Crypto Market on Edge as SEC Chair Faces Tough Questions in Congressional Testimony

24.09.2024 18:00 2 min. read Alexander Stefanov

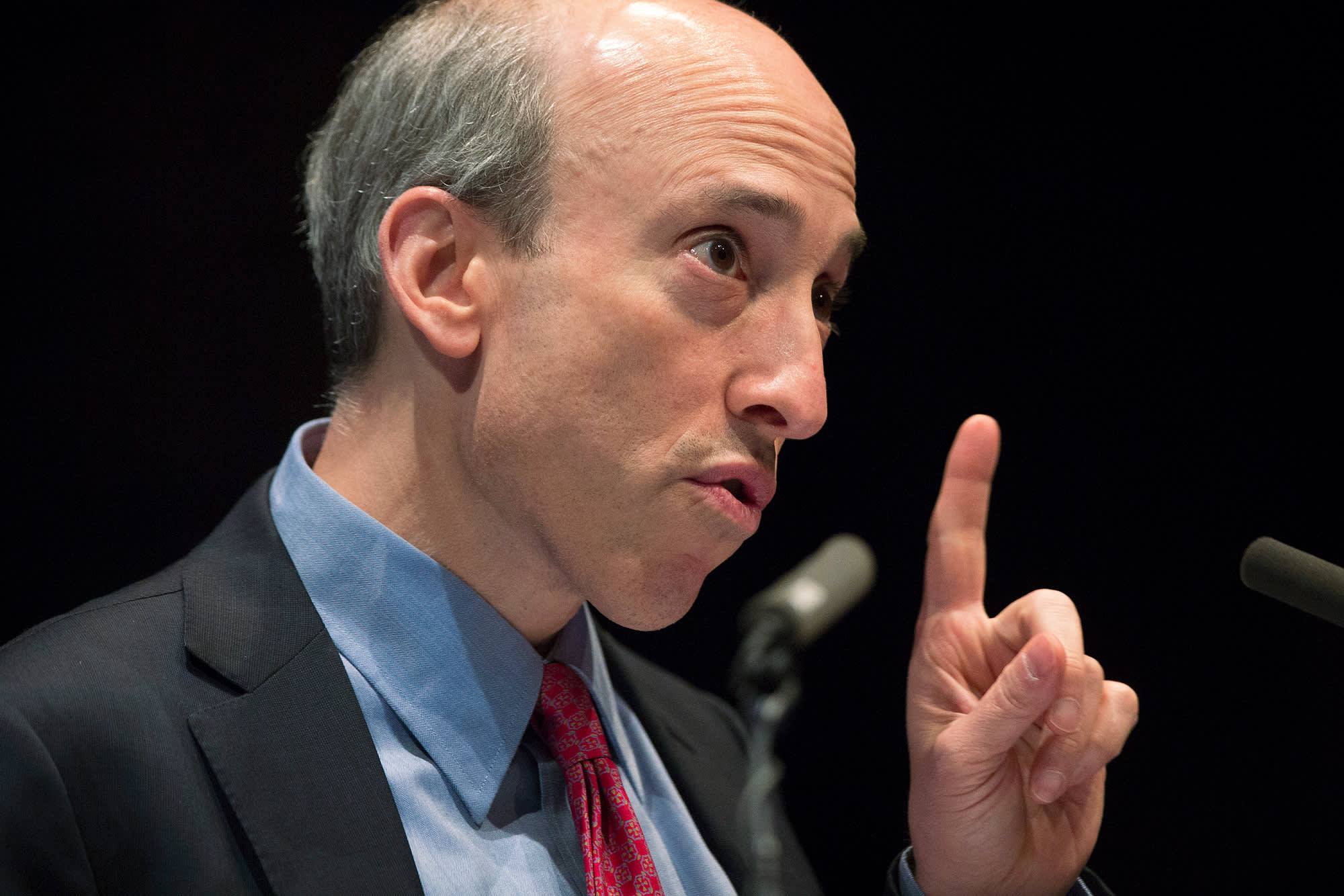

The cryptocurrency market is on high alert as SEC Chair Gary Gensler prepares to testify before Congress this week.

Scheduled for September 24 and 25, Gensler will appear before both the Financial Services Committee and the U.S. Senate Banking Committee. The crypto community and lawmakers are anticipating rigorous examination of the SEC’s aggressive stance on digital assets.

Gensler’s upcoming testimony has stirred speculation in the market, particularly as his leadership faces significant criticism from both political parties. With the U.S. Presidential election approaching, lawmakers are expected to challenge him on various issues, including the SEC’s approach to crypto regulation and its handling of high-profile fraud cases like FTX and Terra.

Recently, Coinbase’s Chief Legal Officer has publicly criticized the SEC’s classification of cryptocurrencies as securities, adding to the pressure from the community.

According to Ron Hammond, the Blockchain Association’s Director of Government Relations, Gensler will encounter scrutiny from both sides of the aisle. He noted that this round of hearings would differ from past ones, primarily due to the diminishing support Gensler enjoys, as many have voiced discontent with his leadership and the agency’s recent crypto policies.

Notably, this will be the first time Gensler is joined by other SEC Commissioners during such hearings, making it a rare occasion. While Democratic leaders are likely to back his policies, Republicans are anticipated to challenge his views, increasing the pressure on him to justify the agency’s current direction.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read