UAE Crypto Market Surges with Over $30B in Transactions

26.09.2024 21:30 1 min. read Alexander Stefanov

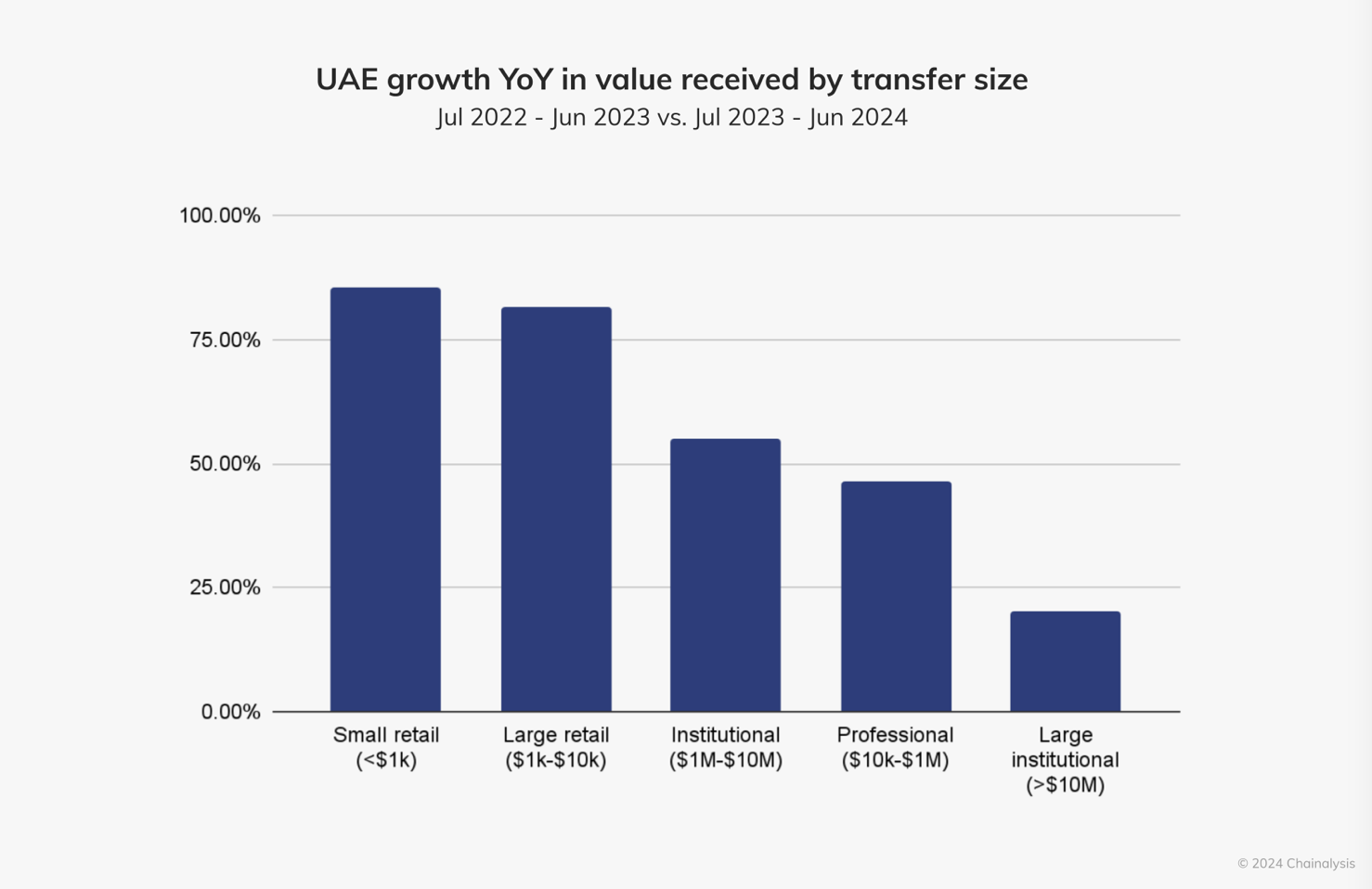

A recent report by Chainalysis highlights that the United Arab Emirates (UAE) stands out in global cryptocurrency activity, showing significant growth across all categories by transaction size.

From July 2023 to June 2024. The UAE has received more than $30 billion in cryptocurrencies, ranking it among the 40 largest countries in the world. This growth is fuelled by regulatory innovation, institutional interest and increased market activity.

Interestingly, cryptocurrency received from retail investors (transactions under $1,000) and mid-sized investors (between $1,000 and $10,000) grew by over 75% year-over-year.

Institutional investor activity (transactions between $1 million and $10 million) also saw a significant increase, growing by over 50% year-over-year.

The UAE is the third largest crypto economy in the MENA region, featuring a more diversified ecosystem compared to neighboring countries where centralized exchanges dominate.

Adoption of the DeFi sector in the UAE exceeds the global average, with 32.4% of transactions taking place on decentralized exchanges (DEX), compared to the global average of 27.8%. The total value of cryptocurrencies received through DeFi services grew 74% year-on-year, with DEX transactions increasing 87% to $11.3 billion.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read