Coinbase Lost a Significant Part of its Market Share

11.09.2024 10:30 1 min. read Kosta Gushterov

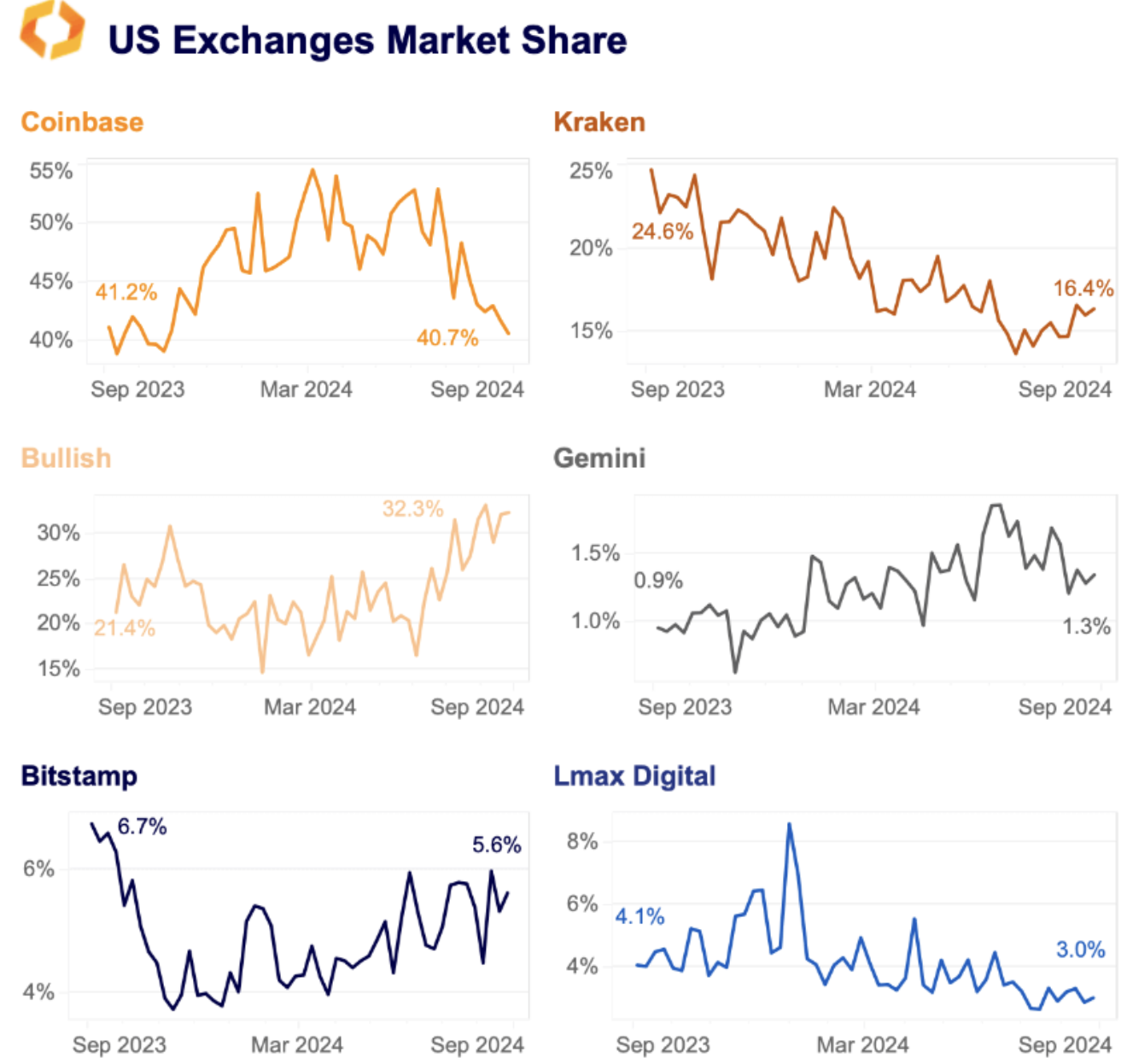

According to a report by Kaiko dated September 9, Coinbase has experienced a significant decline in its market share as smaller exchanges gain ground.

Earlier this year, Coinbase held over 50% of the crypto market in the U.S., reaching 55% in March. However, by the beginning of September, its share had fallen to 41%, a sharp drop from 53% in June.

A major beneficiary of this shift is Bullish, whose market share doubled from 17% to 33% during the same period. Unlike Coinbase, which focuses on retail investors, Bullish is targeted at institutional clients.

According to Kaiko, the top three crypto exchanges in the U.S. now control nearly 90% of the market, compared to 66% in April 2021. In contrast, the share of smaller exchanges has dropped from 34% to just 11%.

This change is attributed to stricter regulations, lower trading activity during the bear market of 2022-2023, and the dominance of large players like Coinbase and Kraken in institutional trading. The collapse of FTX in 2022 and regulatory actions against Binance.US further accelerated this trend.

