FET Experiences Boom in Whale Transactions – Could it Boost Prices?

18.09.2024 14:00 1 min. read Alexander Stefanov

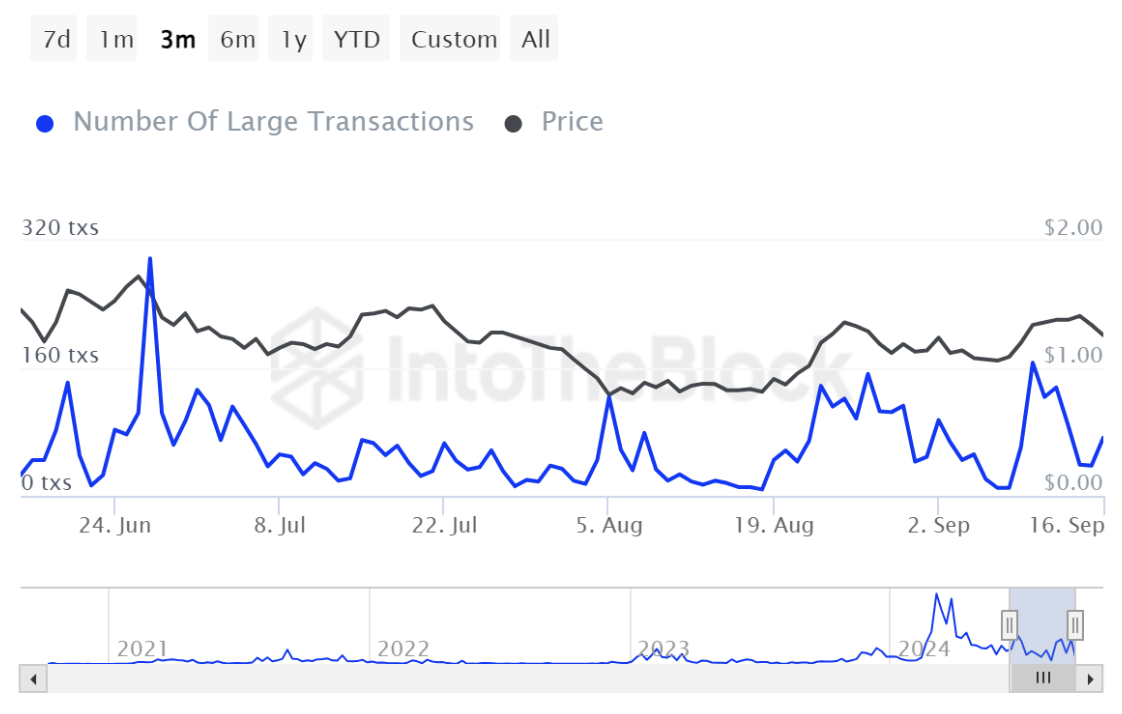

Whale activity around the Artificial Superintelligence Alliance (FET) has increased dramatically, with large transactions up 262%, as reported in IntoTheBlock data.

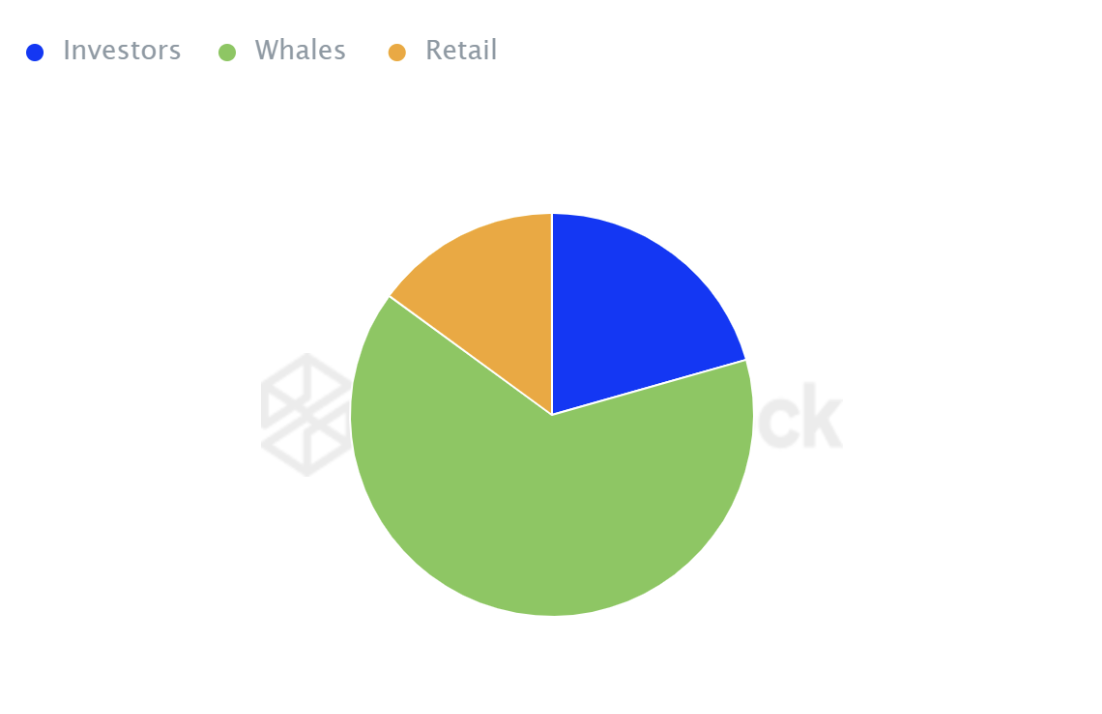

Large holders, often referred to as whales, are driving the upward momentum, suggesting that the token’s price could soon rise as local peaks signal potential growth.

Large investors currently control 64% of the total FET allocation, a statistic that could suggest a significant price increase.

Although overall trading volume has declined, whales are stepping in to stabilize the situation.

Despite this intense whale participation, FET trading activity has dropped by 10, but this has not discouraged large holders who remain committed to increasing the token’s value.

Whale activity in the FET market is signaling a potential price breakout, with large holders controlling 64% of the asset. Recent spikes in significant transactions, up 262%, suggest that these major players are positioning for an upward move.

FET is currently trading within a symmetrical triangle pattern since March, indicating a period of consolidation and a likely breakout soon.

If whale trading continues at this pace, a bullish breakout could attract more buyers and push prices higher, making whale movements a key factor to watch for any upcoming price shifts.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

BNB Chain is set to upgrade the BNB Smart Chain (BSC) by cutting the block time in half, from 1.5 seconds down to 0.75 seconds.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read