Curve Finance May Cut TrueUSD as crvUSD Collateral

26.09.2024 22:00 1 min. read Alexander Zdravkov

A proposal on Curve Finance is aiming to eliminate TrueUSD (TUSD) as collateral for its crvUSD stablecoin due to worries about TUSD’s stability and regulatory concerns.

Submitted by a user named “WormholeOracle,” the proposal suggests setting the TUSD collateral limit to zero and reducing the minting capacity of crvUSD linked to PayPal’s PYUSD from $15 million to $5 million.

The rationale behind this move is rooted in TUSD’s recent troubles, including SEC allegations of fraud against its issuer, TrueCoin, for not fully backing the stablecoin with U.S. dollars.

This proposed change seeks to diversify crvUSD’s collateral and lessen dependence on assets viewed as risky.

This initiative highlights the challenges that decentralized finance protocols face in maintaining regulatory compliance and market stability. If approved, it could reshape TUSD’s role in the DeFi ecosystem and influence how other stablecoin projects manage collateral.

Earlier this year, TUSD saw a notable depegging, dropping to $0.97 amidst significant net outflows on Binance, which further eroded confidence in the stablecoin. Following a hacking incident, TUSD fell even lower to $0.985.

-

1

Memecoins: Culture, Casinos, and Power Laws (Galaxy Report)

02.10.2025 14:30 3 min. read -

2

BNB Breaks Past $1,112 As Treasury Buys And Upgrades Boost Confidence

03.10.2025 12:38 2 min. read -

3

Bitcoin, Ethereum, and Solana Drive Record $5.95 Billion Inflows, CoinShares Reports

06.10.2025 17:30 2 min. read -

4

Bitwise CEO: Solana Could Outpace Ethereum in Staking ETF Market

02.10.2025 16:30 2 min. read -

5

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read

From Panic to Profit: How One Summit Could Change Crypto’s Trajectory

Crypto markets rallied after news of an upcoming US-China summit eased fears of escalating trade tensions.

Crypto Buyback Madness: How Top Projects Are Returning Value to Holders

Crypto token buybacks have surged past $1.4 billion in 2025, with Hyperliquid (HYPE) accounting for nearly half.

Ethereum Is Waking Up – Analysts See a Massive Rally Ahead

Ethereum’s native token is showing fresh signs of strength after rebounding sharply from its September lows.

$1.5 Billion Ethereum Bet: BitMine Is Quietly Taking Over the Blockchain

A quiet yet massive accumulation spree has thrust BitMine Immersion Technologies into the global spotlight.

-

1

Memecoins: Culture, Casinos, and Power Laws (Galaxy Report)

02.10.2025 14:30 3 min. read -

2

BNB Breaks Past $1,112 As Treasury Buys And Upgrades Boost Confidence

03.10.2025 12:38 2 min. read -

3

Bitcoin, Ethereum, and Solana Drive Record $5.95 Billion Inflows, CoinShares Reports

