Is PayPal’s PYUSD Stablecoin in Trouble? Market Cap Drops 30%

26.09.2024 21:00 1 min. read Alexander Stefanov

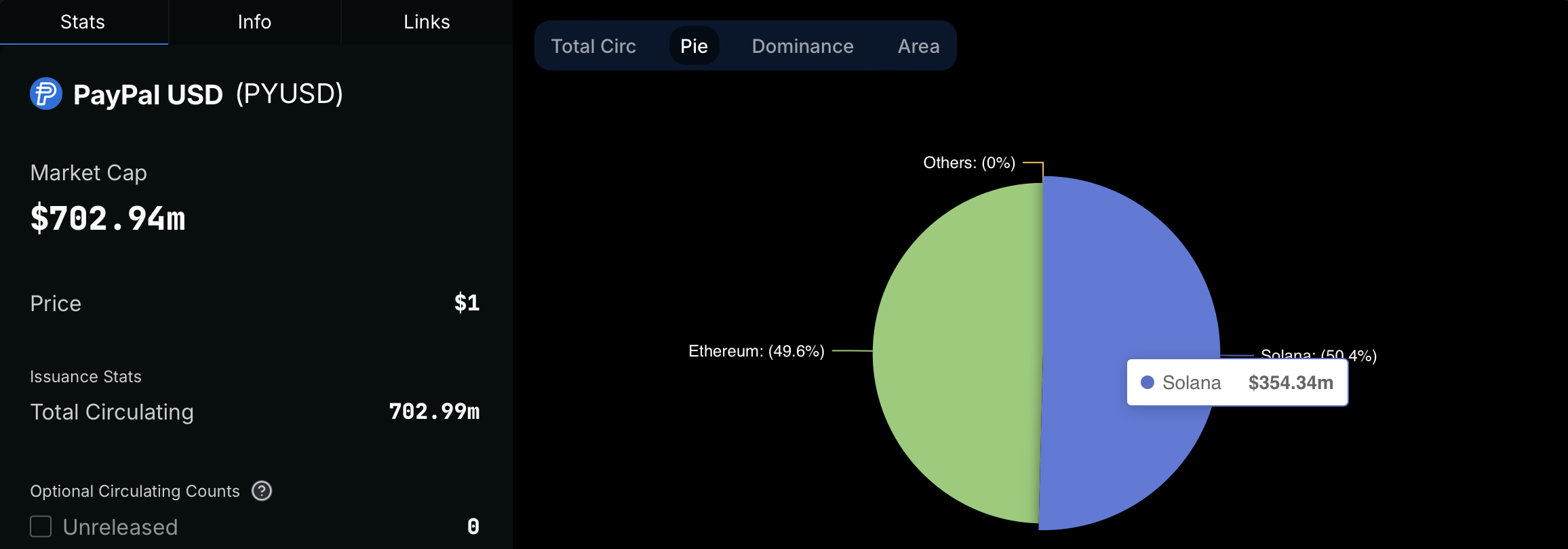

PayPal's stablecoin PYUSD has lost nearly 30% of its market capitalization in the past 30 days, falling from over $1 billion to $709 million as of September 26.

The decline is due to Solana’s significant reduction in its market capitalization, which on August 26 represented about 65% of the total.

PYUSD, circulating or locked within the Solana ecosystem, dropped from $662 million to $354 million, while its market capitalization on Ethereum held steady at $348 million.

However, average daily PYUSD remittance volume held steady at $242.2 million, only slightly below the previous month’s average.

While fluctuations in stablecoin market caps are common, the PYUSD drop coincided with a 1.6% rise in the overall stablecoin market, which added $3 billion.

The decrease is likely related to the decline in DeFi yields, which dropped nearly 50% on platforms like Kamino. PYUSD’s collateral yield fell from 14% in August to 7.6% as of September 24, resulting in a 30% decrease in stablecoins locked in the minutes.

Despite the decline, PYUSD remains the third largest stablecoin in Solana’s network.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

4

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

5

Ethereum Faces Heavy Sell-Off Amid Rising Geopolitical Tensions

13.06.2025 14:00 1 min. read