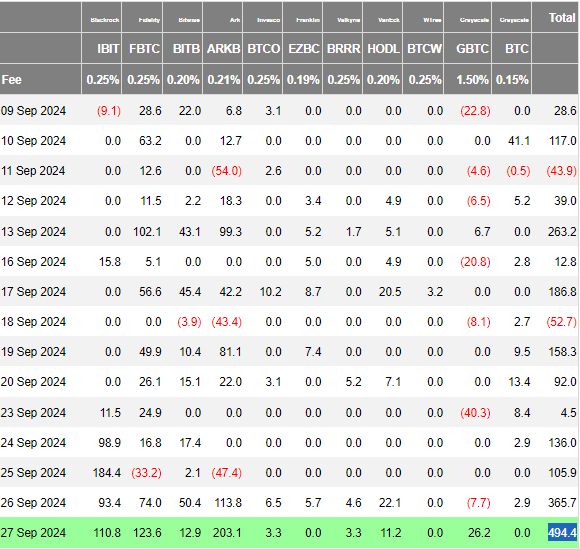

On September 27, U.S. spot Bitcoin ETFs recorded net inflows totaling $494.27 million, continuing a positive trend that began on September 19.

Over the past six days, none of the approved ETFs reported outflows, with just four showing no activity.

Ark & 21Shares’ ARKB led the pack with inflows of $203.07 million, raising its cumulative total to $2.72 billion, a notable increase from $113.8 million the previous day. Fidelity’s FBTC followed with $123.61 million, up from $74 million on September 26. BlackRock’s iShares Bitcoin Trust (IBIT) also saw inflows of $110.82 million, marking five consecutive days of gains, bringing its cumulative net inflow to $21.42 billion, making it the top spot Bitcoin ETF.

Grayscale’s GBTC saw inflows of $26.15 million after reporting outflows of $7.7 million the day prior. Bitwise’s BITB came next with $12.91 million in inflows, though down from $50.4 million the day before, bringing its total to $2.15 billion. VanEck’s HODL added $11.17 million, reaching a cumulative $650.13 million.

Invesco’s BTCO and Valkyrie’s BRRR had smaller inflows of $3.28 million and $3.26 million, respectively, both declining from the previous day’s figures. Other funds, including Grayscale’s BTC and WisdomTree’s BTCW, did not see any activity, and no outflows were recorded across the ETFs.

Collectively, Bitcoin ETFs have brought in $18.69 billion in cumulative net inflows, an increase from $18.31 billion on September 26, with total net assets across all Bitcoin spot ETFs amounting to $61.21 billion, representing 4.71% of Bitcoin’s market capitalization.

-

1

Bitcoin Slips to $108K After New High, But Bullish Signals Persist

24.05.2025 15:00 1 min. read -

2

Bitcoin’s Recent Dip Draws Parallels to Gold’s Historic Rally, Analysts Eye June Recovery

02.06.2025 21:00 1 min. read -

3

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read -

4

Bitcoin Price Prediction from Donald Trump’s Sons

29.05.2025 19:00 1 min. read -

5

Trader Behind 2021 Bear Market Call Now Predicts Major BTC Rally

29.05.2025 20:00 1 min. read

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

Bitcoin’s ascent from fringe experiment to mainstream portfolio staple is accelerating, according to Galaxy Digital founder Mike Novogratz.

Bitcoin Rewards Coming to Amex Users Through Coinbase Partnership

Coinbase is set to launch a Bitcoin rewards credit card in partnership with American Express, marking a new step in merging traditional finance with crypto incentives.

Bitcoin Holds Strong Amid Escalating Israel-Iran Conflict

Bitcoin held firm near the $105,000 level on June 13, shaking off the worst of a steep dip triggered by renewed conflict in the Middle East.

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

Pakistan has found an unexpected use for the electricity it routinely leaves untapped: power thousands of Bitcoin rigs and AI servers.

-

1

Bitcoin Slips to $108K After New High, But Bullish Signals Persist

24.05.2025 15:00 1 min. read -

2

Bitcoin’s Recent Dip Draws Parallels to Gold’s Historic Rally, Analysts Eye June Recovery

02.06.2025 21:00 1 min. read -

3

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read -

4

Bitcoin Price Prediction from Donald Trump’s Sons

29.05.2025 19:00 1 min. read -

5

Trader Behind 2021 Bear Market Call Now Predicts Major BTC Rally

29.05.2025 20:00 1 min. read