-

1

Crypto VC Funding Tops $5.1B in September Despite Fewer Rounds

02.10.2025 17:00 2 min. read -

2

Fasset to Launch World’s First Stablecoin-Powered Islamic Digital Bank in Malaysia

07.10.2025 11:00 2 min. read -

3

SoftBank and Ark Invest Linked to Tether’s Multibillion-Dollar Fundraising Talks

27.09.2025 9:30 1 min. read -

4

TeraWulf Targets $3B Data Center Expansion, Google Said to Backstop

27.09.2025 11:00 1 min. read -

5

Franklin Templeton Expands Tokenization Platform to BNB Chain

24.09.2025 18:00 2 min. read

Changpeng Zhao Responds to Criticism, Highlights Binance Efforts to Shield Users

Tensions flared between Binance and decentralized trading platform Hyperliquid following last week’s severe crypto market downturn.

Crypto Market Momentum Depends on Washington’s Next Move

The ongoing U.S. government shutdown has entered its third week, halting progress across key financial agencies and putting dozens of crypto-related exchange-traded fund (ETF) applications on hold.

Wall Street’s New Crystal Ball: Why Bank Earnings Are Critical Amidst Economic Uncertainty

The usual deluge of economic data that guides Wall Street has run dry, interrupted by an ongoing federal government shutdown.

Biggest Crash in History? Kiyosaki Sounds Alarm Once Again

Robert Kiyosaki, author of Rich Dad Poor Dad, has once again issued a grim forecast for global markets, warning that the largest economic collapse in history could unfold before the end of this year.

-

1

Crypto VC Funding Tops $5.1B in September Despite Fewer Rounds

02.10.2025 17:00 2 min. read -

2

Fasset to Launch World’s First Stablecoin-Powered Islamic Digital Bank in Malaysia

07.10.2025 11:00 2 min. read -

3

SoftBank and Ark Invest Linked to Tether’s Multibillion-Dollar Fundraising Talks

27.09.2025 9:30 1 min. read -

4

TeraWulf Targets $3B Data Center Expansion, Google Said to Backstop

27.09.2025 11:00 1 min. read -

5

Franklin Templeton Expands Tokenization Platform to BNB Chain

24.09.2025 18:00 2 min. read

Coinbase has countered allegations of a significant decline in Bitcoin (BTC) liquidity on its platform following the SEC's lawsuit against Cumberland, a leading market maker.

Coinbase Derivates has filed an application with the Commodity Futures Trading Commission (CFTC) to include futures on Shiba Inu on its platform.

Coinbase has officially listed Peanut the Squirrel (PNUT) on its platform, marking a significant milestone for the memecoin.

Coinbase is rapidly expanding its reliance on artificial intelligence, with CEO Brian Armstrong revealing that nearly 40% of the exchange’s daily codebase is now AI-generated.

The rise of cryptocurrency trading is rapidly outpacing the growth of traditional financial markets, with Coinbase playing a leading role, especially after the boost in market sentiment following Donald Trump’s election win.

Coinbase has partnered with Stripe to increase acceptance of digital assets and improve financial services.

Coinbase has chosen Luxembourg as the base for its European operations after obtaining a Markets in Crypto-Assets (MiCA) license from the country’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF).

Coinbase is preparing to launch its cbBTC token on the Solana blockchain, according to the company's Singapore director, Hassan Ahmed, during the Solana Breakpoint 2024 event.

Coinbase's CEO, Brian Armstrong, announced the company’s plans to expand its workforce in the U.S. by hiring 1,000 new employees this year.

Coinbase is set to remove all stablecoins that fail to meet regulatory standards in the European Economic Area (EEA) by the end of the year as part of its compliance with tightening EU regulations.

As Europe prepares to enforce new crypto regulations under the Markets in Crypto-Assets Regulation (MiCA), exchanges are taking significant steps to comply.

Coinbase, a leading US cryptocurrency exchange, believes digital assets are poised for significant appreciation in the coming months.

Crypto exchange Coinbase has dismissed allegations that it violated campaign finance regulations.

Coinbase reported total revenue of $1.4 billion for the second quarter of this year.

Coinbase revealed in its second-quarter earnings report that its recent data breach cost the company $307 million, confirming suspicions that the cyberattack had significant financial consequences.

South Carolina has reversed its stance and dropped the legal action against Coinbase over staking, a move that mirrors Vermont’s recent decision.

Coinbase, the largest publicly traded crypto exchange in the US, has reestablished its presence in Hawaii after a seven-year hiatus.

Coinbase is expanding its cryptocurrency offerings by introducing new digital assets to its trading platform.

Coinbase is once again setting its sights on tokenized securities, aiming to integrate traditional financial assets with blockchain technology in the U.S. market.

Coinbase has scored a partial victory in its legal battle against the US Securities and Exchange Commission (SEC), potentially gaining access to important documents related to the agency's classification of tokens as securities.