06.10.2025 17:30 2 min. read -

4

Bitwise CEO: Solana Could Outpace Ethereum in Staking ETF Market

02.10.2025 16:30 2 min. read -

5

BBVA Brings Bitcoin and Ethereum Trading to European Retail Investors

02.10.2025 13:50 2 min. read

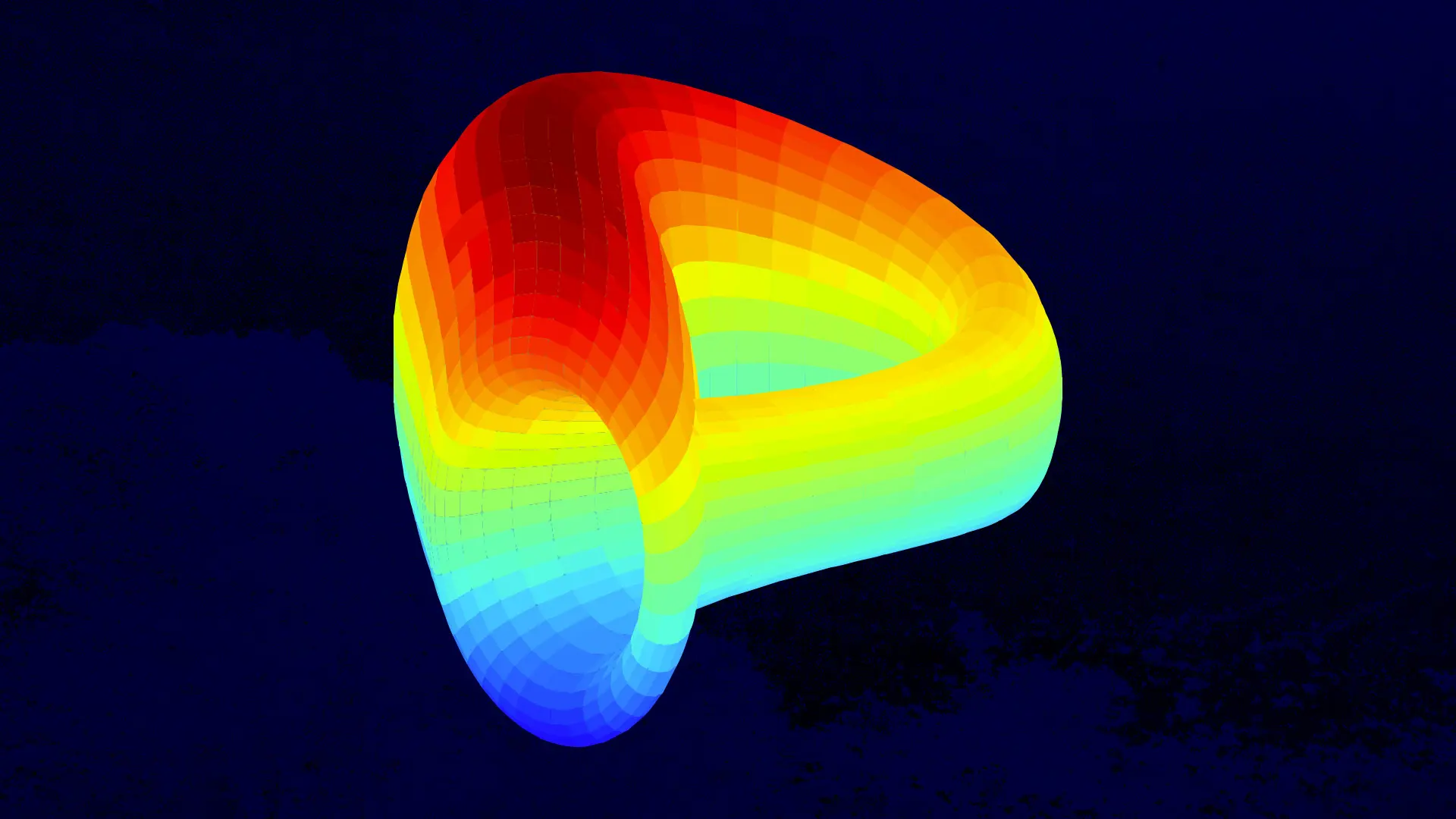

Michael Egorov, the creator of Curve Finance, has unveiled Yield Basis, a decentralized protocol designed to bring sustainable yield opportunities to Bitcoin holders while solving one of DeFi’s most persistent problems, impermanent loss (IL).

Cybercriminals are increasingly targeting GitHub users by creating deceptive repositories to spread malware, particularly designed to steal sensitive information like cryptocurrency details and personal credentials. A

Cyprus has extended its suspension of FTX’s European operations for another six months, effectively halting the exchange from offering services or accepting new clients until May 30, 2025.

Binance founder Changpeng “CZ” Zhao addressed speculation about his involvement with Aster, a perpetual decentralized exchange (DEX), after reposting details on X.

The Czech National Bank (CNB) has approved a proposal to assess the possibility of expanding its investment portfolio, potentially including Bitcoin and other asset classes.

The Czech National Bank (CNB) has entered the crypto sector with a $18 million investment in Coinbase, purchasing 51,732 shares in Q2 2025, according to a U.S. SEC filing.

The Czech National Bank could soon make bitcoin part of its financial strategy if Governor Ales Michl’s proposal gains approval.

In a move that could attract more cryptocurrency investors, the Czech Republic has introduced a new law that will exempt Bitcoin and other cryptocurrencies from capital gains tax if held for over three years.

In a bold move to become a frontrunner in the crypto and blockchain space, the Czech Republic has introduced a series of financial reforms aimed at attracting both local and international cryptocurrency investors and companies.

Compass Coffee in Washington, D.C. has made history as the first retailer to process Bitcoin payments directly through Square’s point-of-sale system.

On Tuesday, an unexpected announcement sent Dogecoin prices soaring, turning a popular meme-driven narrative into a real-life initiative.

Following new regulations on crypto mining in Russia, Dagestan authorities have uncovered numerous illegal mining operations, prompting the regional prime minister to call for increased law enforcement efforts against these illicit activities amid rising electricity consumption.

Binance Research's latest report highlights that decentralized applications (dApps) led the blockchain industry in revenue generation in October, earning $164 million out of the total $182 million produced by the top three blockchains: Tron, Ethereum, and Solana.

In a recent interview with CNBC, Jeff Blau, CEO of Related Companies, praised data centers as a transformative asset class in real estate.

Barstool Sports founder Dave Portnoy unknowingly sank nearly $170,000 into the wrong LIBRA token, triggering a massive price spike before its value collapsed.

Dave Portnoy, the founder of Barstool Sports, has opted not to invest in bitcoin (BTC) at its current price levels, which exceed $60,000.

Crypto trading, especially in the realm of meme coins, often presents unpredictable ups and downs, amplified by volatility and risk.

Bitcoin's integration into traditional finance is accelerating, and according to Lightspark CEO David Marcus, the next major leap could come from within Wall Street.

Before stepping into his role as the Trump administration’s key advisor on artificial intelligence (AI) and cryptocurrency, David Sacks divested a substantial portion of his investments tied to digital assets.

The U.S. government’s handling of confiscated Bitcoin has sparked criticism, with White House crypto advisor David Sacks arguing that past BTC sales were a costly misstep.